Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

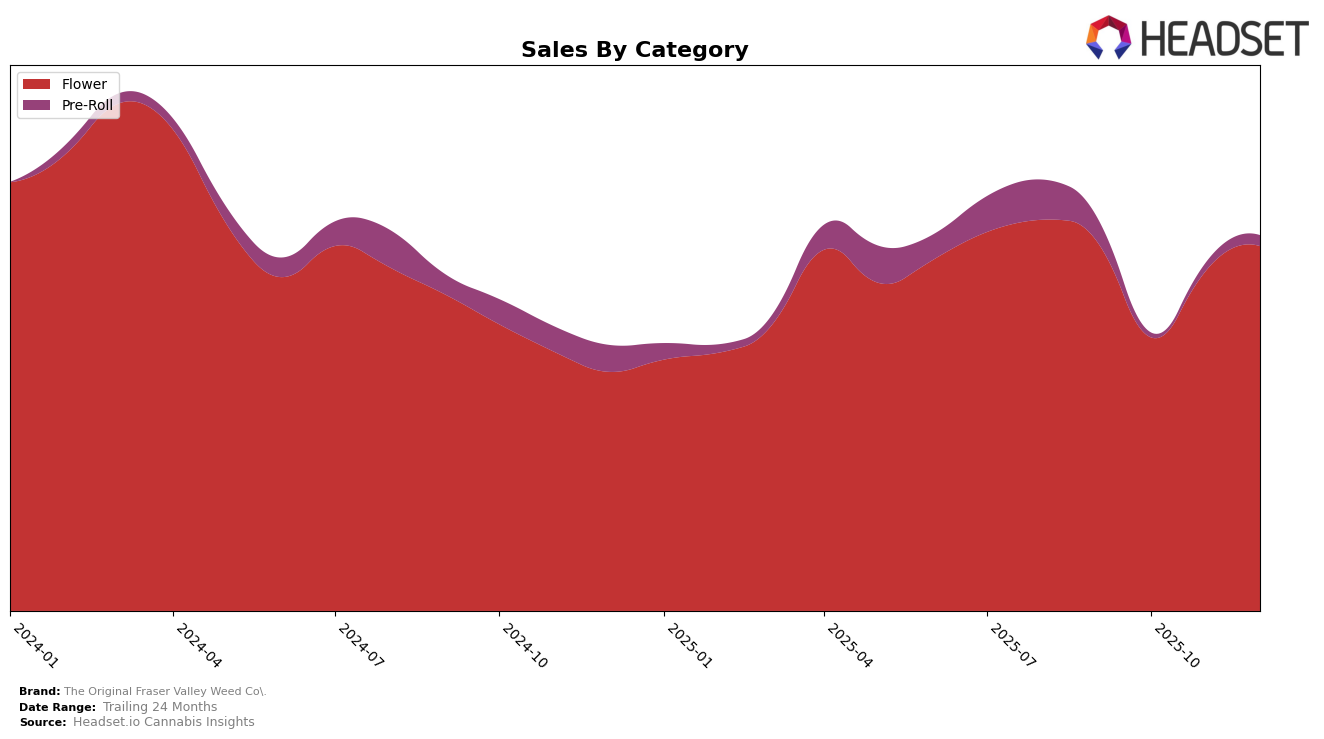

The Original Fraser Valley Weed Co. has demonstrated varied performance across different provinces and product categories. In the Flower category, the brand has shown a notable presence in Alberta, maintaining a strong position with rankings of 3rd in both September and October 2025, although it slipped to 6th by December. This downward trend in Alberta contrasts with their performance in British Columbia, where they recovered from a dip to 7th place in October to secure the 3rd position by November and December. Meanwhile, in Ontario, The Original Fraser Valley Weed Co. maintained a steady 5th place ranking from November through December, indicating a stable foothold in the province. However, their presence in Saskatchewan was limited to September, where they ranked 16th in the Flower category and did not appear in the top 30 in subsequent months.

In the Pre-Roll category, the brand's performance has been less consistent. In Alberta, after appearing in the top 30 in September with a rank of 54, they were absent from the rankings in October, only to reappear at 49th in November and then slip to 52nd in December. This suggests some volatility in their market presence. Similarly, in British Columbia, they were ranked 38th in September, dropped out of the top 30 in October, and then re-entered at 43rd and 42nd in November and December, respectively. In Ontario, the brand maintained a presence in the top 30, though with a gradual decline from 24th in September and October to 27th by December, which could indicate challenges in maintaining a competitive edge in the Pre-Roll market.

Competitive Landscape

In the competitive Ontario flower market, The Original Fraser Valley Weed Co. has shown a promising upward trend in recent months. Starting from a rank of 6th in September 2025, the brand improved to 5th place by November and maintained this position in December. This advancement indicates a positive reception and growing consumer preference, as evidenced by their sales increase from approximately $2.41 million in October to over $3.22 million in December. Despite this progress, The Original Fraser Valley Weed Co. faces stiff competition from established brands like Shred and Big Bag O' Buds, which consistently held higher ranks at 3rd and 4th positions, respectively, throughout the same period. Additionally, Pure Sunfarms closely trails behind, sharing similar rank fluctuations. To maintain and further enhance its market position, The Original Fraser Valley Weed Co. must continue to leverage its strengths and address areas where competitors might have an edge.

Notable Products

In December 2025, Big Red Pre-Roll 20-Pack (10g) reclaimed the top spot in sales for The Original Fraser Valley Weed Co., with a notable sales figure of 15,692 units, showing a consistent performance as it moved back to the first position from second place in the previous two months. Strawberry Amnesia (28g), although dropping to second place, maintained a strong sales presence, having led in both October and November. Kush Breath (28g) held steady in third place, indicating stable customer demand over the past months. Donny Burger (28g) remained consistent, securing fourth place, a slight improvement from November. BC Bounty Milled (28g) rounded out the top five, demonstrating a slight decline from its fourth-place ranking in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.