Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

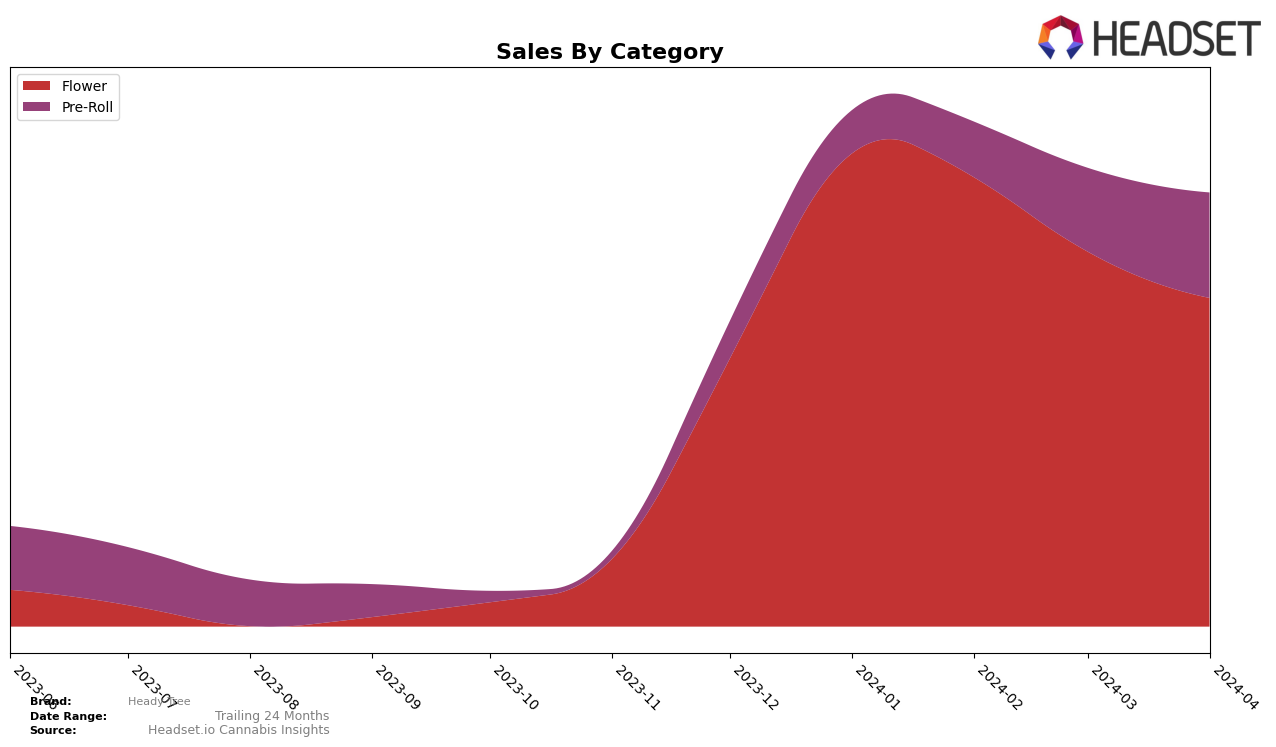

In the competitive cannabis market of New York, Heady Tree has shown a notable presence across different categories, with a particularly strong performance in the Flower and Pre-Roll categories. For the Flower category, Heady Tree maintained the second rank in January and February 2024 but experienced a slight decline to the sixth and seventh positions in March and April, respectively. This downward trend in ranking is mirrored by a consistent decrease in monthly sales from January's peak of $685,415 to April's $484,704, indicating a potential challenge in maintaining market share amidst growing competition. Conversely, in the Pre-Roll category, Heady Tree has shown an upward trajectory in sales, climbing from $87,692 in January to $174,111 in April, despite the rankings hovering around the 12th and 13th positions. This suggests a growing consumer preference for Heady Tree's Pre-Rolls, even as the brand fights to break into the top 10 in this category.

While Heady Tree's performance in New York's Flower and Pre-Roll categories presents a mixed bag of results, the brand's ability to maintain a top 30 ranking across these competitive segments is commendable. The decline in the Flower category rankings from second to seventh place over the four months raises questions about the brand's strategy in retaining its market position against rivals. On the other hand, the consistent improvement in Pre-Roll sales, despite stagnant rankings, highlights a strong consumer loyalty or an effective increase in production and distribution capabilities. These dynamics suggest that while Heady Tree faces challenges in the highly competitive New York market, it also possesses strong potential for growth, particularly in the Pre-Roll category. The brand's performance trajectory offers valuable insights into market trends and consumer preferences, making it a subject of interest for stakeholders looking to understand the evolving cannabis landscape in New York.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Heady Tree has experienced a notable shift in its market position over the recent months. Initially ranked 2nd in January and February 2024, Heady Tree saw a decline, moving to 6th in March and 7th in April. This change in rank is indicative of fluctuating sales, with a peak in January followed by a gradual decrease through to April. Competitors such as Revert Cannabis New York, which consistently held a top 5 position, and Electraleaf, which saw a significant rise from 10th to 5th place, highlight the dynamic nature of the market. Notably, Electraleaf's sales surged in March, positioning it above Heady Tree for the first time. Other brands like Nanticoke and Zizzle also showed varying degrees of competitiveness, with Zizzle experiencing a slight dip in rank but maintaining strong sales. This competitive analysis underscores the importance of monitoring market shifts and the performance of key players like Heady Tree, whose sales and rank trajectories offer valuable insights for strategic positioning.

Notable Products

In Apr-2024, Heady Tree's top-selling product was Uptown Funk (3.5g) from the Flower category, maintaining its number one spot from the previous month with sales reaching 3481 units. Following closely, Glitter Bomb (3.5g), also from the Flower category, secured the second position, holding steady in its rank with a slight sales dip compared to March. The third place was taken by Glitter Bomb Infused Pre-Roll (1g) in the Pre-Roll category, climbing up one rank from the previous month, indicating a growing interest in infused products. A notable entry, Dante Inferno Infused Pre-Roll (1g), debuted in the rankings directly at the fourth position, showcasing a strong market entry. Lastly, Uptown Funk Infused Pre-Roll (1g) rounded out the top five, consistent in its rank over the past months, highlighting a stable demand for Heady Tree's infused pre-roll offerings.

Top Selling Cannabis Brands