Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

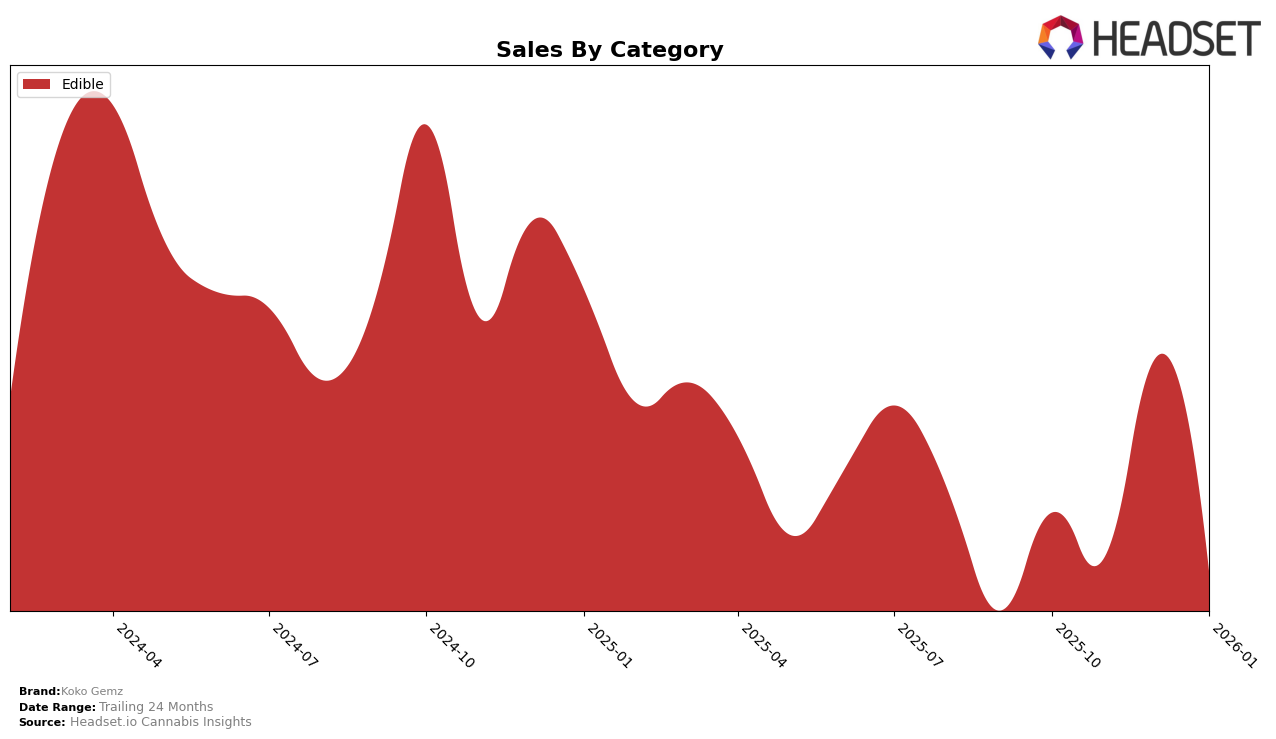

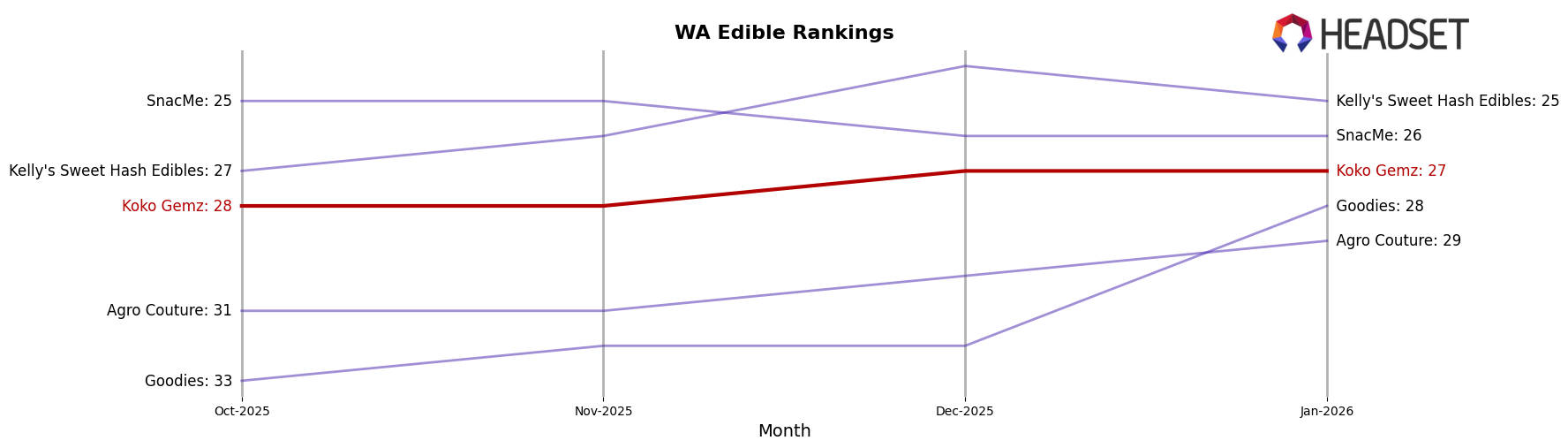

Koko Gemz has shown a steady presence in the edible category in Washington. The brand maintained its position at rank 28 in both October and November 2025, before slightly improving to rank 27 in December 2025, a position it held through January 2026. This upward movement, albeit modest, indicates a positive reception of their products in the local market. The sales figures support this trend, with a notable increase in December 2025, suggesting a possible seasonal boost or successful marketing efforts during that period.

However, the performance of Koko Gemz in other states or provinces is not highlighted, which suggests that the brand may not be in the top 30 in those regions. This could be an area of concern or opportunity for growth, depending on the brand's strategic goals. The absence from other rankings might indicate competitive pressures or a need for stronger market penetration strategies outside of Washington. This data provides a snapshot of where Koko Gemz stands and where it might focus its efforts to enhance its market position across different regions.

```Competitive Landscape

In the Washington edible market, Koko Gemz has maintained a relatively stable position, ranking 28th in both October and November 2025, and slightly improving to 27th in December 2025 and January 2026. Despite this consistency, Koko Gemz faces stiff competition from brands like Kelly's Sweet Hash