Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

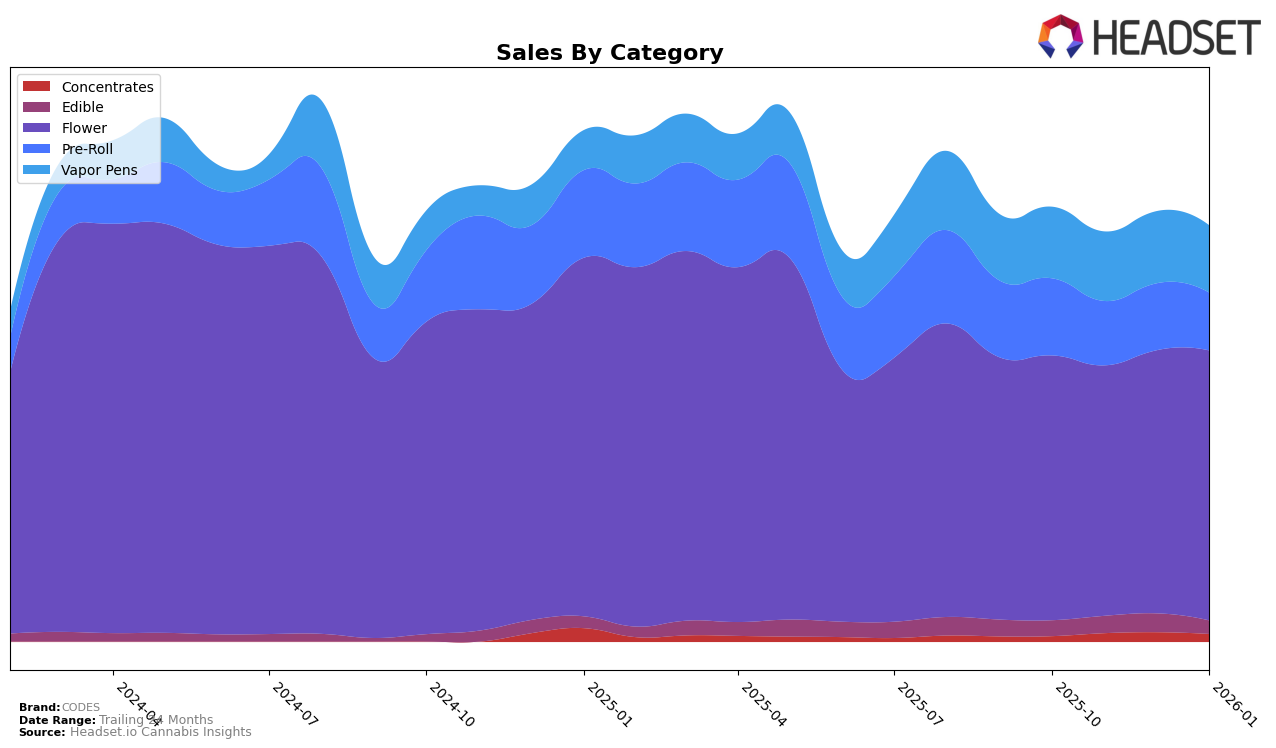

CODES has shown varied performance across different product categories in Missouri. In the Flower category, CODES maintained a strong presence, consistently ranking within the top three from October 2025 to January 2026. This stability highlights their dominance and consumer preference in this category. However, in the Concentrates category, CODES only appeared in the top 30 rankings during November and December 2025, indicating room for improvement or less focus on this segment. Their performance in Vapor Pens improved slightly, moving from rank 13 in October to 11 by January, suggesting a positive trend in consumer reception.

The Edible category witnessed a consistent performance, with CODES maintaining a position around the 20th rank throughout the observed months. This steadiness suggests a loyal customer base, although there might be potential for growth. In the Pre-Roll category, CODES experienced a slight decline from rank 3 in October to 4 in the subsequent months, which could be a point of concern if the trend continues. Notably, CODES was absent from the top 30 in the Concentrates category in October 2025 and January 2026, which could indicate either a strategic shift or a competitive disadvantage in this segment. Overall, while CODES shows strength in certain categories, there are clear opportunities for further market penetration and expansion.

