Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

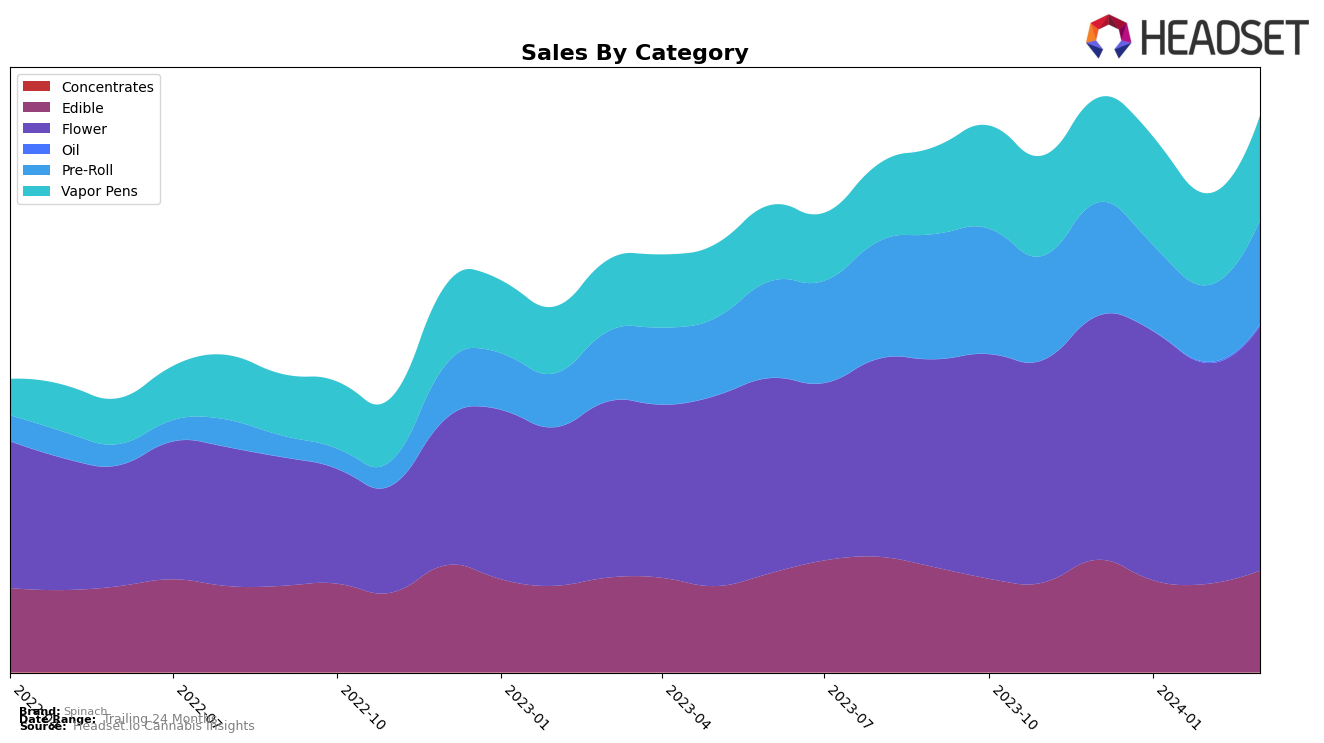

In the dynamic landscape of the cannabis market, Spinach has shown remarkable consistency and growth across various categories and provinces. Notably, in Alberta, Spinach maintained its top position in the Edibles category from December 2023 to March 2024, despite a slight dip in sales in January and February before rebounding in March. The brand also held steady in the Flower and Pre-Roll categories, ranking second consistently, showcasing its strong presence in these competitive segments. However, a significant upward movement was observed in the Oils category, where Spinach climbed from a rank of 22 in December 2023 to 15 by March 2024, indicating a growing consumer interest in their oil products despite starting from a lower sales figure. This trend of improvement is a testament to Spinach's ability to expand its market share in a category where it wasn't a leading player initially.

Looking at Ontario, Spinach's performance is even more impressive, dominating the Flower category with a consistent first-place ranking from December 2023 through March 2024, and achieving the highest sales figures among all categories and provinces reported. This dominance in Ontario, Canada's most populous province, is a significant achievement and speaks volumes about the brand's popularity and the quality of its Flower products. However, in the Oil category, Spinach faced challenges, not ranking in the top 30 in December 2023 but making a notable jump to 11th by February and maintaining this position into March 2024. This dramatic improvement in ranking, alongside a substantial increase in sales, highlights Spinach's potential for growth and adaptation in less dominant categories. The brand's ability to recover and improve in categories where it initially had a weaker presence showcases its resilience and strategic market positioning.

