Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

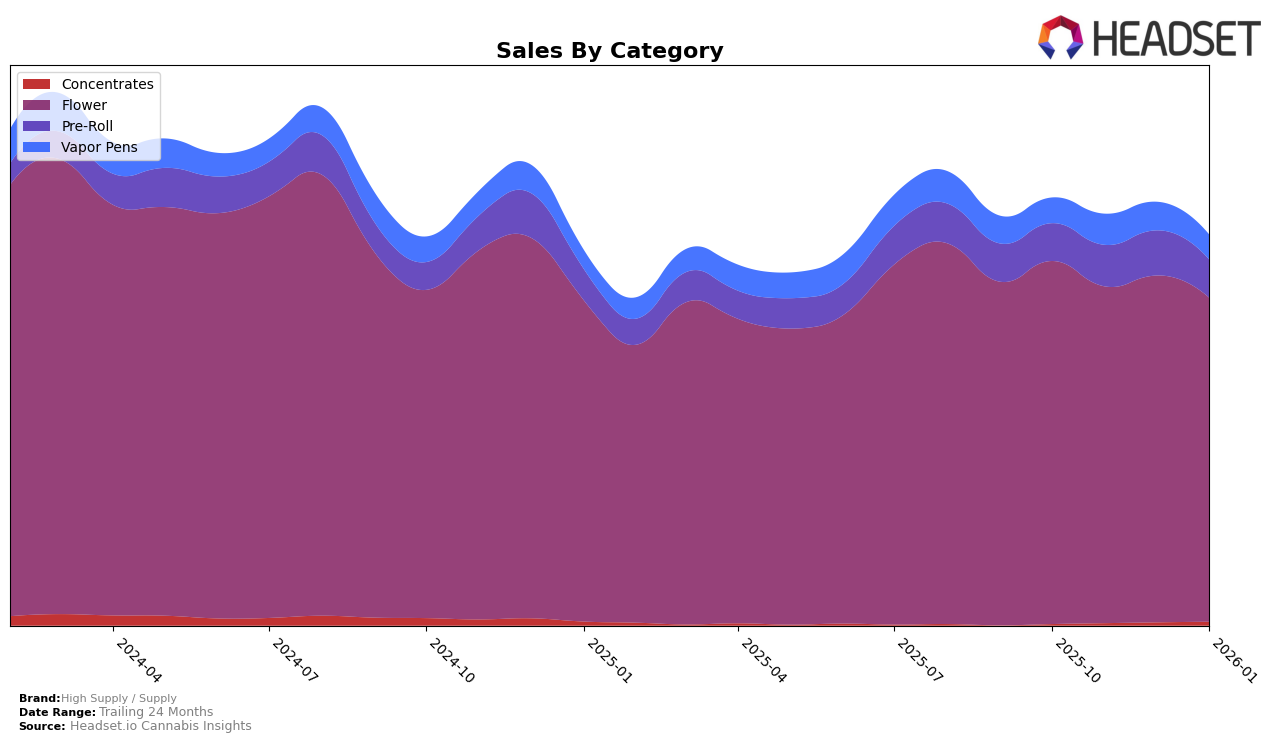

High Supply / Supply has demonstrated a strong performance in the Illinois market, particularly in the Flower category where it has consistently held the number one rank from October 2025 through January 2026. This indicates a stable and dominant market presence in this category. In the Pre-Roll segment, the brand has shown an upward trajectory, climbing from sixth to third place in November 2025, and maintaining a steady fourth place in December 2025 and January 2026. This suggests a solid foothold in the Illinois Pre-Roll market as well. However, in the Vapor Pens category, the brand has experienced moderate success, inching up from 18th to 16th place by December 2025 and maintaining this position into January 2026, indicating potential for growth but also highlighting room for improvement in market penetration.

In Massachusetts, High Supply / Supply has maintained a strong presence in the Flower category, although it saw a dip from second to fourth place by January 2026. This decline might suggest increased competition or changing consumer preferences. The brand's performance in the Pre-Roll category has been more volatile, fluctuating between ninth and 13th place over the same period, which could indicate challenges in maintaining a consistent market share. Notably, the brand's presence in the Vapor Pens category in Massachusetts was not ranked in January 2026, suggesting it fell out of the top 30, which could be a cause for concern regarding its competitive position in this segment. Meanwhile, in Michigan and Ohio, the brand's rankings in the Flower category have been declining, pointing to potential challenges in sustaining its market position in these states.

Competitive Landscape

In the Illinois flower category, High Supply / Supply has consistently maintained its position as the top-ranked brand from October 2025 to January 2026. This stability in rank underscores its strong market presence and consumer preference. Despite a slight decline in sales from October to November 2025, High Supply / Supply's sales figures rebounded in December and January, indicating resilience and effective market strategies. In contrast, RYTHM, the second-ranked brand, has maintained a steady rank but with lower sales figures, consistently trailing behind High Supply / Supply. Meanwhile, Daze Off has shown a positive trend by climbing from fourth to third place in November 2025 and sustaining that position through January 2026, although its sales remain significantly lower than those of High Supply / Supply. These dynamics highlight High Supply / Supply's dominance in the market, while competitors strive to close the gap.

Notable Products

In January 2026, Pineapple Under the Sea Pre-Roll (1g) reclaimed its position as the top-performing product for High Supply / Supply, with a notable sales figure of $12,483. Kush Cream Pre-Roll (1g) rose to the second spot, improving from its third-place rank in December 2025. Pineapple Under the Sea (7g) entered the rankings at third place, indicating strong demand for this product across different formats. Gastro Pop Shake (7g) followed closely in fourth place, while Chocolate OG (3.5g) slipped to fifth, down from fourth in November 2025. The rankings highlight the continued popularity and consumer preference for the Pineapple Under the Sea line within the High Supply / Supply brand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.