Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

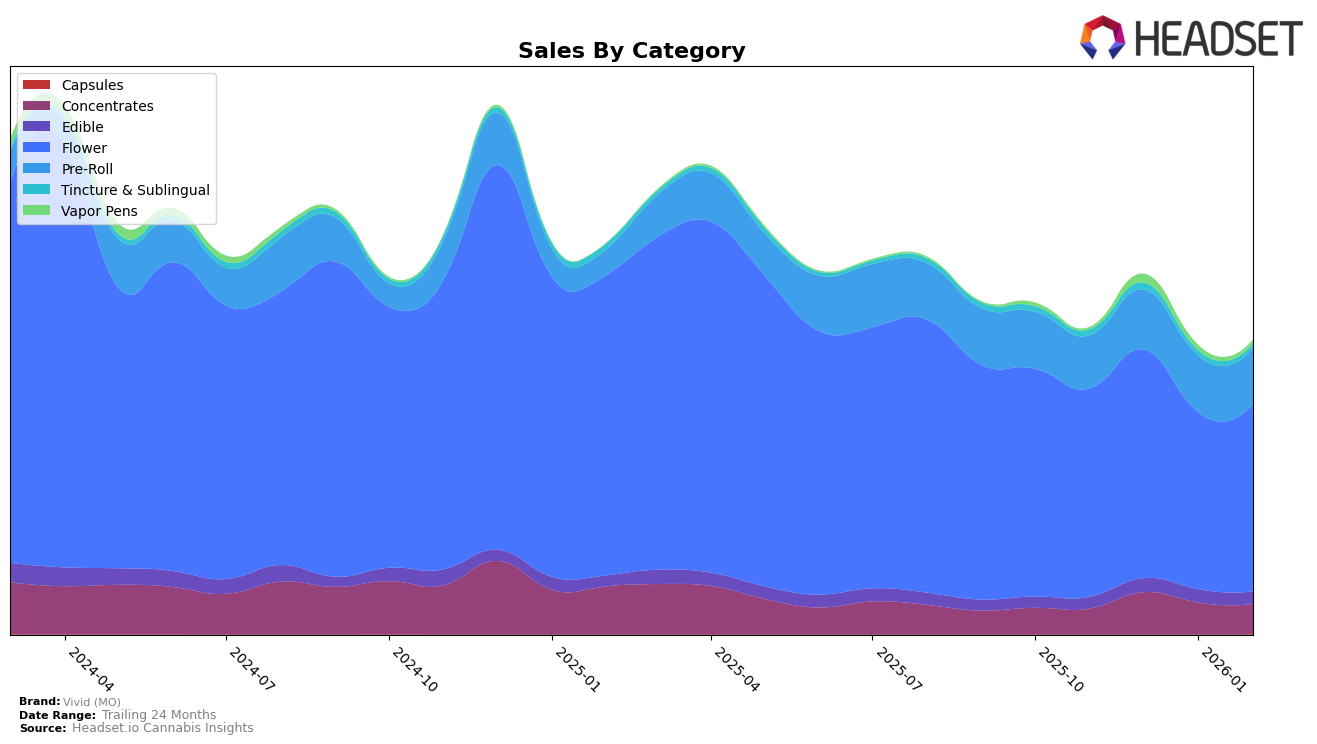

Vivid (MO) has demonstrated notable performance across various product categories in Missouri, with some categories showing more consistent rankings than others. In the Concentrates category, Vivid (MO) improved its ranking from 8th in November 2025 to 4th in December 2025, maintaining a strong position at 5th place in both January and February 2026. This indicates a solid presence and possibly a loyal customer base in this segment. In contrast, the Edible category saw Vivid (MO) struggling to consistently break into the top 30, only achieving a rank of 28th in January 2026 and improving slightly to 26th by February 2026. This suggests potential challenges in the Edible market or perhaps an opportunity for growth if they can address consumer needs more effectively.

The Flower category has been a stronghold for Vivid (MO), consistently ranking within the top 10, maintaining 6th and 7th positions across the observed months. This stability suggests a strong product offering that resonates well with consumers in Missouri. In the Pre-Roll category, Vivid (MO) also maintained a steady presence, ranking 7th consistently from December 2025 through February 2026. However, the Tincture & Sublingual category saw a dramatic rise, with Vivid (MO) achieving the top position in December 2025, although no data is available for subsequent months, indicating either a lack of continued top 30 presence or missing data. The Vapor Pens category presents a different story, where Vivid (MO) did not rank in the top 30 except for a brief appearance at 54th in December 2025, suggesting significant competition or a need for product differentiation in this segment.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Vivid (MO) has maintained a consistent presence, though it faces stiff competition from several notable brands. Over the period from November 2025 to February 2026, Vivid (MO) experienced fluctuations in its rank, starting at 6th place in November and December, dropping to 7th in January and maintaining that position in February. This stability contrasts with the upward trajectory of Good Day Farm, which improved from 8th to 5th place, indicating a strong growth trend. Meanwhile, Amaze Cannabis held a steady position in the top 5, though it saw a slight dip to 6th in February, suggesting potential vulnerabilities. Vibe Cannabis (MO) showed a recovery from 10th place in December and January to 8th in February, highlighting a potential resurgence. Vivid (MO)'s sales figures reflect a mixed performance, with a notable dip in January followed by a recovery in February, indicating resilience amidst competitive pressures. As the market dynamics continue to evolve, Vivid (MO) must strategize to enhance its competitive edge and capitalize on growth opportunities in Missouri's Flower category.

Notable Products

In February 2026, Vivid (MO) saw impressive sales figures, with Florida Kush (3.5g) topping the charts as the leading product in the Flower category, achieving the number one rank with sales of 9,856 units. This product regained its top position after a slight dip to second place in December and January. Florida Kush Pre-Roll (1g) held a strong performance in the Pre-Roll category, securing the second rank, slightly dropping from its first-place position in the previous two months. Fruit Gusherz Pre-Roll (1g) maintained its third-place rank from January, highlighting its steady popularity among consumers. Meanwhile, Alien Mintz Pre-Roll (1g) and Caps Frozen Lemons Pre-Roll (1g) held their positions at fourth and fifth, respectively, indicating consistent demand for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.