Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

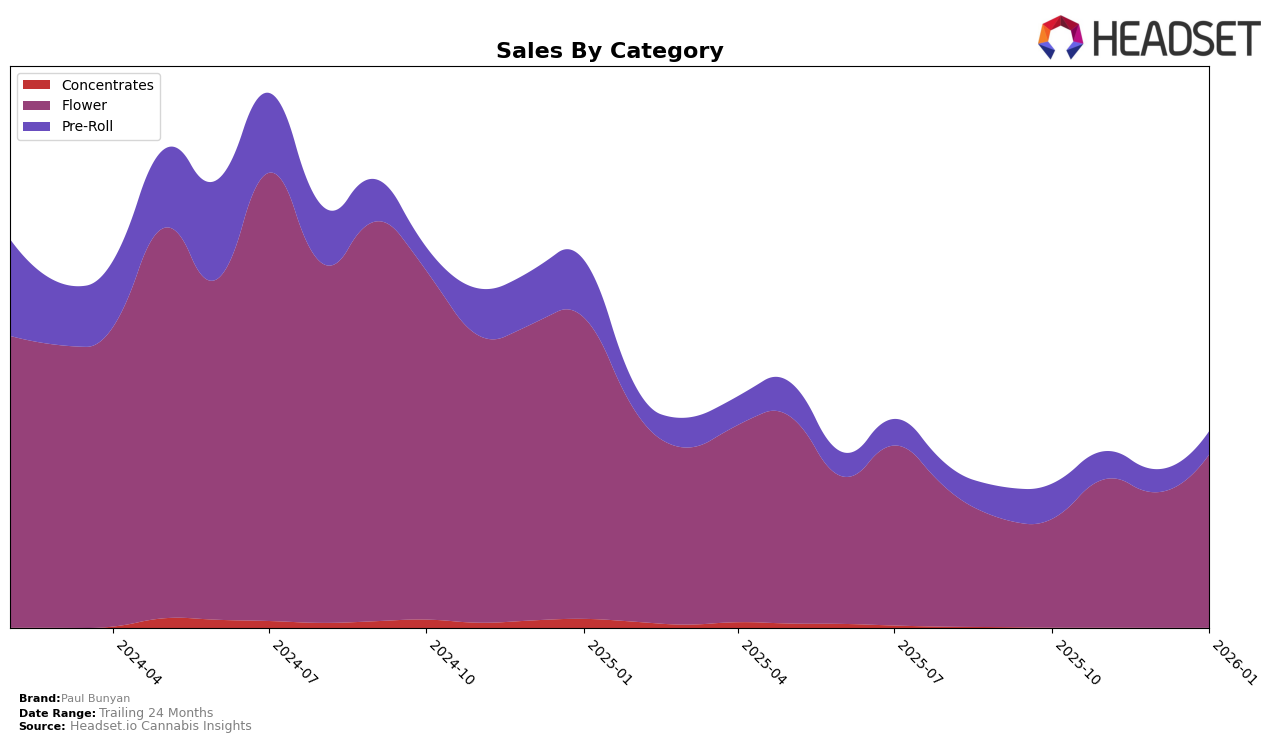

Paul Bunyan has shown notable performance in the Illinois market, particularly within the Flower category. Over the span from October 2025 to January 2026, the brand has climbed from the 28th to the 20th position, illustrating a positive growth trajectory. This upward movement is indicative of an increasing consumer preference for Paul Bunyan's Flower products in this state. The brand's sales in this category have also seen a consistent rise, with a significant jump in January 2026, reflecting a robust demand. However, it's worth noting that the brand did not make it into the top 30 in the Pre-Roll category, suggesting potential areas for improvement or strategic focus.

In the Pre-Roll category within Illinois, Paul Bunyan has fluctuated around the 30th position, ranking as high as 33rd in November 2025 and as low as 43rd in October 2025. Despite not breaking into the top 30, the brand has shown some resilience, with a slight improvement in rank by January 2026. The sales figures for Pre-Rolls have been relatively stable, with a modest increase toward the end of the period. This suggests that while the brand has yet to achieve a breakthrough in this category, there is a foundation for potential growth if strategic adjustments are made.

Competitive Landscape

In the competitive landscape of the flower category in Illinois, Paul Bunyan has shown a promising upward trajectory in recent months. Starting from a rank of 28 in October 2025, Paul Bunyan climbed to the 20th position by January 2026, marking a significant improvement in its competitive standing. This rise is particularly notable when compared to brands like Island, which saw a decline from rank 17 to 22 over the same period, and Sol Canna, which experienced a drop from 14 to 18. Meanwhile, Kaviar and Tales & Travels maintained relatively stable positions, with Kaviar consistently holding the 19th rank and Tales & Travels fluctuating slightly but remaining around the 20th position. Paul Bunyan's sales growth, culminating in a notable increase by January 2026, suggests a strengthening market presence and consumer preference shift towards its offerings, potentially driven by strategic marketing or product innovation.

Notable Products

In January 2026, Paul Bunyan's top-performing product was Crunch Berries (3.5g) from the Flower category, maintaining its leading position since December 2025 with notable sales of 2,835 units. The Crunch Berries Pre-Roll (1g) emerged as a strong contender, securing the second spot despite not being ranked in previous months. Garlic OG (3.5g) entered the rankings at third place, showing a promising start. Sundae Driver (3.5g) followed closely in fourth place, indicating a consistent performance. Cocomamba (3.5g), which was second in December 2025, dropped to fifth, suggesting a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.