Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

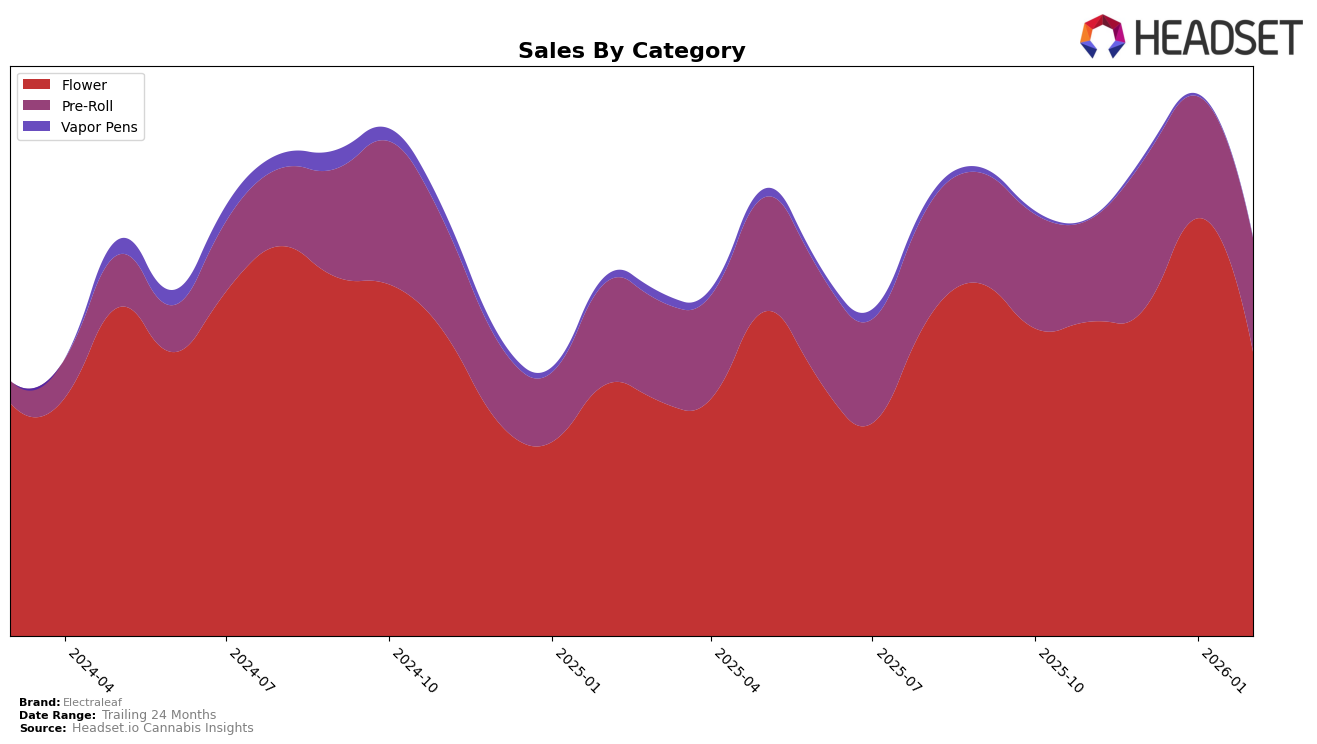

In the New York market, Electraleaf has shown a mixed performance across different categories. In the Flower category, the brand maintained a relatively stable ranking, moving from 17th in November 2025 to 16th in both December 2025 and January 2026, before dropping slightly to 18th in February 2026. This fluctuation corresponds with a notable sales peak in January 2026, suggesting a temporary surge in popularity or a successful marketing push during that month. Conversely, in the Pre-Roll category, Electraleaf demonstrated a more dynamic presence, climbing from 31st place in November 2025 to 21st in December 2025. However, this upward momentum was not sustained, as the brand's ranking slipped to 25th by February 2026. The Pre-Roll sales figures reflect a similar trend, with a peak in December 2025, followed by a gradual decline.

Electraleaf's varying performance across these categories highlights the brand's ability to capture consumer interest, albeit with some volatility. The Flower category's relatively stable ranking suggests a consistent consumer base, while the Pre-Roll category indicates potential challenges in maintaining a top-tier position. Notably, Electraleaf did not break into the top 30 brands in any other state or category during this period, which could be seen as a limitation in their market reach. This absence from additional rankings might point to opportunities for growth and expansion into new markets or categories, where they could leverage their existing brand recognition and consumer loyalty in New York to gain traction.

Competitive Landscape

In the competitive landscape of the New York flower category, Electraleaf has experienced some fluctuations in its ranking over recent months. While maintaining a steady presence, Electraleaf's rank shifted from 17th in November 2025 to 18th by February 2026. This slight decline in rank is notable, especially when compared to competitors like LivWell, which improved its position from 15th to 17th, and 1937, which made a significant leap from 33rd to 20th. Despite these changes, Electraleaf's sales showed a peak in January 2026, indicating a strong market presence during that period. However, the subsequent drop in sales by February suggests potential challenges in maintaining momentum. Meanwhile, The Plug Pack managed to recover from a dip in December, improving its rank to 16th by February, showcasing its resilience in the market. These dynamics highlight the competitive pressure Electraleaf faces and underscore the importance of strategic adjustments to sustain and enhance its market position.

Notable Products

In February 2026, Marshmallow OG (3.5g) emerged as the top-performing product for Electraleaf, climbing from a previous rank of 2.0 in January to the 1.0 position, with sales reaching 1,698 units. Mac 1 (3.5g) made its debut on the ranking list at position 2.0, showcasing strong entry performance. Super Lemon Diesel (3.5g), previously ranked 1.0 in January, dropped to the 3.0 position, indicating a slight decline in popularity. The Super Lemon Diesel Pre-Roll (1g) saw a significant drop from its consistent top rank in previous months to 4.0, suggesting a shift in consumer preference towards other products. Biscotti (3.5g) maintained its presence at rank 5.0, indicating stable demand within its category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.