Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

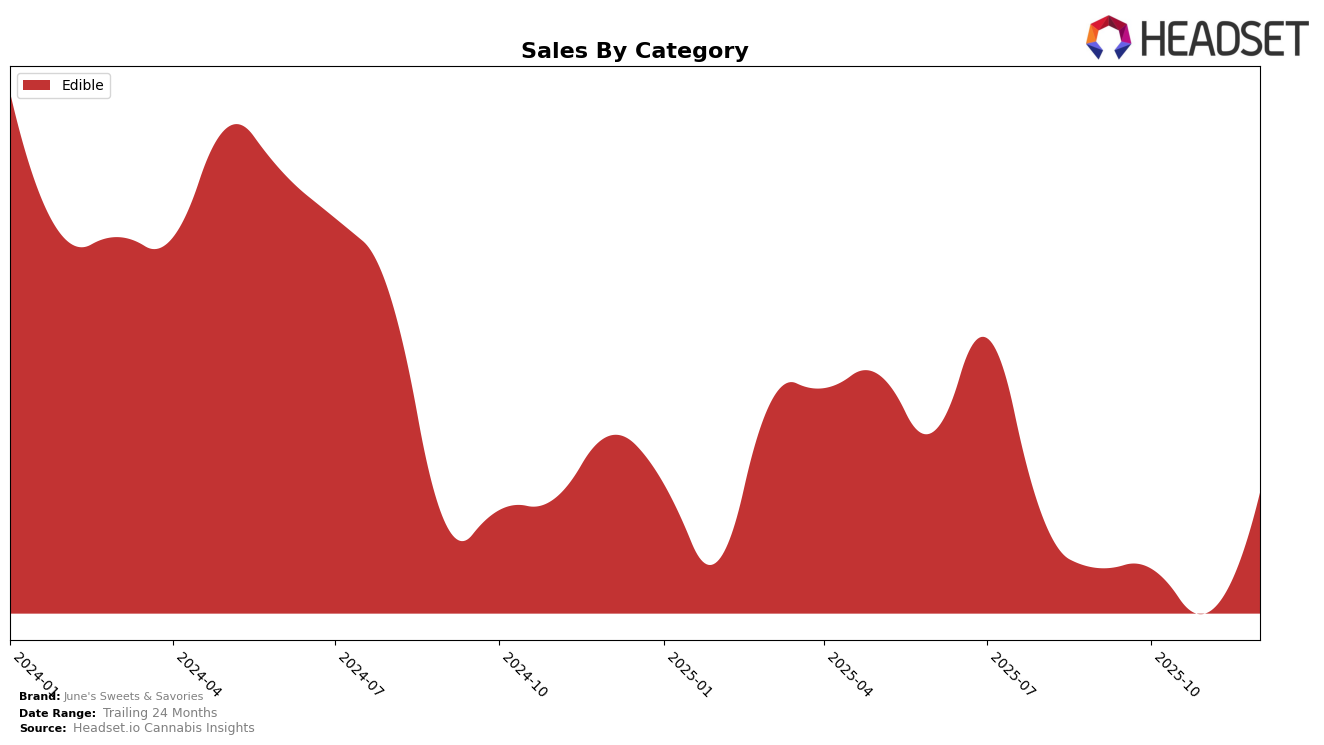

June's Sweets & Savories has experienced varied performance across different states and categories towards the end of 2025. In the Washington market, the brand showed a slight dip in the edible category rankings from September to November, moving from 28th to 31st place. This dip indicates a challenge in maintaining a consistent presence within the top 30. However, December saw a positive shift as the brand climbed back to 30th place, suggesting a potential recovery or successful strategic adjustments. This fluctuation in rankings highlights the competitive nature of the edible market in Washington and the need for brands to innovate and adapt continually.

Despite the fluctuations in rankings, the sales figures for December in Washington are noteworthy, reflecting a significant increase compared to the previous months. This upward trend in sales, despite the brand's ranking struggles, could indicate a strong customer base or successful promotional activities during the holiday season. The absence of June's Sweets & Savories from the top 30 in November serves as a reminder of the volatility and challenges faced by brands in maintaining a leading position. The insights from the Washington market provide a glimpse into the brand's performance dynamics, offering a foundation for further exploration into other states and categories where the brand operates.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Washington, June's Sweets & Savories experienced fluctuating rankings from September to December 2025, highlighting both challenges and opportunities. Notably, the brand saw a dip in its rank from 28th in September to 31st in November, before slightly recovering to 30th in December. This movement contrasts with competitors like Hi-Burst, which consistently maintained a higher rank, ending December at 28th, and Agro Couture, which improved its position to 29th by December. Meanwhile, Goodies remained stable at the 32nd position throughout the period. The sales trends suggest that while June's Sweets & Savories experienced a sales increase in December, its competitors, particularly Hi-Burst, managed to outpace it in terms of rank, indicating a need for strategic adjustments to enhance market positioning. The data underscores the importance of understanding competitive dynamics to capitalize on growth opportunities in the Washington edibles market.

Notable Products

In December 2025, the top-performing product from June's Sweets & Savories was Sweet Blood Orange Fruit Jellies 10-Pack (100mg), maintaining its number one rank from November with sales reaching 504 units. Sweet Strawberry Pineapple Fruit Jellies 10-Pack (100mg) climbed to the second position, up from fifth in the previous two months, with a notable increase in sales to 417 units. Sour Blue Raspberry Fruit Jellies 10-Pack (100mg) dropped to third place despite consistent popularity in earlier months. Sour Watermelon Fruit Jellies 10-Pack (100mg) held steady at fourth place, showing a slight fluctuation in sales figures. Lastly, Sour Strawberry Lemonade Fruit Jellies 10-Pack (100mg) rounded out the top five, experiencing a decline from its second-place rank in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.