The Michigan cannabis market : A high-level overview

Introduction

This report provides a high-level overview of the Michigan adult-use and medical cannabis markets, exploring various sales and market trends from this year. All of the data in this report can be accessed in our market intelligence tool, Headset Insights. To explore market reads for Michigan and other legal cannabis markets further, sign up for a demo of Headset Insights.

Note: This report was first published in September 2020 and updated in August 2021.

Executive Summary

Although still a young market, Michigan is surpassing more mature markets in sales. From January to July 2021, Michigan has reached $970.4M in sales, exceeding both Washington and Oregon markets. When we break down Michigan's medical and adult-use cannabis markets, we find that in January, Michigan’s medical sales made up 38% of total sales but decreased to 27% of sales in July. When compared to other markets in this report, Michigan has the highest share to Edibles, and sells more Caramels, Chews, and Taffy than Colorado and California. Michigan also has the second highest average basket size so far this year at $81.04.

Methodology

All data for this report is sourced from Headsets Insights from January to July 2021. Data for both medical and adult-use sales are included for Oregon and Michigan in this industry report as that is how the data is presented for those markets in Headset Insights. Data for the Pennsylvania market is medical sales only.

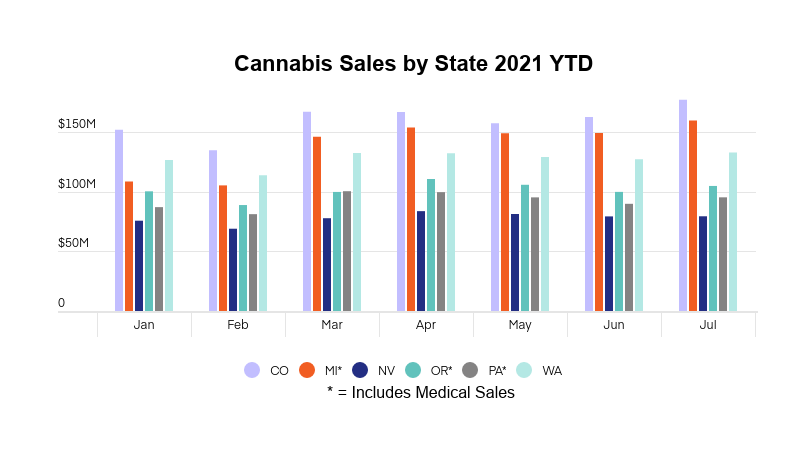

Cannabis sales by state

Let's first compare Michigan sales to other legal markets in the US. Even though Michigan is a young market, it has surpassed more mature markets such as Oregon and Washington in sales already this year and has reached $970.4M in sales, only $145M behind Colorado!

Monthly cannabis sales by state

By breaking down the sales by month, we can see just how quickly Michigan’s market has grown in 2021 and how it compares to more mature markets. Michigan cannabis sales started the year well behind Washington, but then surpassed Washington's sales in March. In May, Michigan’s cannabis sales ($148.9M) were less than $8.5M short of overtaking Colorado’s sales ($157.2.7M).

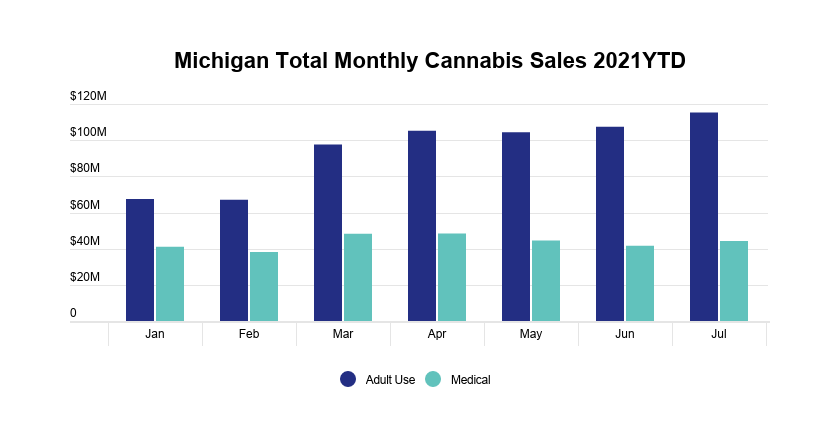

Total cannabis sales in Michigan

Now, we look specifically at Michigan's adult-use and medical sales by month. In January, Michigan’s medical sales made up 38% of total sales, but that has decreased down to 27% of sales in July. Adult-use sales continue to grow at an average of 10% month over month YTD.