Competitive Landscape

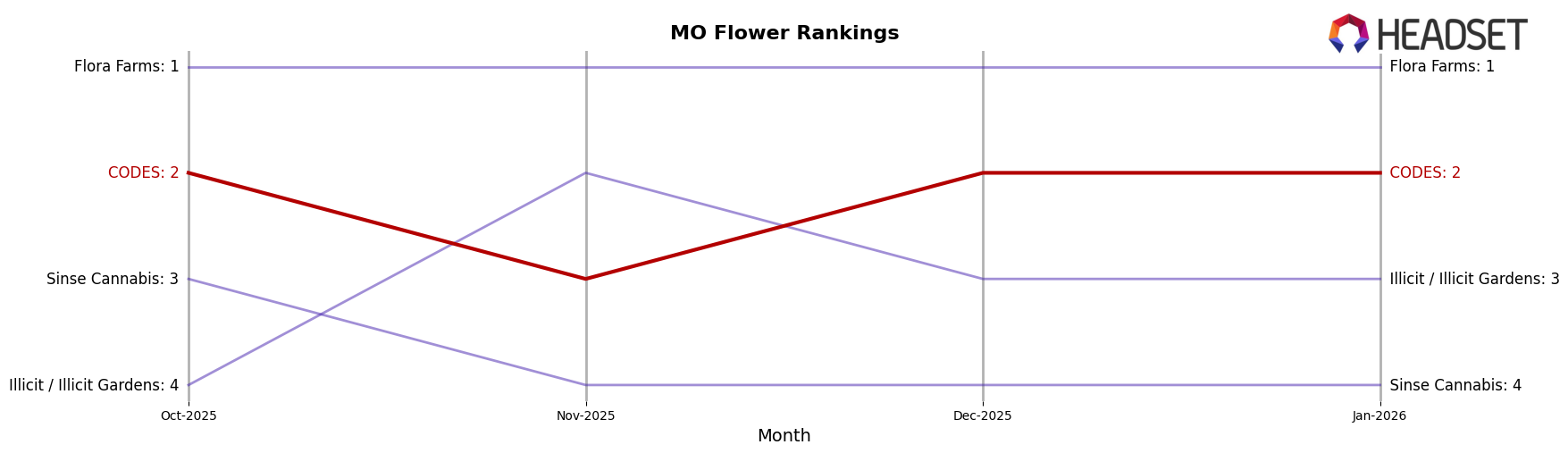

In the competitive landscape of the Missouri flower category, CODES has demonstrated resilience and strategic positioning amidst fluctuating market dynamics. Over the analyzed period from October 2025 to January 2026, CODES consistently maintained a strong presence, ranking second in October, December, and January, with a slight dip to third in November. This stability in rank is noteworthy given the competitive pressures from brands like Illicit / Illicit Gardens and Sinse Cannabis, which experienced more volatility in their rankings. Notably, Flora Farms consistently held the top position, indicating a strong market dominance. Despite these challenges, CODES' sales trajectory showed a positive trend, with January 2026 sales surpassing those of October 2025, suggesting effective market strategies and consumer loyalty. This performance highlights CODES' capability to adapt and thrive in a competitive market, making it a formidable player in Missouri's flower category.

Notable Products

In January 2026, the top-performing product for CODES was Triangle Mints (3.5g) in the Flower category, reclaiming its top position with sales hitting 11,426 units. Grape Gas (3.5g), also in the Flower category, slipped to the second rank, despite leading in the previous two months. Member Berry (3.5g) maintained a consistent third place across both December and January. Notably, Triangle Mints Pre-Roll (1g) rose to fourth place, marking a significant increase in popularity from November. Gelato Stomper Pre-Roll (1g) entered the rankings at fifth place, indicating a strong entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.