Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

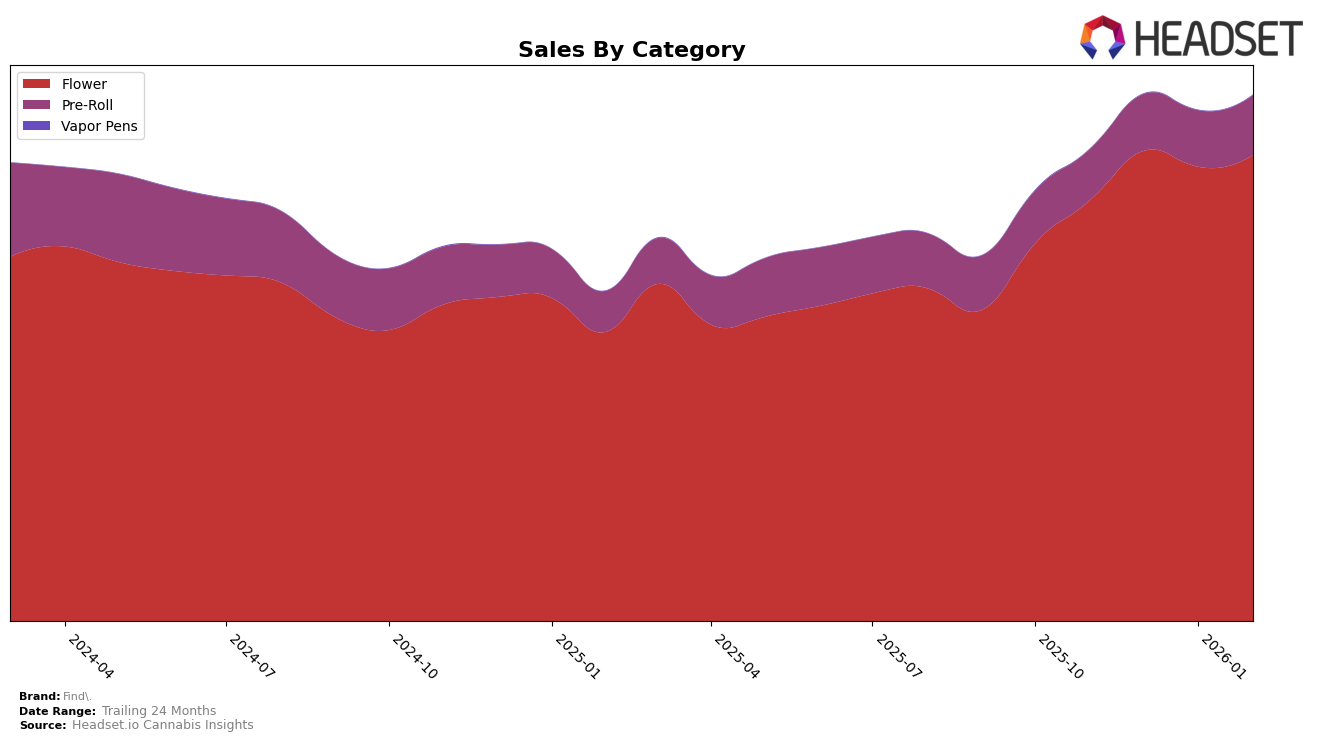

Find. has shown a dynamic performance across several states, particularly in the Flower category. In Arizona, the brand achieved a significant milestone by climbing to the number one spot in February 2026, up from third place in November 2025. This upward trajectory in Arizona is mirrored by a substantial increase in sales, indicating a strong consumer preference for their Flower products. Meanwhile, in Illinois, Find. saw a steady improvement from 16th to 10th place over the same period, suggesting a growing market presence. However, it's worth noting that in Ohio, the brand's Flower category ranking slipped to 22nd place by February 2026, showing a need for strategic adjustments in that market.

In the Pre-Roll category, Find. has had a mixed performance. In Massachusetts, the brand consistently maintained a strong position, ranking third in both January and February 2026, which is indicative of a stable demand for their Pre-Roll products. However, in Arizona, the brand was absent from the top 30 in December 2025 and January 2026, which could be seen as a challenge in maintaining a consistent market presence. Despite this, they managed to return to 9th place by February 2026, suggesting a potential rebound. These movements across different states and categories highlight the varied challenges and opportunities that Find. encounters in the competitive cannabis market.

Competitive Landscape

In the Arizona Flower category, Find. has demonstrated a remarkable upward trajectory in recent months, culminating in a significant leap to the top rank by February 2026. This rise is particularly noteworthy given the competitive landscape dominated by brands like JustFLOWR (MA) and Mohave Cannabis Co.. While JustFLOWR (MA) maintained the lead from November 2025 through January 2026, it slipped to the second position in February 2026, indicating a potential shift in consumer preference or market dynamics. Similarly, Mohave Cannabis Co. consistently held the second position until February 2026, when it dropped to third. This reshuffling in rankings suggests that Find.'s strategic initiatives, possibly in marketing or product offerings, have resonated well with consumers, leading to a substantial increase in sales and a climb in rank, positioning them as a formidable player in the market.

Notable Products

In February 2026, the top-performing product for Find was Baya Dulce (3.5g) in the Flower category, maintaining its number one position from January with a notable sales figure of 15,748. Mutant Cookies Pre-Roll (1g) held steady at the second rank from the previous month, indicating consistent popularity in the Pre-Roll category. Mimosa Kush Mints Pre-Roll (1g) moved up to third place, showing an upward trend from its fifth position in January. Jayna's Sunshine (3.5g) entered the top five for the first time, securing the fourth position, while Jayna's Sunshine (14g) followed closely in fifth place. Overall, the rankings reflect a strong preference for both Flower and Pre-Roll products from Find in February 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.