The demographics of cannabis consumers

For an updated look at cannabis consumer behavior, please see our latest report Exploring cannabis consumer trends & demographics in 2021.

Executive summary

This report focuses on the demographics of cannabis consumers. It uses data from loyalty program participants to examine the purchasing habits of different generations, examining their overall market shares, as well as specific preferences on price, product type, brands, and more. It will be especially useful to companies developing and marketing products to consumers, but also to journalists and observers who want to learn more about how consumers approach cannabis under the framework of legalization.

Introduction

In this report, we attempt to understand how age and gender affect cannabis purchasing habits. As in any industry, cannabis consumers from different generations have different purchasing habits, and the same is true for gender. By looking at things like Average Item Price (AIP) and Basket Size, we’re able to better understand the way the economy at large affects the cannabis industry.

Because the cannabis industry is dominated by millennials, the amount of disposable income available to them has a lot to tell us about what does and doesn’t work in the cannabis industry. Big ticket items are going to sit on shelves a lot longer, for starters. On average, the younger generations have less to spend on each visit than their more established counterparts, but they do make up a vastly larger share of the overall market. It is not exaggerating to say that Gen Z and millennials combined could make up more than three quarters of the cannabis consumer base in a few short years.

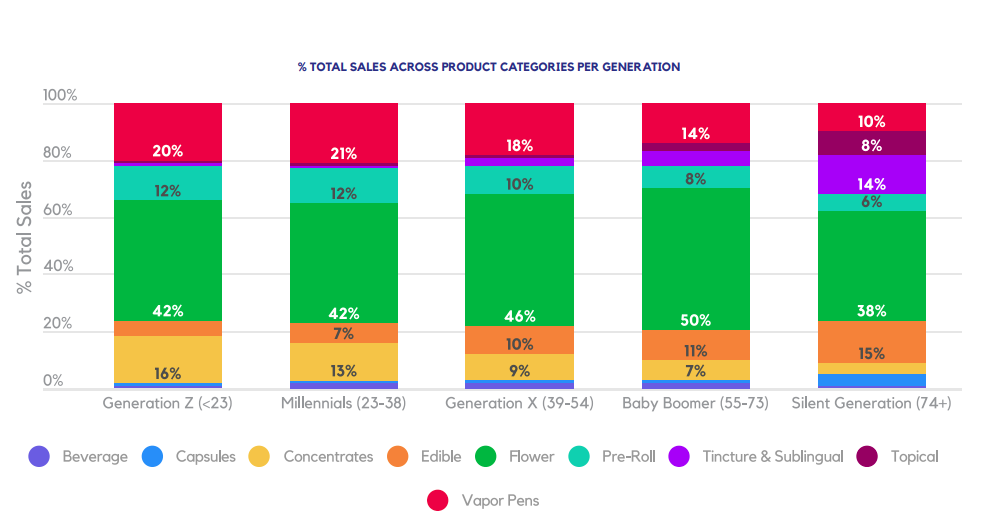

Beyond the simple matter of sales and price sensitivity, these data show us that there are many soft preferences between generations. For instance, baby boomers still prefer flower, even after five years of exposure to other options. The youth preference for vaping mirrors that of the tobacco industry, with Gen Z and millennials being much more inclined to it.

When it comes to gender preferences, it’s clear that the legal cannabis industry still leans heavily towards men. Men make up over 60% of sales across all generations and spend more on average than women. However, it’s interesting to note that, when broken down into categories, participation is about even in certain areas, mostly ones that are very wellness oriented. The broad preference among women for wellness products persists in the cannabis industry as well. And on the flip side, men prefer products that could be construed as more intense, like Concentrates. There is also a slight preference among women for CBD products.

Overall, the cannabis industry’s consumer base behaves according to long-established age and gender preferences, and newer but generally applicable ones. However, there are some cannabis-specific caveats, like the way that cannabis intersects with the wellness industry. This report will provide you with a detailed look at them.

Methodology

Data for this report come from participants in Washington store loyalty programs, which are linked up with Headset’s business analytics software. The data included are for 2019, from January 1 to August 31. Those data are cross-referenced with our catalog of millions of products to provide detailed information on market trends.

Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. For this report, the data are also self-reported by loyalty program participants. Thus, there is a slight margin of error to consider.

Taking stock: Total sales by generation

Millennials have made up the majority of cannabis sales since legalization and continue to do so. They currently make up a little under 52% of total sales, with the remaining half split evenly between Generation X and the other three generations (baby boomers, the Silent Generation, and Generation Z). However, the real story here is about growth. Gen Z, as Generation Z is casually referred to, is just coming into the market, but are coming in hot. Their market share doubled from 3% in 2018 to about 6% in 2019. Each year has added one year of Gen Z to the market, so it’s reasonable to assume they could continue to make significant leaps until the entire generation is of legal purchasing age. If that trend continues unchanged, the entire market will be dominated by Gen Z and millennials in a few years.

.png)

Boomers are still buying flower

When demographic data is broken out by category, it becomes clear that some old habits die hard. Boomers, notorious for rolling joints on their frisbees back in the ‘60s, are apparently still at it. Of all the generations, they have the strongest preference for Flower products, at 50%. Flower is still the primary consumption method for all generations but has slowly been falling off as other products gain market share. This is especially true for younger generations, who are welcoming vapor products with open arms. Gen Z and millennials prefer Vapor Pens at a rate of 20% and 21%, respectively. They also have the lowest preference for flower outside of the Silent Generation (38%), at 42% for both. The Silent Generation seems to be generally averse to inhaled products, preferring Edibles more than other generations, and spending 40% of their money on non-inhaled products overall.

