Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

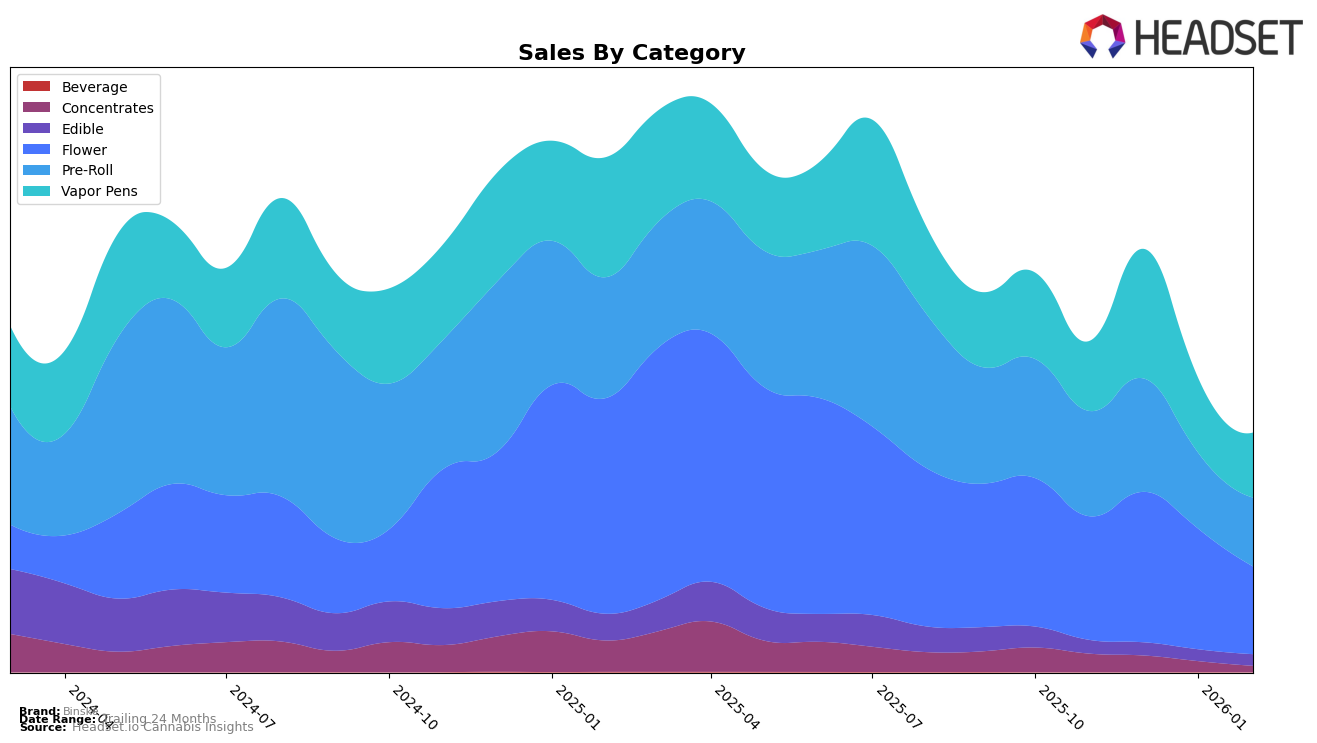

Binske's performance across various cannabis product categories and states indicates a mixed trajectory, with notable fluctuations in rankings and sales. In Colorado, the brand has shown resilience in the Pre-Roll category, maintaining a strong presence with rankings consistently within the top 30, peaking at 17th in December 2025. However, Binske's performance in the Concentrates category in Colorado has been less impressive, as it did not secure a spot in the top 30 from January 2026 onwards. In the Vapor Pens category, Binske experienced a dip, moving from 23rd in December 2025 to 33rd by February 2026, suggesting a need for strategic adjustments to regain momentum.

In Illinois, Binske's Flower and Pre-Roll categories have faced challenges, with rankings mostly outside the top 40, indicating tough competition or market dynamics that may not favor the brand's offerings. Conversely, in New York, Binske's Flower category has seen a significant decline from 69th in November 2025 to 100th by February 2026, reflecting a potential drop in consumer preference or market share. The brand's presence in Washington is sporadic, with Edibles ranking 33rd in November 2025 and reappearing in January 2026, suggesting intermittent market engagement. Meanwhile, in Michigan, Binske's entry into the Pre-Roll category in February 2026 at rank 100 suggests a nascent presence with room for growth.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Binske has experienced notable fluctuations in its ranking over recent months. In November 2025, Binske was ranked 32nd, but it saw a significant rise to 23rd in December 2025, indicating a strong sales performance during that period. However, by February 2026, Binske's rank had dropped to 33rd, suggesting a decline in sales momentum. In contrast, Lazercat Cannabis maintained a more stable position, consistently hovering around the 30th rank, while Sunshine Extracts showed a slight improvement from 35th in November 2025 to 32nd in February 2026. Meanwhile, Good Chemistry Nurseries and Roll One / R.O. were not in the top 20, with ranks of 37th and 35th respectively in February 2026. These dynamics suggest that while Binske had a strong end to 2025, it faces stiff competition from brands like Lazercat Cannabis and Sunshine Extracts, which could be impacting its sales trajectory in the vapor pen category in Colorado.

Notable Products

In February 2026, Jungle Pie (Bulk) emerged as the top-performing product for Binske, securing the number one rank in the Flower category with sales of 785 units. The Double Baked Cake Pre-Roll (1g) followed closely as the second best-seller in the Pre-Roll category, maintaining its position from November 2025 but showing a decline from its first-place ranking in December 2025. Chrome Berry Pre-Roll 7-Pack (3.5g) ranked third in February, consistent with its November 2025 position. Jungle Pie Pre-Roll (1g) entered the top rankings for the first time, achieving fourth place in the Pre-Roll category. The Bubble Punch Live Resin Cartridge (1g) in the Vapor Pens category dropped from second place in January 2026 to fifth place in February 2026, indicating a slight decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.