Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

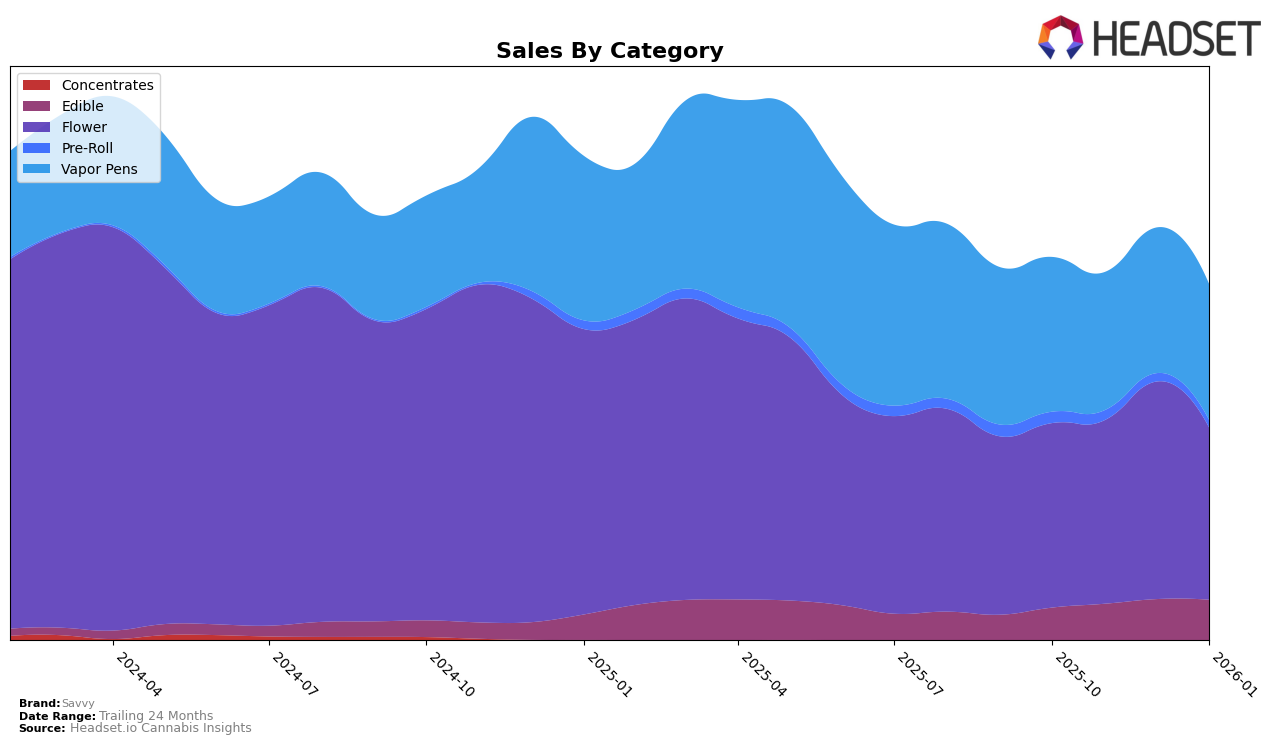

In Arizona, Savvy's performance in the Flower category showed some fluctuations, with rankings moving from 16th in October 2025 to 23rd by January 2026. This decline indicates a competitive market where Savvy's presence slightly weakened over the months. Conversely, in the Vapor Pens category, Savvy maintained a relatively stable position, hovering between 16th and 18th place, which suggests a consistent demand for their products in this segment. However, in Connecticut, Savvy's dominance in the Flower category is evident, holding the top spot from November 2025 through January 2026. This strong performance highlights their competitive edge and popularity in this category within the state.

