Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

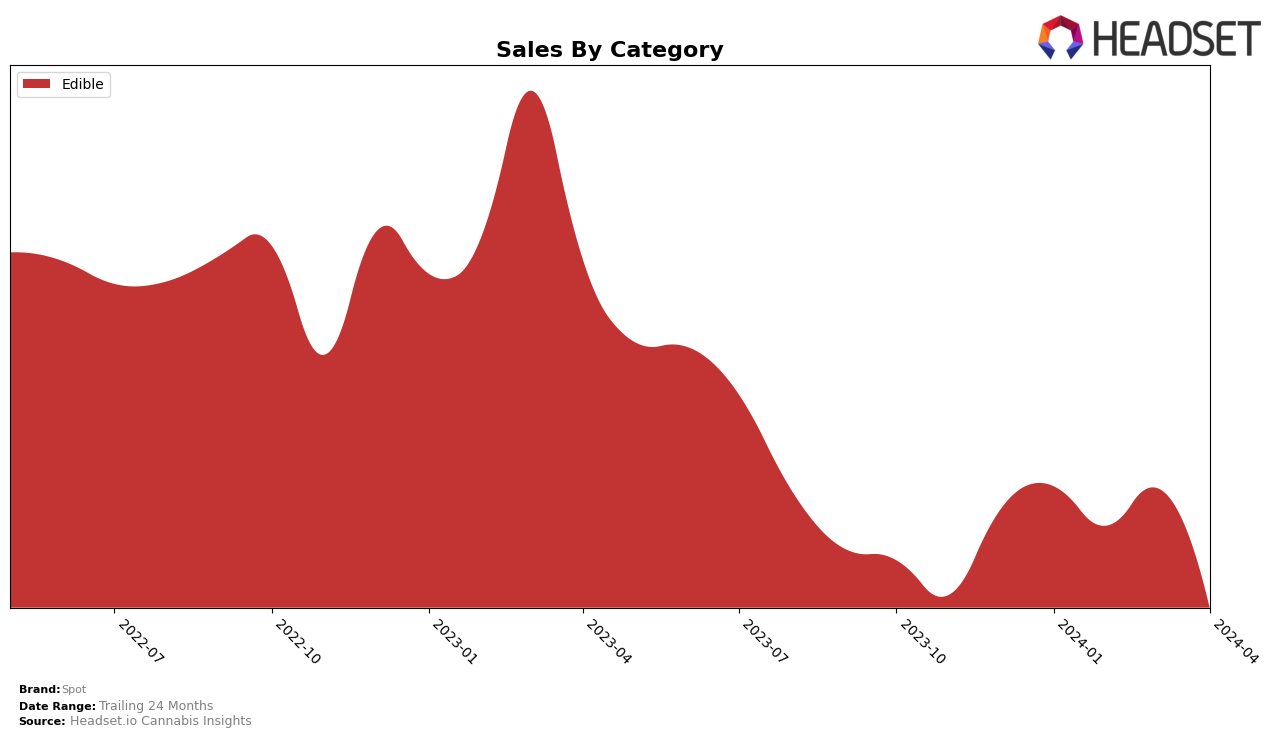

In Washington, Spot has shown a consistent presence in the edible category, maintaining a position within the top 30 brands over the observed months. Starting the year at rank 20 in January 2024, Spot held its ground in February but experienced a slight decline in March and April, slipping to ranks 21 and 22, respectively. This downward trend in ranking, despite relatively stable sales figures in the first quarter, suggests an increasingly competitive market or a shift in consumer preferences within the state. Notably, Spot's sales in January 2024 reached $92,646, indicating a strong start to the year, but by April, sales had decreased to $67,261, highlighting a potential area for concern or an opportunity for strategic adjustments.

The performance of Spot across categories and states/provinces reveals a nuanced picture of its market positioning and brand dynamics. The slight but consistent drop in ranking within the Washington edible category, coupled with the fluctuating sales figures, points towards challenges the brand may be facing in maintaining its market share amidst growing competition or changing market conditions. The absence of Spot from the top 30 brands in any other state or category for the given months further emphasizes the brand's concentrated presence and potential dependency on the Washington market. This analysis suggests that while Spot has a solid foothold in the Washington edibles market, diversification and strategic initiatives may be necessary to sustain and enhance its market position in the face of evolving consumer preferences and competitive pressures.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Washington, Spot has faced a challenging trajectory, with its rank slipping from 20th in January 2024 to 22nd by April 2024. This decline in rank is indicative of Spot's struggle to maintain its foothold amidst fierce competition. Notably, Binske, which was trailing behind Spot in January and February, managed to overtake Spot by March, securing the 20th rank by April. This shift underscores Binske's growing prominence and Spot's challenges in retaining its market position. Meanwhile, Cosmic Candy has consistently outperformed Spot, maintaining a higher rank and showcasing stronger sales performance throughout the period. On the other end, June's Sweets & Savories and Koko Gemz have fluctuated in ranks below Spot, indicating a competitive but less direct threat. This competitive analysis highlights the dynamic nature of the edible cannabis market in Washington and Spot's need to innovate and adapt to regain and improve its market standing.

Notable Products

In April 2024, Spot's top-performing product was the CBG:THC 4:1 Gooseberry Soft Chews 2-Pack (40mg CBG, 10mg THC) in the Edible category, reclaiming its number one spot with sales of 1835 units. Following closely behind was the Vacation Blend - CBD/THC 1:1 Indica Dark Chocolate Squares 10-Pack (100mg CBD, 100mg THC), which held steady at second place from the previous month. The Vacation Blend - CBD/THC 1:1 Indica Milk Chocolate Bar 10-Pack (100mg CBD, 100mg THC) maintained its third position, demonstrating consistent consumer preference within the Edible category. Noteworthy is the new entrant, Adventure Blend - CBD/THC 3:10 Sativa Dark Chocolate Bar 10-Pack (30mg CBD, 100mg THC), which debuted directly in fourth place, indicating a strong market introduction. The rankings highlight not only the popularity of edible cannabis products but also the dynamic shifts and preferences within Spot's product range.

Top Selling Cannabis Brands