Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

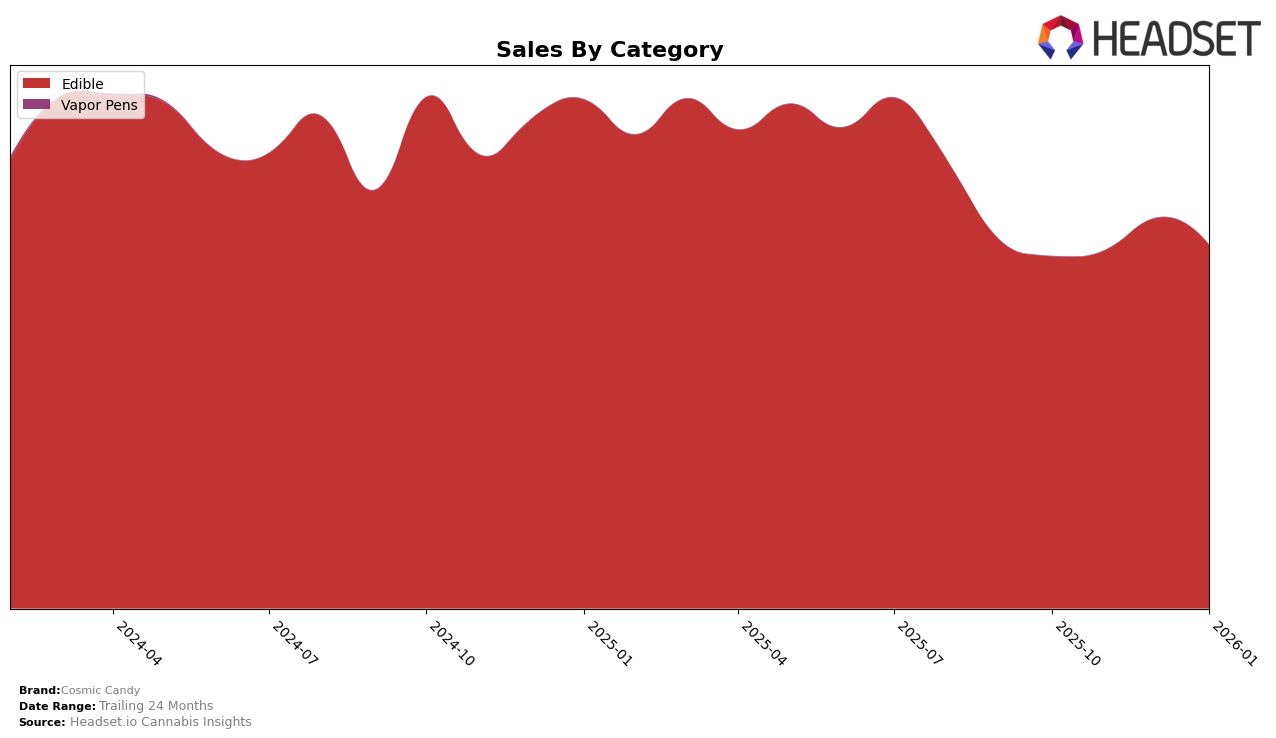

Cosmic Candy has shown a relatively stable performance in the Washington market within the Edible category over the last few months. Starting from October 2025, the brand held the 20th position, briefly slipping to 21st in November, regaining its spot in December, and then dropping slightly to 22nd in January 2026. This consistent presence within the top 30 suggests a steady consumer base and a competitive edge in Washington's edible market. However, the slight fluctuations in rank might indicate emerging competitors or seasonal shifts in consumer preferences.

When examining the sales figures, there is a noticeable increase from October to December, with a peak in sales during December, which is often a strong month for retail due to holiday shopping. The sales then slightly decreased in January, which could be attributed to post-holiday slowdowns. Despite this, Cosmic Candy's ability to remain within the top 30 brands consistently highlights its resilience and appeal in the market. The absence of ranking data for other states or provinces suggests that Cosmic Candy may not have a significant presence outside of Washington, or it might be focusing its efforts primarily within this state. This concentration could be a strategic decision to solidify its standing before expanding further.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Washington, Cosmic Candy has experienced notable fluctuations in its ranking over the past few months. Starting from October 2025, Cosmic Candy held the 20th position, but by January 2026, it had slipped to 22nd. This decline in rank is contrasted by the steady performance of Soulshine Cannabis, which consistently improved its position to reach 20th by January 2026. Meanwhile, Happy Cabbage Farms and Swell Edibles have shown similar trends, with ranks fluctuating but ultimately maintaining a competitive edge over Cosmic Candy. Despite these changes, Cosmic Candy's sales saw a peak in December 2025, indicating potential for recovery if strategic adjustments are made. The brand's ability to regain its rank will depend on how it addresses these competitive pressures and capitalizes on its sales momentum.

Notable Products

In January 2026, the top-performing product from Cosmic Candy was Flying Saucer - Indica Big Bang Blue Raspberry Gummies 10-Pack (100mg), maintaining its consistent first-place ranking from previous months with sales of 2044 units. Flying Saucer - Sativa Big Bang Blue Raspberry Gummies 10-Pack (100mg) held its second-place position, mirroring its performance from October through December 2025. Flying Saucer - Indica Supernova Strawberry Gummies 10-Pack (100mg) climbed back to third place after slipping to fourth in December 2025. Flying Saucer- Sativa Planetary Peach Gummies 10-Pack (100mg) dropped to fourth place, showing a decline in sales compared to previous months. Notably, Space Time - Sativa Sour Raspberry Gummies 10-Pack (100mg) entered the rankings in fifth place, demonstrating a new competitive presence in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.