Examining adult-use sales in the Ontario cannabis market

There have been a variety of conflicting reports covering Ontario sales trends over the last year and we set the record straight in the analysis below. For starters, Ontario stands as the largest province for total cannabis sales throughout Canada. Revenue growth has been healthy since the market launched, with $165M in total sales in April 2022. While total sales are increasing, prices of products are decreasing with price compression impacting larger categories. This price compression was mainly driven by increased competition as more retailers opened stores. The growing number of stores also had a negative impact on the average revenue of individual retailers in Ontario. For example, when examining a sample of 100 retailers that were open during April 2021 and April 2022, the median store saw a 14% decline in sales year over year. Below, we take a close look at the past year of cannabis sales in Ontario and explore the drivers of this growing market.

Cannabis sales growth in Ontario

Let’s first compare total sales in the two largest provinces in Canada, Alberta and Ontario. There is a point from June 2020 through August 2021 where sales growth increases exponentially in Ontario compared to Alberta. The growth in Ontario can be attributed to many things, but let’s find out how price and competition contributed to the sales growth during this period.

Changes in cannabis prices in Ontario

Here, we compare average prices of cannabis products with how many products were being sold in Ontario. Over the past year, Average Unit Price in Ontario has decreased by -13.2%. In April 2021, average item prices were stable at around $27.00 but by the end of the year, prices had dropped to a low of $25.70. The number of units sold, on the other hand, continued to trend upwards. This increase in products sold can help to explain the increase in sales growth that we saw in the previous graph.

Next let’s look at the prices of the top performing product categories in Ontario. Average EQ price, or average price per gram, reflects the same drop in price that we saw in the previous graph. Here we see that both Flower and Pre-Roll categories have seen a drop in price of about -10%. These drops in prices can be observed in most other categories as well. Vapor Pens, for example, had a decline of -17% in price per gram over the last year. These declines in price are driven by stark increases in competition as Ontario issued a large number of licenses through 2021, which dramatically changed the competitive landscape for retailers.

Impact of sales growth on Ontario retailers

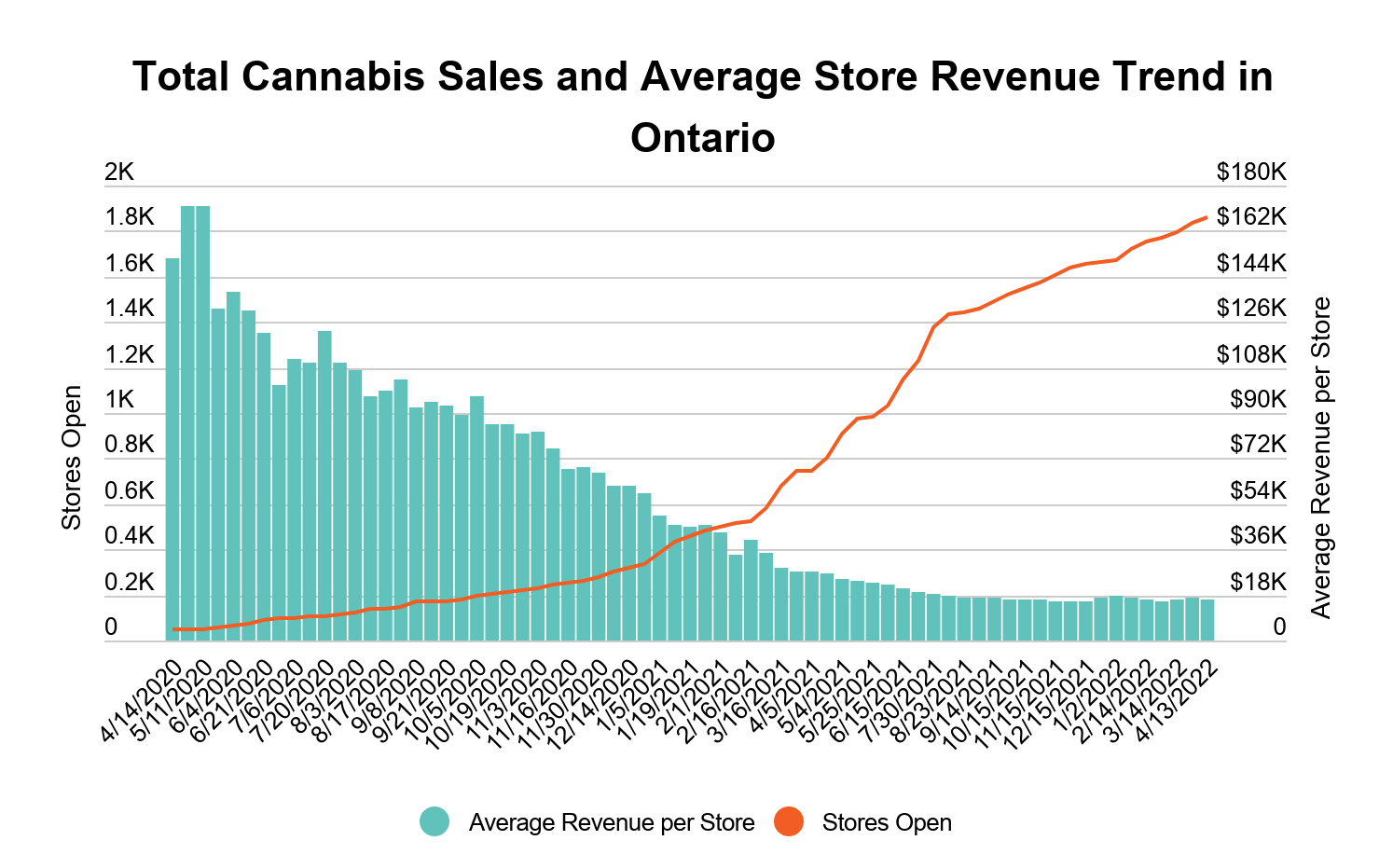

Here, we look at how sales were impacted by the growing number of retail stores in Ontario. Since the cannabis market opened in 2018, sales in Ontario have trended up consistently. On average, sales increased by $320k CAD per week. Sales trends were muted in the summer and fall months of 2021, when a large influx of store openings occurred. At the end of 2020, only 338 stores were authorized to open. This figure quadrupled after a year with over 1600 stores authorized to open by December 2021. Cannabis sales have recently resumed a relatively upward trend in more recent months.

*Source: AGCO (total authorized retailers) and StatCan (total cannabis retail sales).

In this graph, we can see how store revenue was impacted by the increase in licenses. As new stores opened, average revenue per store rapidly declined from $100k in average weekly sales per store in 2020 to about $20K in 2022. So while we are seeing total cannabis sales trends remain positive throughout Ontario, the story is very different for individual retailers, who have seen average revenues decline as new competition opens their doors. The median retailer in Ontario saw year over year like-store-sales-growth of -3.7% in April 2021 (compared to April 2020). Examining sales in 2022 we see that for stores that were open in both April 2021 and April 2022 there was an even larger decline with the median store seeing revenue decline by -14% in April 2022.

Total sales trends are positive and growing for Ontario, but some retailers are seeing a completely different picture in their revenue figures. This highlights the importance of drilling into market insights to gain a deeper understanding of how trends are impacting your business. If you’d like to take a deeper dive into Ontario or other legal markets or need help assessing opportunities in the industry, sign up for a demo today.