Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

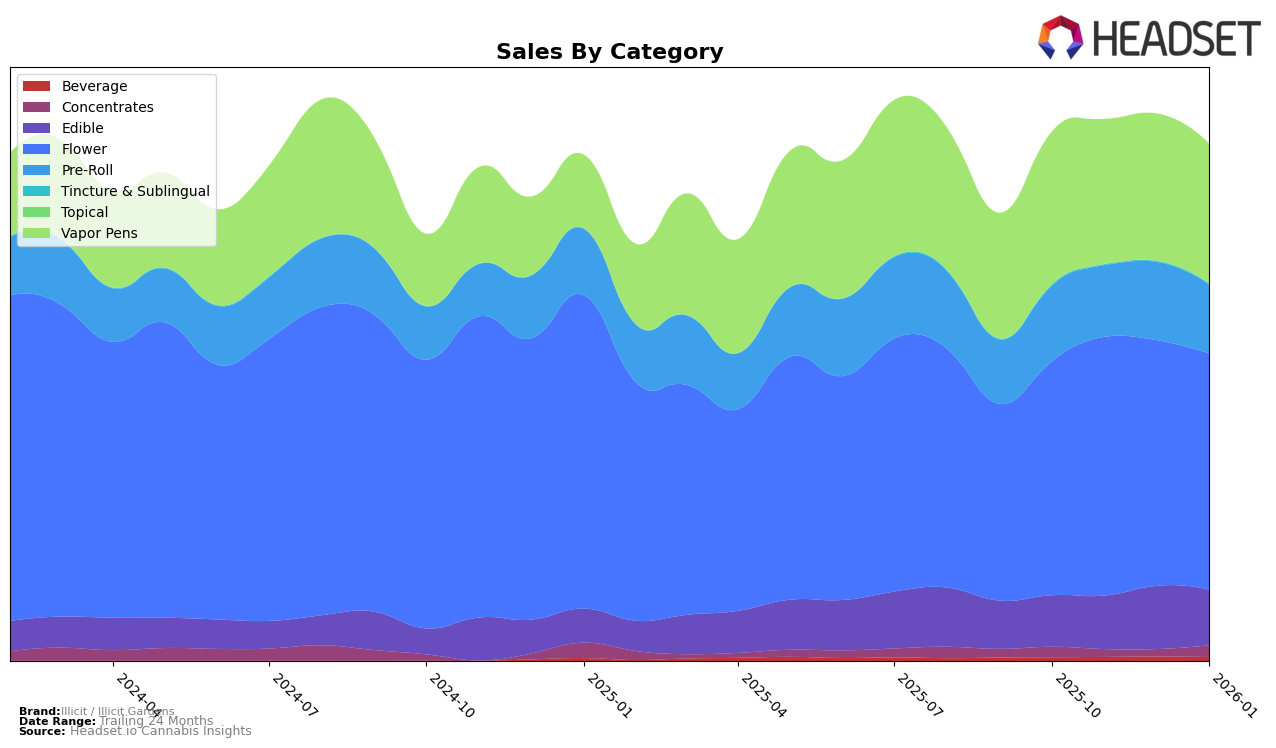

Illicit / Illicit Gardens has shown a strong performance in the state of Missouri, particularly in the Vapor Pens and Flower categories. In Missouri, the brand maintained a consistent second-place rank in Vapor Pens from November 2025 to January 2026, with sales peaking in December. Their Flower category also displayed notable resilience, holding a top-three position throughout the same period. The brand's Edible category saw a positive trajectory, climbing from seventh to fifth place by December 2025, although there was a slight dip in sales in January 2026. These movements indicate a solid foothold in the Missouri market, with particular strength in Vapor Pens.

In contrast, the performance of Illicit / Illicit Gardens in New Jersey presents a different picture. The brand's Flower category experienced fluctuations, with rankings ranging from 24th in November 2025 to falling out of the top 30 in December before recovering slightly in January 2026. This indicates challenges in maintaining a stable presence in the New Jersey market. Additionally, while the brand's Vapor Pens category showed some promise with an 18th place rank in November, data for subsequent months is unavailable, suggesting they did not maintain a top 30 position. These insights highlight the contrasting market dynamics between Missouri and New Jersey, with Illicit / Illicit Gardens facing more competitive pressures in the latter.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Illicit / Illicit Gardens has demonstrated a strong presence, consistently ranking within the top four brands from October 2025 to January 2026. Notably, Illicit / Illicit Gardens improved its position from fourth in October 2025 to second in November 2025, before stabilizing at third place in December 2025 and January 2026. This upward trend in ranking indicates a robust market performance, even as it competes with dominant brands like Flora Farms, which maintained the top spot throughout this period. Despite facing stiff competition from CODES and Sinse Cannabis, Illicit / Illicit Gardens managed to sustain its sales momentum, reflecting a resilient brand strategy that resonates well with consumers. This competitive positioning suggests that Illicit / Illicit Gardens is effectively capturing market share and could potentially challenge for higher ranks with continued strategic efforts.

Notable Products

In January 2026, Ghost OG (3.5g) maintained its top position as the leading product for Illicit / Illicit Gardens, with sales reaching 7,964 units. Gorilla Pie (3.5g) climbed to the second rank from the third in December 2025, showing a recovery in sales. Chem Butter (3.5g) improved its standing to third place, up from the fifth position in the previous month. The CBD/CBN/THC 2:2:1 Peaches & Dreams Nighttime Gummies slipped to fourth place, despite being second in December 2025. Kingdom Kush (3.5g) remained consistent in its performance, ranking fifth, showing stable sales figures over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.