Missouri's first recreational weekend

Introduction

In November 2018, Missouri voted to legalize medical cannabis through Amendment 2. The state’s program began in 2019, and since then, sales have been limited to medical patients only. In November 2022, Missouri voters approved the legalization of adult-use cannabis. The state set a timeline for recreational cannabis sales to being in early 2023. The Missouri Department of Health and Senior Services issued licenses for recreational cannabis businesses and on Friday, February 3rd, 2023, sales started, which was three days before the planned February 6th opening!

Customers must be 21 years or older and there is a limit to the amount of cannabis that can be purchased at one time. Additionally, it is not legal to consume cannabis in public spaces. The legalization of recreational cannabis is expected to bring in significant revenue for the state by way of a tax on the retail sale. Revenue will go towards healthcare, education, and infrastructure.

The purpose of this blog post is to examine the first weekend of recreational cannabis sales in Missouri, analyzing the growth in sales compared to historical data and exploring the factors that may have contributed to this growth. We aim to provide insight into the current state of the Missouri cannabis market and its potential for future growth.

Data Collection

Headset's integration with thousands of cannabis retailers has allowed us to quickly track and measure market trends in real-time, providing valuable insights that allow our customers to stay ahead of the competition. As a leading provider of market intelligence and business optimization solutions for the cannabis industry, Headset is dedicated to delivering the data and insights that businesses need to succeed in a fast-moving and rapidly evolving market.

At the time of publishing, Headset has measured a total of 3.9 million transactions, representing approximately $330 million dollars in cannabis sales in Missouri. This data provides a comprehensive view of the Missouri cannabis market, including key trends and market conditions that are shaping the industry. It also gives businesses the ability to compare their own performance against industry averages and identify areas for improvement.

One important aspect of this data is the high level of utilization of the Dutchie POS system among Missouri cannabis retailers. In fact, 73% of the dispensaries in our sample utilize this system. This information can help businesses to make informed decisions about their own technology choices and ensure that they are well-positioned to compete in the market.

Overall, Headset's data and insights provide a valuable resource for businesses looking to succeed in the Missouri cannabis market. Whether you're a retailer, cultivator, or supplier, Headset can help you to stay ahead of the curve and make the most of the rapidly growing market for recreational cannabis in Missouri.

Historical Weekend Sales

From the beginning of medical cannabis sales in Missouri, Headset has seen same-store sales grow at a healthy pace, as is common with new and growing markets.

When looking at the weekend periods over the last 6 months, an average store would expect to bring in roughly $23,000 in revenue from Friday to Sunday. With the addition of adult-use sales, an average store this past weekend clocked in at $70,000+ in revenue. That is a greater than 3x increase.

While averages can provide a general picture of the market, they don't necessarily paint the full picture. Our analysis at Headset has revealed a range of increases across our customers, with some retailers experiencing significant growth. In particular, one retailer stands out, achieving a staggering 11.9 times their previous weekend sales.

This highlights the diversity of the Missouri cannabis market and the unique challenges and opportunities that different retailers may face. It's important to note that the top retailer's success may not necessarily be replicated by other businesses, and that each retailer must carefully analyze their own operations and market conditions in order to identify their own path to success.

Composition

When it comes to retail revenue, increases can only come from three categories: item price, number of units, and/or receipt count. Either customers are buying more expensive products (item price), they are buying more products (number of units), or there are more customers shopping (receipt count). In this case we can attribute the increased revenue almost entirely to the receipt count. Average item price and average units per transaction have stayed flat when compared to the medical days, $77.90 and 2.9 respectively. However, the number of customers visiting a dispensary each day has skyrocketed from 92 up to 251.

Market Comparison

The legalization of recreational cannabis in Missouri has brought about a new era of growth for the state's dispensaries. With the newfound tailwinds, these establishments have experienced a remarkable rise in the measure of raw revenue per store. This growth can be seen as a testament to the increasing demand for recreational cannabis in the state and a sign of the thriving market that has emerged as a result of legalization.