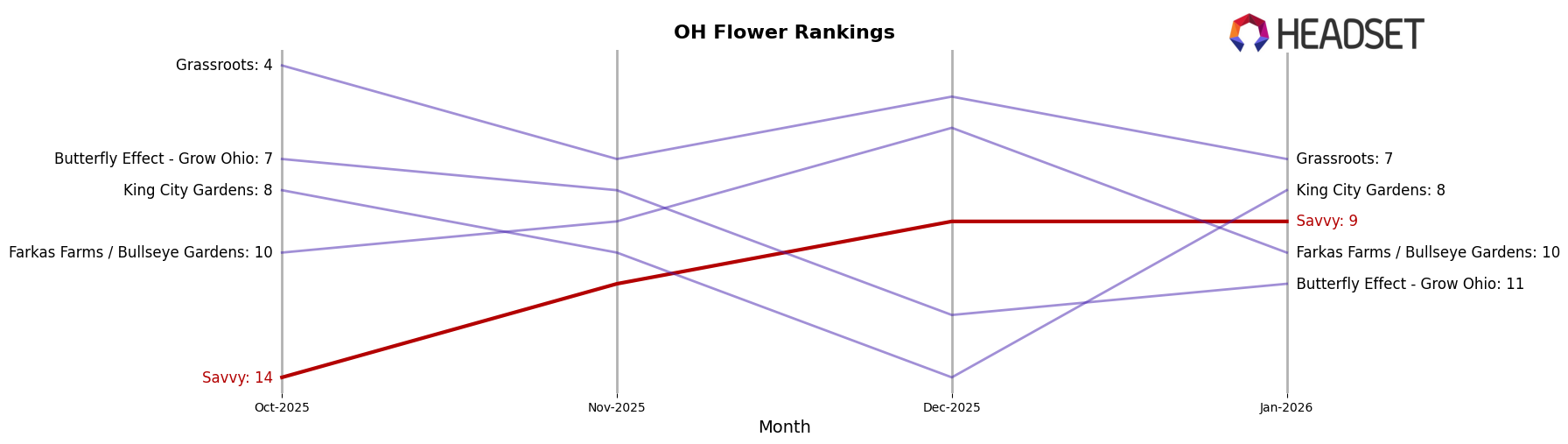

In Illinois, Savvy's Vapor Pens have been consistently strong, maintaining a top-five position across the observed months, which underscores their popularity and market strength in this category. The Flower category saw a slight dip, with rankings varying from 16th to 17th, indicating some competitive pressure. Meanwhile, in Maryland, Savvy's presence in the Vapor Pens category was inconsistent, with their ranking disappearing from the top 30 in November and January, pointing to potential challenges in maintaining market share. In Ohio, Savvy's performance in the Flower category improved significantly, moving into the top 10 by December 2025 and maintaining this position into January 2026, suggesting a growing consumer base and increased brand recognition.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Savvy has demonstrated a notable upward trajectory in its market position from October 2025 to January 2026. Initially ranked 14th in October, Savvy improved its standing to 9th by December and maintained this rank into January 2026. This rise is indicative of a robust sales performance, with a significant jump in sales from November to December. In contrast, Grassroots experienced fluctuations, dropping from 4th in October to 7th in January, reflecting a downward sales trend. Similarly, Farkas Farms / Bullseye Gardens showed volatility, peaking at 6th in December before falling back to 10th in January. Meanwhile, Butterfly Effect - Grow Ohio saw a decline from 7th in October to 11th in January, and King City Gardens displayed inconsistent rankings, ending January at 8th. Savvy's consistent improvement amidst these fluctuations highlights its growing appeal and competitive edge in the Ohio flower market.

Notable Products

In January 2026, Savvy's top-selling product was the Guap Berry Drip Macro Dose RSO Gummy (100mg), maintaining its first-place position for four consecutive months with sales reaching 35,048 units. Following closely was the Guap Tangie Crush Macro Dose RSO Gummy (100mg), which has consistently held the second rank since October 2025. The Guap CBD/THC 1:1 Peachy Punch RSO Gummy (100mg CBD, 100mg THC) saw a notable rise in popularity, climbing from the fifth rank in October to the third rank by January. Meanwhile, the Guap Blue Magic Macro Dose Gummy (100mg) slipped from third to fourth place despite a previous upward trend. Lastly, the Guap Jungle Juice Macro Dosed Gummy (50mg) remained steady at the fifth rank, showing consistent sales performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.