Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

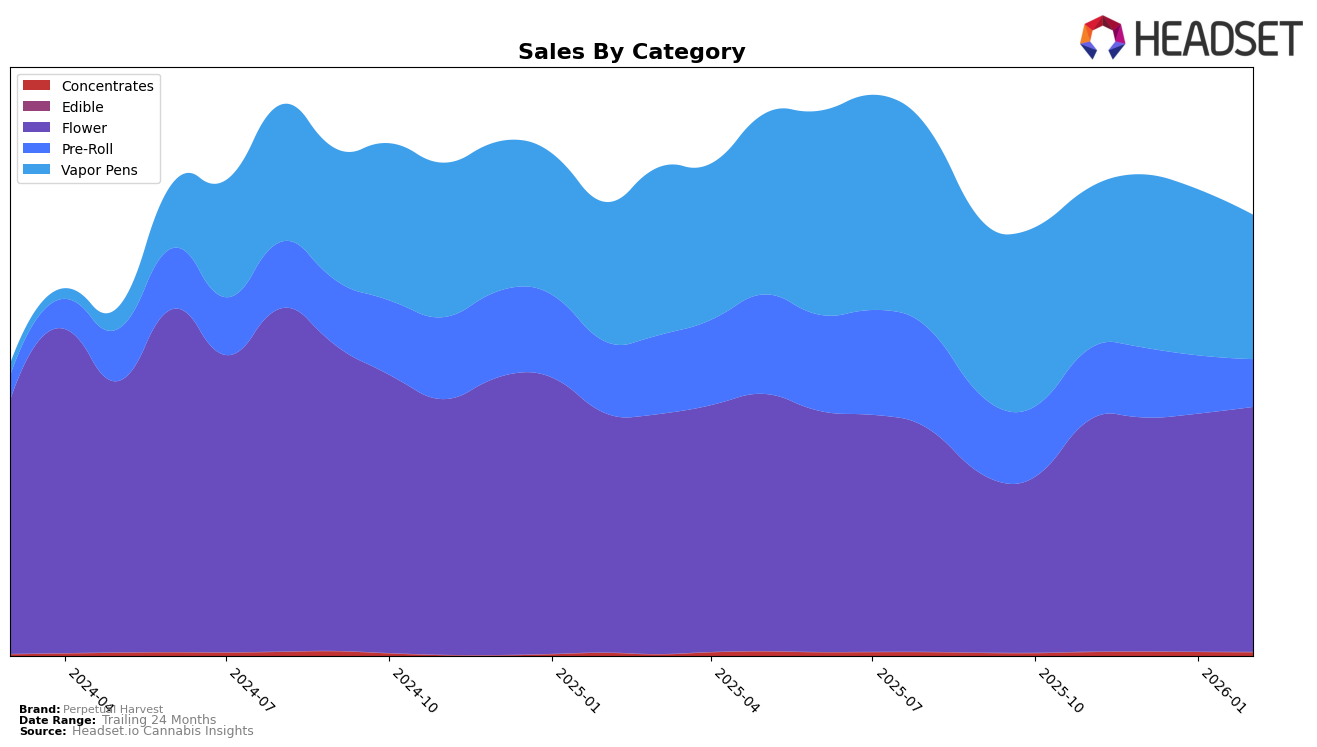

In Massachusetts, Perpetual Harvest has shown a consistent performance in the Flower category, maintaining a solid third-place rank for most of the observed period, with a slight dip to fourth place in December 2025. This stability is accompanied by a steady increase in sales, indicating a strong foothold in this category. However, their performance in the Vapor Pens category saw a slight decline from third to fourth place by February 2026, which might suggest emerging competition or shifts in consumer preferences within the state. Despite this, the brand's sales figures in Vapor Pens remained robust, showcasing resilience and a substantial market presence.

The Pre-Roll category presents a more dynamic picture for Perpetual Harvest in Massachusetts. Initially holding the seventh position, the brand experienced a decline to the eleventh spot by February 2026. This drop out of the top ten could be a point of concern, indicating potential challenges in maintaining market share or adapting to consumer demands. The sales figures for Pre-Rolls also reflect this downward trend, suggesting that strategic adjustments might be necessary to regain a competitive edge. Overall, while Perpetual Harvest has maintained strong positions in some categories, the fluctuations in rankings highlight areas that may require strategic focus and resource allocation.

Competitive Landscape

In the Massachusetts flower category, Perpetual Harvest has maintained a steady position, consistently ranking third in both January and February 2026, despite facing stiff competition. Notably, Simply Herb has dominated the top spot throughout this period, showcasing a strong market presence with sales figures significantly higher than its competitors. Meanwhile, Farmer's Cut has shown an upward trajectory, climbing from fourth place in November 2025 to second place by February 2026, potentially posing a threat to Perpetual Harvest's position. High Supply, which started strong in second place, has seen a decline, dropping to fifth place by February 2026, which could indicate shifting consumer preferences or strategic missteps. Find. has remained relatively stable, fluctuating between fourth and fifth place, suggesting a consistent but less aggressive market strategy. For Perpetual Harvest, maintaining its rank amidst these dynamics highlights its resilience and potential areas for strategic growth to capture more market share.

Notable Products

In February 2026, Garlic Juice (3.5g) topped the sales chart for Perpetual Harvest, achieving the number one rank with sales of 5822 units. Chocolope Pre-Roll (1g) followed closely in second place, while Dirty Banana (3.5g) secured the third spot. Notably, Acapulco Gold Distillate Cartridge (1g), which was the top-seller in January, dropped to fourth place despite a strong performance in previous months. Pineapple Bang Bang (3.5g) slipped from its second-place position in January to fifth, indicating a shift in consumer preferences. Overall, the rankings highlight a competitive market with dynamic changes in product popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.