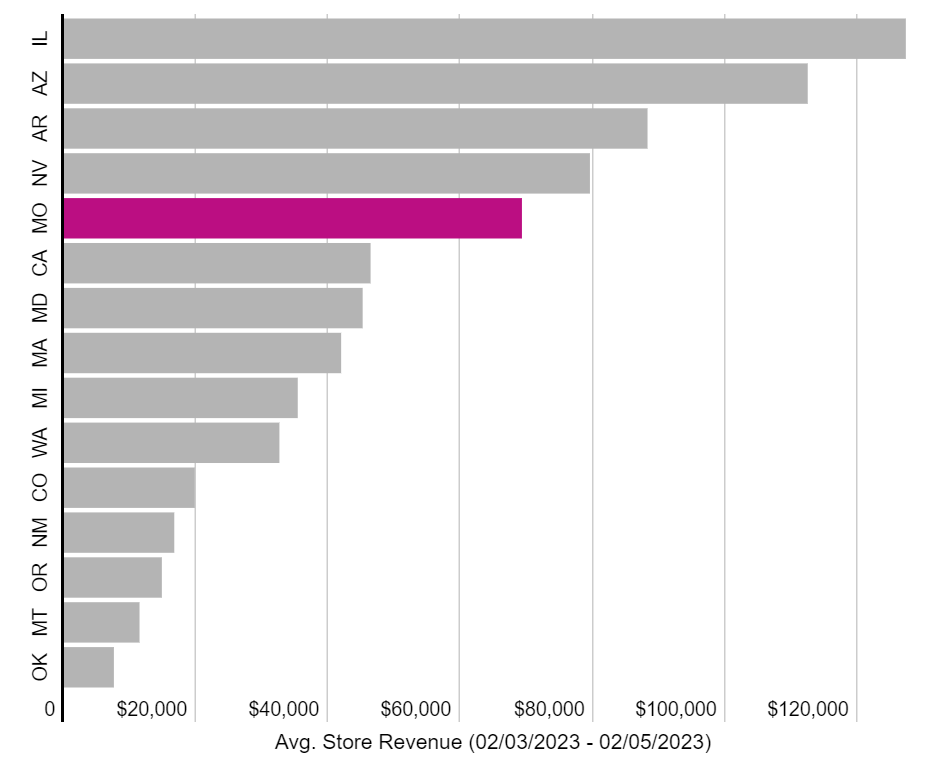

To provide a better understanding of this growth, the chart below compares the value of Missouri retailers to that of other states for the period of February 3rd through the 5th. This comparison provides a snapshot of the performance of Missouri dispensaries in the early stages of recreational sales, offering insight into the potential for future growth. Whether you're a cannabis enthusiast, a business owner, or simply interested in market trends, this chart provides a unique and valuable perspective on the state of the Missouri cannabis market.

Inventory

The quick approval of adult-use sales in Missouri brought about concerns about producers and retailers' ability to keep up with demand. At Headset, we use various tools to monitor inventory levels, including our partnership with Leafly, which allows us to see the number of items being removed from menus across the state. The first week of adult-use sales saw a record number of items go out of stock, indicating that demand is outpacing supply.

Our advanced inventory analytics provided by the Headset Retailer platform also offer a comprehensive view of supply health. This includes the average days of supply carried by each dispensary, providing a more accurate picture of the state of the market. This information can help retailers and producers to make informed decisions and stay ahead of the game in an ever-changing market.

The Future

The legalization of recreational cannabis in Missouri is still in its early stages, and the initial excitement surrounding the new market is expected to eventually settle down. Despite this, Missouri offers several unique advantages, including its proximity to other states that have not legalized cannabis, which we have extensively analyzed.

As the market matures, there may be challenges along the way as demand stabilizes. However, retailers using Headset's tools will be well-equipped to handle these challenges, as they provide the ability to accurately forecast inventory and optimize return on investment.

At Headset, we are thrilled to see another Midwest state legalize recreational cannabis and join the ongoing movement towards ending the war on cannabis. We will continue to closely monitor this exciting and rapidly evolving market, providing valuable insights and support to businesses operating in the Missouri cannabis industry.