Edibles, which has shown a more dynamic upward trend, moving from 27th in October 2025 to 25th by January 2026, with sales significantly higher than Koko Gemz throughout the period. Meanwhile, SnacMe has maintained a steady rank at 25th, consistently outperforming Koko Gemz in sales, indicating a strong consumer preference. Additionally, Agro Couture and Goodies are gradually climbing the ranks, suggesting increased competition in the lower tiers of the market. These trends highlight the need for Koko Gemz to innovate and differentiate its offerings to capture a larger market share and improve its ranking in the competitive Washington edible market.

Notable Products

In January 2026, the top-performing product from Koko Gemz was the Milk Chocolate Bite 10-Pack (100mg), maintaining its first-place rank consistently since October 2025 with sales of 843 units. The Mint Dark Chocolate 10-Pack (100mg) secured the second position, a consistent rank since December 2025, with notable sales improvement from previous months. Cookies N' Cream Chocolate Bites 10-Pack (100mg) held the third position, showing a slight decline in sales figures compared to December 2025. Milk Chocolate With Sea Salt Truffles Bites 10-Pack (100mg) ranked fourth, experiencing a drop in sales, which has been a trend since November 2025. The Belgian Dark Chocolate Bites 20-Pack (100mg) remained steady at fifth place, with a minor increase in sales compared to November 2025 but still trailing behind its October figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.