Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

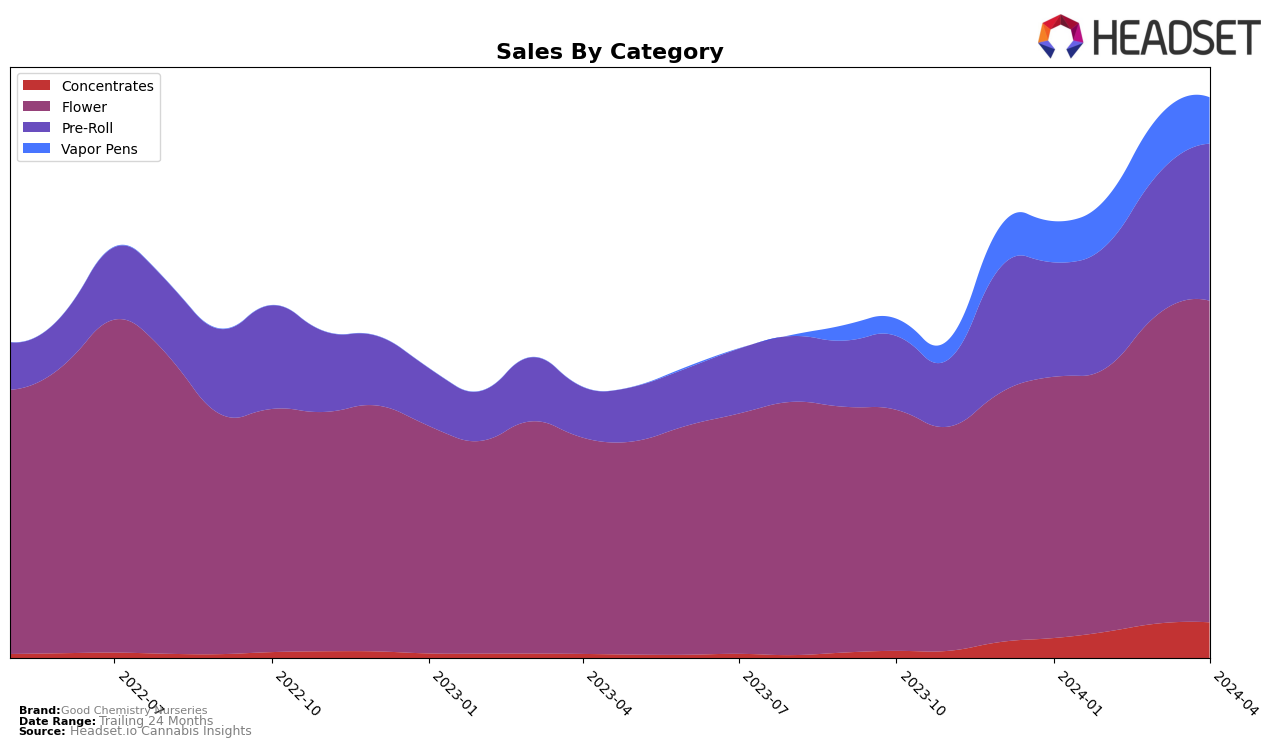

In Colorado, Good Chemistry Nurseries has shown a strong and consistent performance across its product categories, particularly in the Flower and Pre-Roll categories. The brand maintained a top position in the Flower category, starting the year at number 1 and holding a close second place for the following months. This indicates a strong consumer preference and brand loyalty within the state's competitive cannabis market. The Pre-Roll category saw a notable improvement, climbing from the 10th to the 6th position from January to April 2024. This upward trend is a positive sign, demonstrating the brand's growing market share and effectiveness in expanding its consumer base within this category. However, the absence of Good Chemistry Nurseries in other categories within Colorado suggests a focused but potentially limited market penetration strategy.

In Massachusetts, the brand's performance is both diverse and impressive, spanning across Concentrates, Flower, Pre-Rolls, and Vapor Pens categories. Notably, in the Concentrates and Pre-Roll categories, Good Chemistry Nurseries secured a stable second place from March to April 2024, reflecting strong consumer demand and brand strength. The Flower category rankings remained steady in the top four, showcasing consistent sales and popularity. Although the Vapor Pens category showed some fluctuation, with rankings moving from 11th to 8th place, it indicates a positive trajectory and growing interest in Good Chemistry Nurseries' offerings in this segment. The brand's ability to maintain high rankings across multiple categories in Massachusetts speaks to its versatile product appeal and strategic market positioning.

Competitive Landscape

In the competitive landscape of the Flower category within the Massachusetts market, Good Chemistry Nurseries has maintained a strong presence, consistently ranking in the top 4 from January to April 2024. Despite this stable position, it's worth noting the dynamic shifts among its competitors. High Supply / Supply has consistently outperformed Good Chemistry Nurseries, holding the second rank throughout the observed period, indicating a higher sales volume and a strong market presence. On the other hand, Perpetual Harvest showed remarkable growth, moving from the 8th position in January to the 3rd by April, surpassing Good Chemistry Nurseries in terms of sales growth rate. Meanwhile, Altitude East (Treatments Unlimited LLC) and Find. have also shown significant movements but remained below Good Chemistry Nurseries in rankings, indicating a competitive but less threatening position. This analysis underscores the importance of monitoring competitive dynamics, as shifts in rank and sales among these key players could signal changing consumer preferences or effective market strategies that Good Chemistry Nurseries may need to adapt to.

Notable Products

In April 2024, Good Chemistry Nurseries saw Cloudy Daze Pre-Roll (1g) as its top-selling product, with impressive sales reaching 23,069 units, marking a significant increase and securing the number one spot from its third-place ranking in March. Following closely, Apple Gelato Pre-Roll (1g) took the second position, showcasing its popularity without a prior ranking in the earlier months. The third place was claimed by 5280 Gravy Pre-Roll (1g), another newcomer to the top rankings in April. Blue Dream Pre-Roll (0.5g) and The Ménage (3.5g) rounded out the top five, both also making their first appearance in the top rankings for April. These shifts indicate a dynamic change in consumer preferences, with Pre-Roll products dominating the top spots and notable sales figures highlighting the market's demand.

Top Selling Cannabis Brands