Competitive Landscape

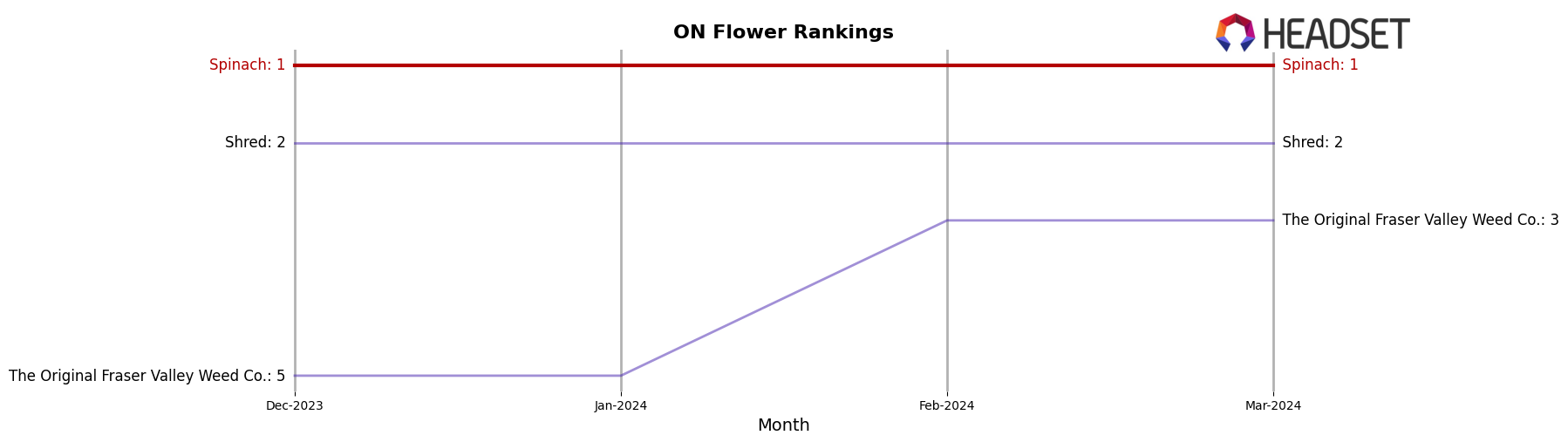

In the competitive landscape of the cannabis flower category within Ontario, Spinach has maintained its dominance as the top-selling brand from December 2023 through March 2024, showcasing a consistent lead in sales and rank. Its closest competitor, Shred, has consistently held the second position during the same period, though trailing behind Spinach in sales, indicating a clear preference among consumers for Spinach's offerings. Notably, The Original Fraser Valley Weed Co. has shown an upward trend, moving from the fifth to the third rank by March 2024, and significantly closing the sales gap with Shred. This shift suggests a dynamic competitive environment where brands such as The Original Fraser Valley Weed Co. are gaining momentum. However, Spinach's sustained lead in both rank and sales underscores its strong market position and consumer loyalty in Ontario's cannabis flower market.

Notable Products

In March 2024, Spinach's top-selling product was Sourz - Blue Raspberry Watermelon Gummies 5-Pack (10mg) from the Edible category, maintaining its number one rank from previous months with sales hitting 100,080. Following closely, Sourz - Strawberry Mango Gummies 5-Pack (10mg) also kept its second rank consistently, showcasing the brand's dominance in the Edible category. The third spot was secured by Sourz - CBD/THC 1:1 Peach Orange Gummies 5-Pack (10mg CBD, 10mg THC), indicating a stable preference among consumers for Spinach's Sourz line. Notably, all top three products have not changed their rankings since December 2023, demonstrating a strong and steady demand. The entry of Feelz Deep Dreamz - THC/CBN 2:1 Blueberry Pomegranate Gummies 2-Pack (10mg THC, 5mg CBN) in the top five, maintaining its position since January, suggests a growing interest in products offering a combination of THC and CBN.

Top Selling Cannabis Brands