Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

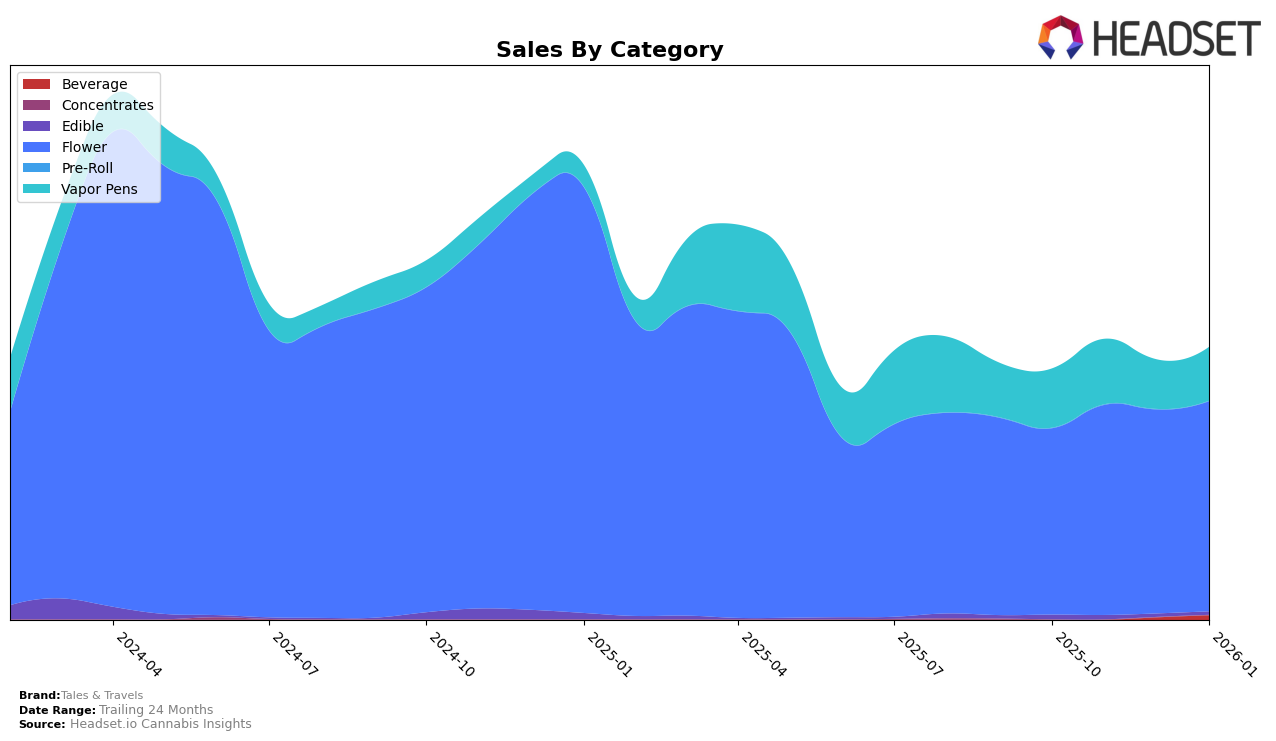

Tales & Travels has shown a steady performance in the Illinois market, particularly in the Flower category. Over the past few months, the brand has maintained a consistent presence in the top 30, moving from a rank of 23 in October 2025 to 21 by January 2026. This stability in ranking indicates a solid and reliable customer base in the Flower category, with sales figures reflecting a slight upward trend from $635,072 in October to $716,788 in January. Such consistency suggests the brand's ability to maintain its market position amidst competitive pressures.

In contrast, Tales & Travels' performance in the Vapor Pens category in Illinois has been more variable. The brand did not appear in the top 30 for December 2025, highlighting a potential area of concern or opportunity for growth. However, by January 2026, it managed to re-enter the top 35, suggesting some recovery or strategic adjustments. The sales figures for Vapor Pens reflect this volatility, with a notable dip in December followed by a modest recovery in January. This fluctuation may point to shifting consumer preferences or competitive dynamics within the Vapor Pens market segment.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Tales & Travels has shown a consistent presence, maintaining a stable rank at 21st position in December 2025 and January 2026. This stability is notable given the fluctuating ranks of other brands, such as Legacy Cannabis (IL), which dropped from 19th in October 2025 to 23rd by January 2026. Meanwhile, Kaviar consistently held the 19th position, indicating a slightly stronger market presence. Despite Island experiencing a decline from 17th to 22nd, Tales & Travels managed to surpass them in the rankings by November 2025. The sales trajectory for Tales & Travels shows a positive trend, with sales peaking in January 2026, suggesting effective market strategies and consumer loyalty. This performance highlights Tales & Travels' resilience and potential for upward mobility in a competitive market.

Notable Products

In January 2026, the top-performing product for Tales & Travels was the Banana Mango Distillate Disposable in the Vapor Pens category, which jumped to the number one rank with sales reaching 792 units. This product showed a significant improvement from its previous rank of fourth in November 2025. Following closely was the Pink Lemonade Distillate Disposable, also in the Vapor Pens category, securing the second position with a notable rise from its previous third rank in October 2025. The Peach Crescendo in the Flower category made its debut in the rankings at third place, indicating a strong entrance. Berry Cherry Distillate Disposable and Horchata, both new to the rankings, occupied the fourth and fifth positions, respectively, showcasing the growing popularity of Vapor Pens and Flower products within the brand's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.