Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

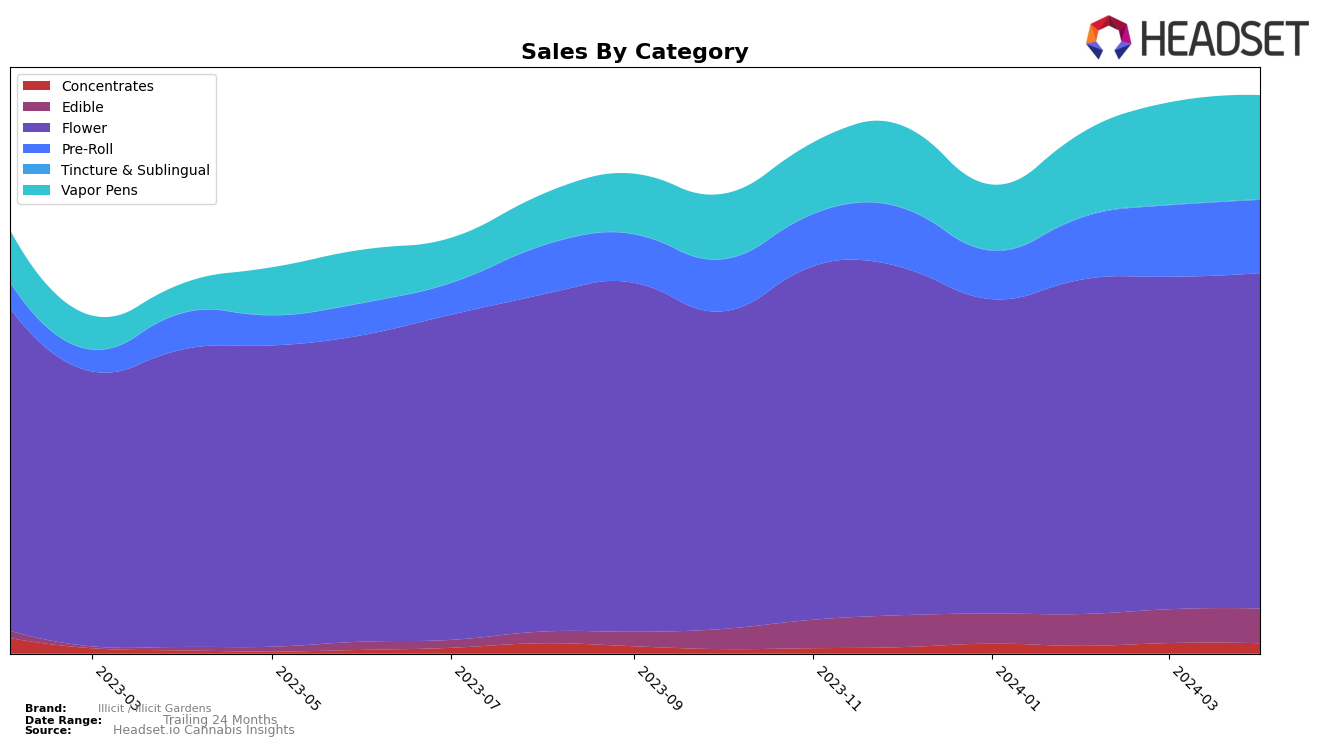

In Missouri, Illicit / Illicit Gardens has demonstrated a strong and consistent performance across multiple cannabis categories, indicating a solid market presence. Particularly noteworthy is their dominance in the Flower category, maintaining the number 1 rank from January to April 2024. This consistent top position, coupled with a steady increase in sales from 5,773,145 in January to 6,159,709 in April, illustrates the brand's strong foothold and consumer preference in this category. The Pre-Roll and Vapor Pens categories also show significant positive trends, with the brand holding steady at rank 2 in Pre-Rolls and improving from rank 3 to 2 in Vapor Pens over the same period. These movements suggest a well-received product line and growing consumer trust in these categories.

However, the Edible category presents a slightly different story for Illicit / Illicit Gardens in Missouri. While still maintaining a top 10 position from January to April 2024, the brand saw a slight drop from rank 10 in January and February to rank 11 in March, before returning to rank 10 in April. This fluctuation, while minor, indicates a more competitive landscape in the Edibles market or potential areas for improvement in product offerings or marketing strategies. Despite this, the increase in sales from 548,341 in January to 632,389 in April suggests a growing consumer base and resilience in maintaining a strong market position. This nuanced performance across categories highlights Illicit / Illicit Gardens' overall market strength while also pinpointing areas for strategic focus.

Competitive Landscape

In the competitive landscape of the Missouri flower cannabis market, Illicit / Illicit Gardens has maintained its position as the top brand from January to April 2024, showcasing consistent growth in sales. Despite this stronghold, the brand faces notable competition, particularly from CODES, which surged from the sixth position in January to the second by April, showing a significant increase in sales and closing the gap with Illicit / Illicit Gardens. Another competitor, Vivid (MO), despite fluctuating in rank, has shown resilience by holding onto the third spot from February through April, with a notable uptick in sales during this period. This dynamic indicates a competitive market where Illicit / Illicit Gardens, while leading, must continue to innovate and adapt to maintain its top position amidst the aggressive growth of competitors like CODES and the steady presence of Vivid (MO).

Notable Products

In Apr-2024, Illicit / Illicit Gardens saw GMO Cookies (3.5g) as its top-selling product, maintaining its position from the previous month with impressive sales of 16,026 units. Following closely, Ghost OG (3.5g) climbed to the second rank, up from its third position in March, showcasing the brand's ability to keep consumer interest in its flower category. Gorilla Pie (3.5g) experienced a slight drop to the third rank after being the top seller in February, indicating a competitive market within Illicit / Illicit Gardens' product lineup. The fourth place was secured by Dawg Lemons (3.5g), which also showed a consistent improvement in its ranking since February. Interestingly, Hibernate (3.5g), which was the top product in January, saw a significant decline, landing in the fifth position by April, highlighting dynamic consumer preferences within the cannabis market.

Top Selling Cannabis Brands