Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

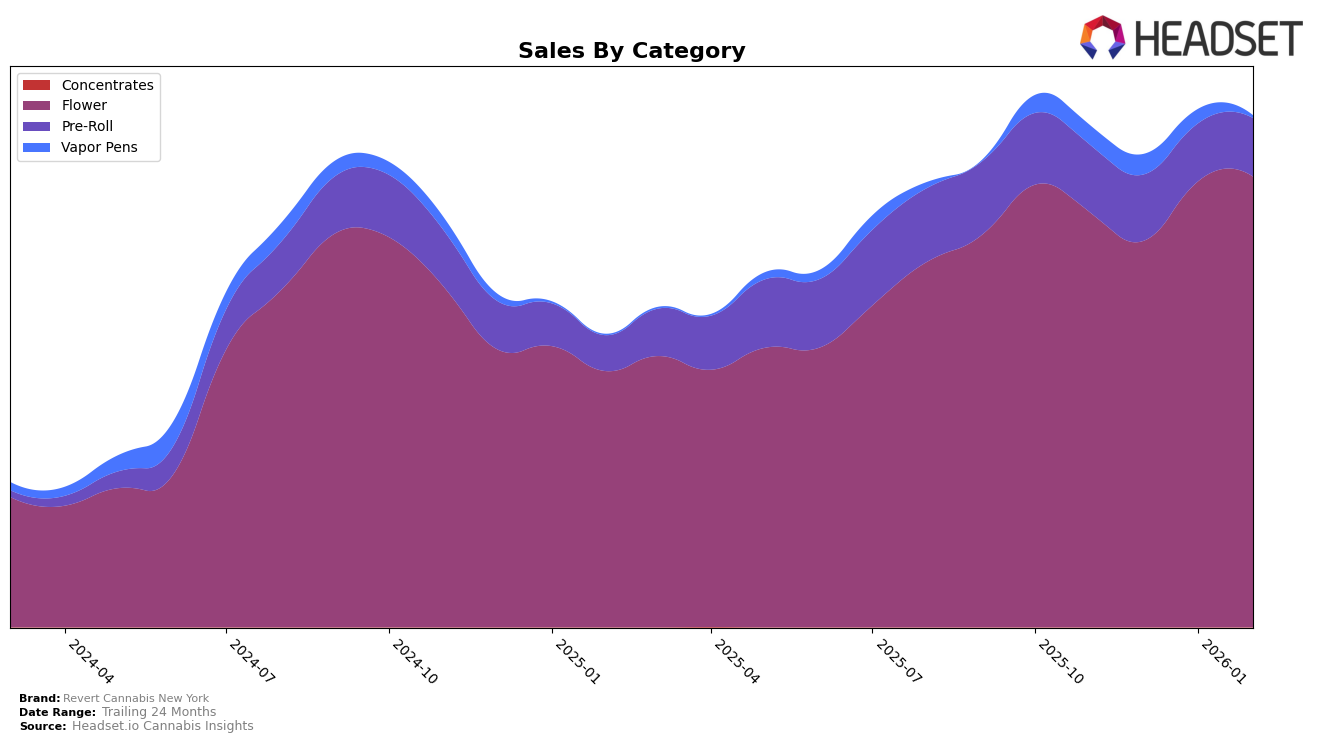

Revert Cannabis New York has shown a dynamic performance across different categories, particularly in the New York market. In the Flower category, the brand has maintained a strong presence, consistently ranking within the top six from November 2025 to February 2026. Despite a slight dip from third to sixth place in December, Revert quickly rebounded to fifth position in January and maintained this rank in February. This resilience is reflected in their sales figures, which show a steady increase over the months, culminating in over $2.3 million in February 2026. This indicates a robust demand and effective market strategies in the Flower category.

In contrast, Revert Cannabis New York's performance in the Pre-Roll and Vapor Pens categories has been less impressive. The brand has struggled to break into the top 20 for Pre-Rolls, hovering around the 21st to 26th positions. This stagnation is coupled with a decline in sales, suggesting challenges in capturing a larger market share. The situation is even more pronounced in the Vapor Pens category, where the brand fell out of the top 30 by January 2026. This drop, along with the absence of a ranking in February, highlights potential issues in product appeal or distribution in this category. These contrasting performances across categories suggest areas of both strength and potential improvement for Revert Cannabis New York.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Revert Cannabis New York has experienced notable fluctuations in its rank over recent months. Starting at 3rd place in November 2025, Revert saw a dip to 6th in December, before recovering slightly to stabilize at 5th in January and February 2026. This volatility contrasts with the steady ascent of Find., which climbed from 6th to 3rd place over the same period, indicating a strong upward trend. Meanwhile, RYTHM maintained a consistent presence in the top 5, while Rolling Green Cannabis experienced a decline, dropping from 3rd to 7th place by February 2026. Despite these shifts, Revert Cannabis New York's sales figures show resilience, with a recovery in sales from December to February, suggesting a potential for regaining higher ranks if this positive trend continues.

Notable Products

In February 2026, Pineapple Haze Pre-Roll (0.5g) maintained its position as the top-performing product for Revert Cannabis New York, with sales reaching 6366 units. Strawberry Amnesia Pre-Roll (0.5g) held steady at the second rank, showing a consistent upward trend in sales from previous months. Godfather OG Pre-Roll (0.5g) remained in third place, despite a dip in sales compared to January. Sunset Sherbert Pre-Roll (0.5g) secured the fourth position, improving from its initial entry at fifth place in December. Notably, Pink Punch Pre-Roll (0.5g) entered the rankings for the first time in February, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.