Product preferences by generation

Looking at the best performing products/brands in Washington by generation, we see the usual suspects, but organized by some pretty clear generational preferences. A Tincture is a top product for the Silent Generation, with Fair winds —a notable manufacturer of tinctures — being the second most purchased brand for them. The Silent Generation’s top 5 also includes inedible brand, Magic Kitchen. On the other hand, Smokey Point Productions’ Vapor Pen is a top seller for Gen Z, and millennials also have the Airo Pro (a proprietary vape system) in their top 5. Besides that, the middle generations generally go for flower from the two biggest brands in the state: Phat Panda and Northwest Cannabis Solutions

Older buyers spend bigger

While millennials make up the majority of the market, they have the second smallest basket size, meaning they spend a relatively low amount each trip. They’ve spent less than $25 per trip for the past two years, with only Gen Z beating them in terms of thrift. This makes sense, as Gen Z is either new to the workforce or just finishing college, two situations that don’t denote a lot of disposable income. Operating on the simple theory that people accumulate more wealth and grow their earning power over their lives, the curve of this graph makes sense. The Silent Generation can afford to spend over $30 each trip, because they have enough salted away to. However, it’s important to keep in mind that doesn’t necessarily mean they’re the most lucrative demographic segment to pursue. While Boomers and members of the Silent Generation spend more per trip, it’s safe to assume they take fewer trips, given the fact that millennials and Gen X make up more than 75% of the overall market.

Buying more, spending less

Statistics on AIP by generation bear out the previous theory that millennials buy lower priced products but more frequently. The trend line is pretty much the same — numbers get higher as you go from younger to older generations — just on a different axis in this chart. Millennials and Gen Z both have an AIP just below $14, while boomers and the Silent Generation are in the $15-17 range. These two slides are linked, as higher AIP often translates to higher basket sizes.

Men shell out more

Moving on from generational differences for a moment, we see that gender plays a significant role in purchasing patterns. Men, who we know participate more in the cannabis industry, also spend more on average. Their AIP is close to $15, while women are just below $14. Perhaps increased participation drives this difference, as men are more familiar with available products and develop expensive taste because of it. As with any gender dichotomies in cannabis, however, traditional gender roles probably have something to do with it.

The cannabis gender imbalance persists

Speaking of traditional gender roles, not much has changed for each generation of cannabis consumers. Across the board, men buy over 60% of cannabis, with millennial men being the most frequent consumers. Somewhat counterintuitively, Boomer women have the highest rate of participation in the industry. However, when you consider that many came of age in the‘60s, when cannabis was at its most culturally relevant point pre-legalization, this makes more sense. It’s also worth noting here that high AIPs for men, coupled with high millennial male participation in the market, could go a long way towards explaining why millennials make up over half of total sales.

Gentlemen prefer blunts

While it’s sometimes hard to say how traditional gender roles affect sales, it becomes a lot easier when we break down category sales data by gender. Wellness is a market phenomenon that has been almost exclusively marketed to women and is considered inherently feminine. Wellness is also a huge aspect of the cannabis industry, with modern recreational cannabis markets almost all coming after existing medical ones. And within cannabis, there are categories that are much more closely associated with wellness, like Tinctures & Sublingual's, Topicals, Capsules, and Edibles. Among those four categories, we see the highest participation from women, with over 45% of sales going to women. In every other category except Pre-Roll (41%),sales to women are less than 40% of the market. While women may prefer wellness, the other side of that coin is that inhaled cannabis often has a per formatively macho connotation .Smoking big blunts, taking huge dabs, and so on. And sure enough, the Concentrates market is 70% male, with Flower following close behind at 67%. Whether these gender roles are a good thing is a discussion for another place, but it’s clear that they play a role in the cannabis industry.

CBD products appeal more to women

The chart below is simple, and lines up neatly with the idea that wellness is marketed to and appeals more to women in cannabis, just as in other markets. Women spend 66% more of their cannabis wallet on CBD-containing cannabis products than men. CBD products are absolutely considered part of the wellness side of cannabis, if not the central pillar of it. What’s more ,the Categories with the highest participation from women are those that tend to have more products containing CBD. CBD Flower is relatively rare, while nearly every Topical contains CBD.

Key takeaways

• Millennials still dominate the cannabis industry, but Gen Z is the fastest-growing age group

.• Younger generations prefer Vapor Pens over their elders, which lines up with broader trends in tobacco consumption.

• Older generations have a slight preference for wellness-adjacent products, and Boomers continue to prefer traditional Flower products

.• Older generations spend more per visit than younger ones and buy higher-priced items. Gen X falls neatly in the middle of everyone, both in terms of AIP and basket size

.• In terms of gender, men still make up the bulk of cannabis consumers. They spend more and buy more overall.

• Women have a strong preference for wellness-adjacent products, with their highest rates of market participation being in Tinctures & Sublingual's, Topicals, Capsules, and Edibles.

• Men dominate markets like Concentrates and Flower, suggesting a male preference for inhalable products.

• Women buy CBD at a significantly higher rate than men, lining up with their apparent preference for wellness-adjacent products.