Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

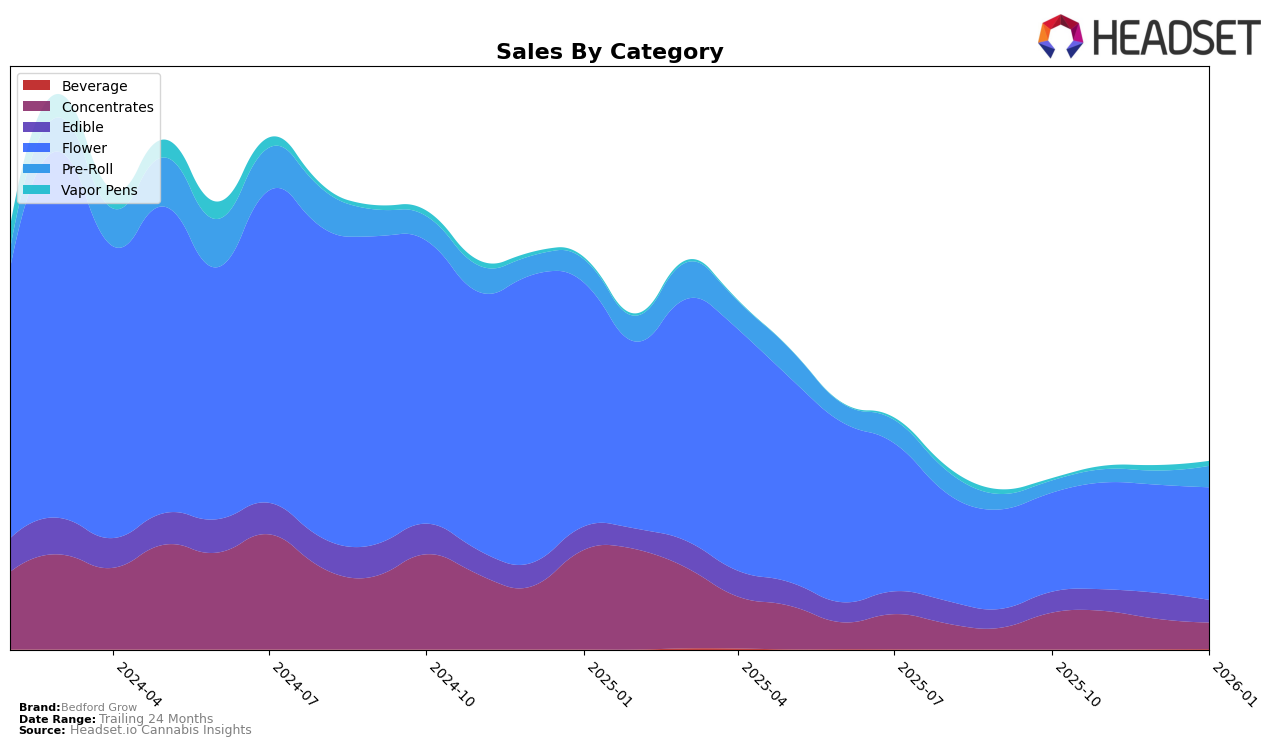

Bedford Grow's performance in the Illinois cannabis market has shown varied results across different product categories. In the Concentrates category, the brand maintained a strong presence, starting with a rank of 9th in October 2025 and slightly declining to 13th by January 2026. Despite this drop in ranking, the overall sales trend for Concentrates indicates a decrease from $204,853 in October to $147,428 in January, reflecting a need for strategic adjustments to regain momentum. In contrast, the Flower category demonstrated stability, with Bedford Grow consistently holding ranks 24th and 25th throughout the observed months, coupled with a gradual increase in sales, signaling a positive reception in this segment.

In the Edibles market, Bedford Grow's performance maintained a consistent rank between 27th and 28th, suggesting a steady, albeit less dominant, presence. However, the Pre-Roll category saw a noteworthy improvement, as the brand climbed from the 47th position in October to 27th in January, accompanied by a significant sales increase, indicating growing consumer interest. On the other hand, the Vapor Pens category presented a different challenge, as Bedford Grow did not appear in the top 30 rankings until December, where it held the 74th position, suggesting potential growth opportunities but also highlighting the competitive nature of this segment. Overall, Bedford Grow's varied performance across categories in Illinois provides insights into both their strengths and areas where further development could enhance their market standing.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Bedford Grow has shown a consistent presence, maintaining a steady rank from October 2025 to January 2026. Despite not breaking into the top 20, Bedford Grow's sales have been on an upward trajectory, culminating in a notable increase in January 2026. This upward trend is significant when compared to competitors like Island, which experienced a decline in sales over the same period, and Legacy Cannabis (IL), which saw fluctuating ranks and sales. Meanwhile, IC Collective and Nez have shown variability in their rankings, with Nez making notable progress from October to January. Bedford Grow's consistent rank and increasing sales suggest a strengthening market position, potentially poised to climb higher in the rankings if current trends continue.

Notable Products

In January 2026, Bedford Grow's top-performing product was Pink Runtz (1g) in the Flower category, achieving the number one rank with impressive sales of 1246 units. Bustin' Sudz Diamond Infused Pre-Roll (1g) followed closely behind in second place, indicating strong consumer demand for their Pre-Roll offerings. The Guava Barz Pre-Roll 2-Pack (1g) secured the third position, further highlighting the popularity of the Pre-Roll category. Notably, the Milk Chocolate Bar 10-Pack (100mg) experienced a drop from its previous first-place ranking in December 2025 to fourth in January, suggesting a shift in consumer preferences. Meanwhile, Strawberry Lemonade Gummies 5-Pack (100mg) entered the top five, demonstrating a growing interest in edible products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.