Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

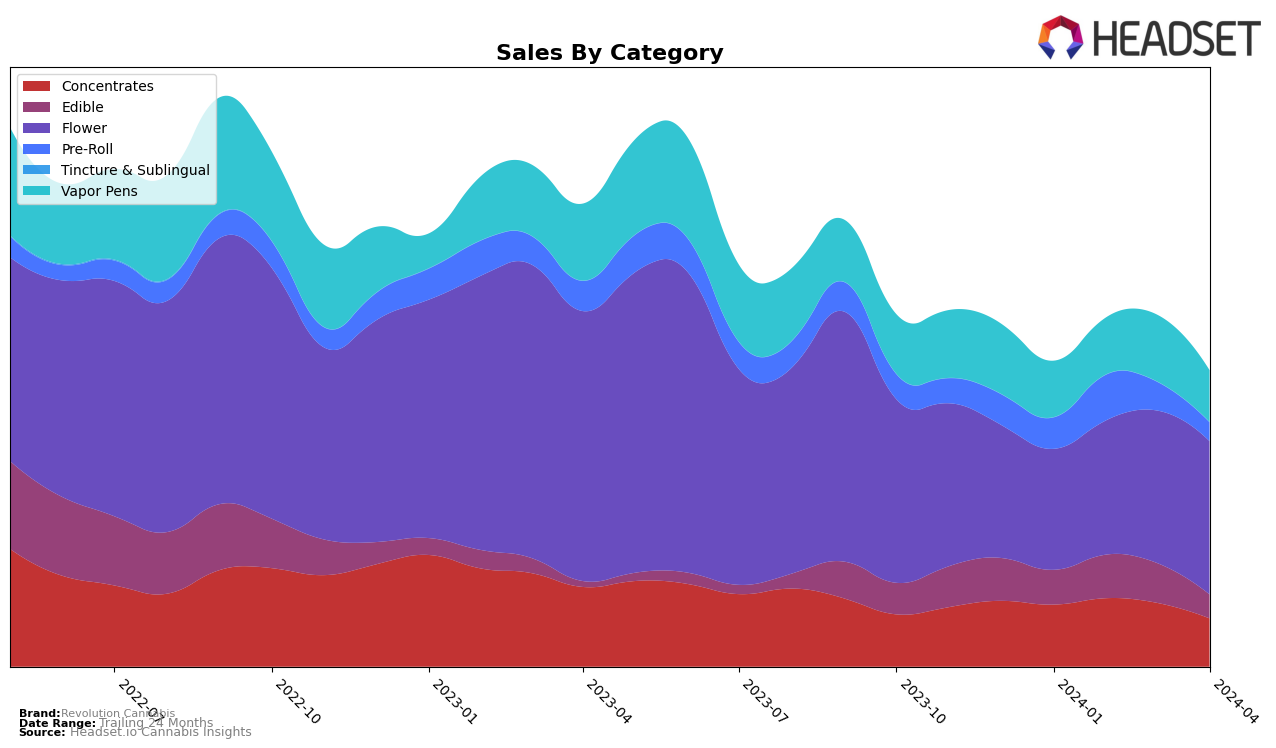

In Illinois, Revolution Cannabis has shown a varied performance across different cannabis categories, indicating a dynamic market presence. In the concentrates category, the brand maintained top 3 positions from January to March 2024 but saw a slight decline to the 5th position by April, suggesting increased competition or shifts in consumer preferences. This shift is noteworthy, especially considering their sales in January were significant at $645,651. The edible category presents a more concerning trend, with rankings slipping from 14th in January to 22nd by April, a movement that could indicate challenges in product appeal or distribution. Conversely, their flower category performance improved, moving from 18th in January to a consistent 11th place from March to April, highlighting a potential area of strength for the brand in Illinois. The pre-roll and vapor pens categories saw fluctuations, with rankings generally declining over the four months, hinting at possible areas for strategic reassessment.

Outside of Illinois, in Missouri, Revolution Cannabis's presence in the flower category is struggling to capture a significant market share, with rankings not breaking into the top 30 until a peak at 35th in April 2024. This performance starkly contrasts with their stronger position in Illinois, suggesting regional market differences or perhaps strategic focus areas. The brand's performance in Missouri may reflect early stages of market penetration or indicate challenges in brand recognition and consumer preference within this state. Such a discrepancy between states underscores the importance of tailored strategies to navigate the diverse cannabis landscapes across the United States. While specific sales figures for Missouri are not detailed here, the rankings provide a clear indication of the brand's current standing and potential areas for growth or reevaluation.

Competitive Landscape

In the competitive Illinois flower market, Revolution Cannabis has shown a notable upward trajectory in rankings over the first four months of 2024, moving from 18th in January to 11th in February, and stabilizing around 11th to 12th place in the subsequent months. This improvement in rank is indicative of a positive sales trend, despite not breaking into the top 10. Competitors such as Savvy and Bedford Grow have consistently outperformed Revolution Cannabis in both rank and sales, maintaining positions within the top 10 throughout the same period. Savvy, in particular, has shown a slight decrease in rank from 8th to 10th, while Bedford Grow moved up, indicating a highly competitive landscape. Interestingly, Paul Bunyan and Tales & Travels have seen significant rank improvements, with Paul Bunyan making a leap into the top 15 by March and Tales & Travels moving up to 12th by April, directly competing with Revolution Cannabis. These dynamics suggest a fiercely competitive market where brands are closely jockeying for position, with sales trends and rankings fluctuating significantly over short periods.

Notable Products

In April 2024, Revolution Cannabis saw Mac and Cheese (3.5g) from the Flower category leading the sales with a significant figure of 4923.0 units, maintaining its top position from March. Blueberry Clementine (3.5g), another Flower category product, ranked second in April, improving its position from not being in the top rankings in the previous months. Purple Monarch (3.5g) from the Flower category, previously the top-selling product in January, dropped to the third position by April. The Indica Creamy Caramel Bite (100mg) from the Edible category, which had seen fluctuating ranks in previous months, secured the fourth position in April. Notably, Zeebra Cakez (3.5g) from the Flower category, which had a lower rank in previous months, made it to the top five in April, illustrating the dynamic nature of consumer preferences within Revolution Cannabis's product range.

Top Selling Cannabis Brands