Cannabis sales growth in Michigan

This graph displays month over month growth of cannabis sales, which can help us predict future growth and compare growth rates between various markets. Here we can see that Michigan adult-use sales have had consistently higher month over month growth than Michigan's medical sales so far this year. Growth in both portions of the market are slowing down slightly, indicating that the market is heading towards a more stable position. It is notable that Michigan is following the same month over month growth as other more mature markets.

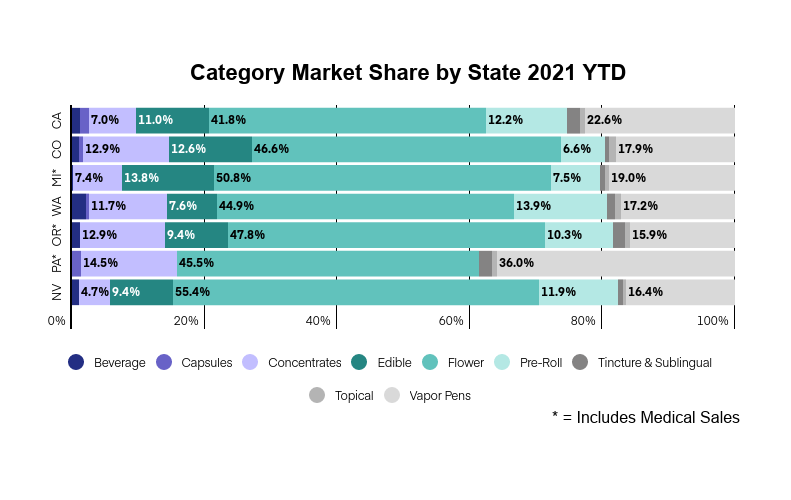

Category market share by state

When comparing category share across markets for this year, we can see what makes markets similar, and where they are unique. Focusing on Michigan, we can see that this market has the highest share to Edibles, followed by Colorado and the second highest share to Flower, with Nevada with the highest share to Flower. Michigan also has the third highest share to Vapor Pens, and relatively low Pre-Roll and Concentrate category shares.

Market share of cannabis Edibles by state

Since Edibles have the highest market share in California, Colorado, and Michigan, let's dive a bit deeper and look at their segments. Michigan is selling quite a bit more Caramels, Chews and Taffy, than Colorado and California. Michigan is not selling as many Gummies, although this is still the dominant Edible segment by a wide margin.

Prices of Edibles by state

Let's next take a look at pricing of Edibles in California, Colorado and Michigan. The orange bars are the total units sold, and the blue dots show the average item price. California has sold more Edibles so far in 2021 than Colorado and Michigan combined. Michigan has sold more Edibles than Colorado by 416K so far this year. Michigan is selling their Edibles at an average item price of $14.48, which is 11% lower than California's average item price of $16.23.

Average basket size by state

Michigan stands out among other US cannabis markets with the second to largest average basket size so far this year, at $81.04. That’s 2.3x larger than Washington’s average basket size, which has the smallest baskets of any state.

Conclusion

Headset Insights provides a detailed look at Michigan's cannabis market so that you can monitor cannabis sales trends, demographics, product pricing and more in order to stay ahead of the opportunities in the market. To keep track of Michigan and other legal states and provinces, sign up for a demo.

Key takeaways

- Michigan has reached $970.4M in sales in July 2021, surpassing both Washington and Oregon markets.

- In May, Michigan’s cannabis sales ($148.9M) were less than $8.5M short of overtaking Colorado’s sales ($157.2.7M).

- In January, Michigan’s medical sales made up 38% of total sales, which has decreased to 27% of sales in July. Adult-use sales continue to grow at an average of 10% month over month YTD.

- Edibles in Michigan are selling at an average item price of $14.48, 11% lower than California's average item price of $16.23.

- Michigan has the second highest average basket size so far this year at $81.04.