Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

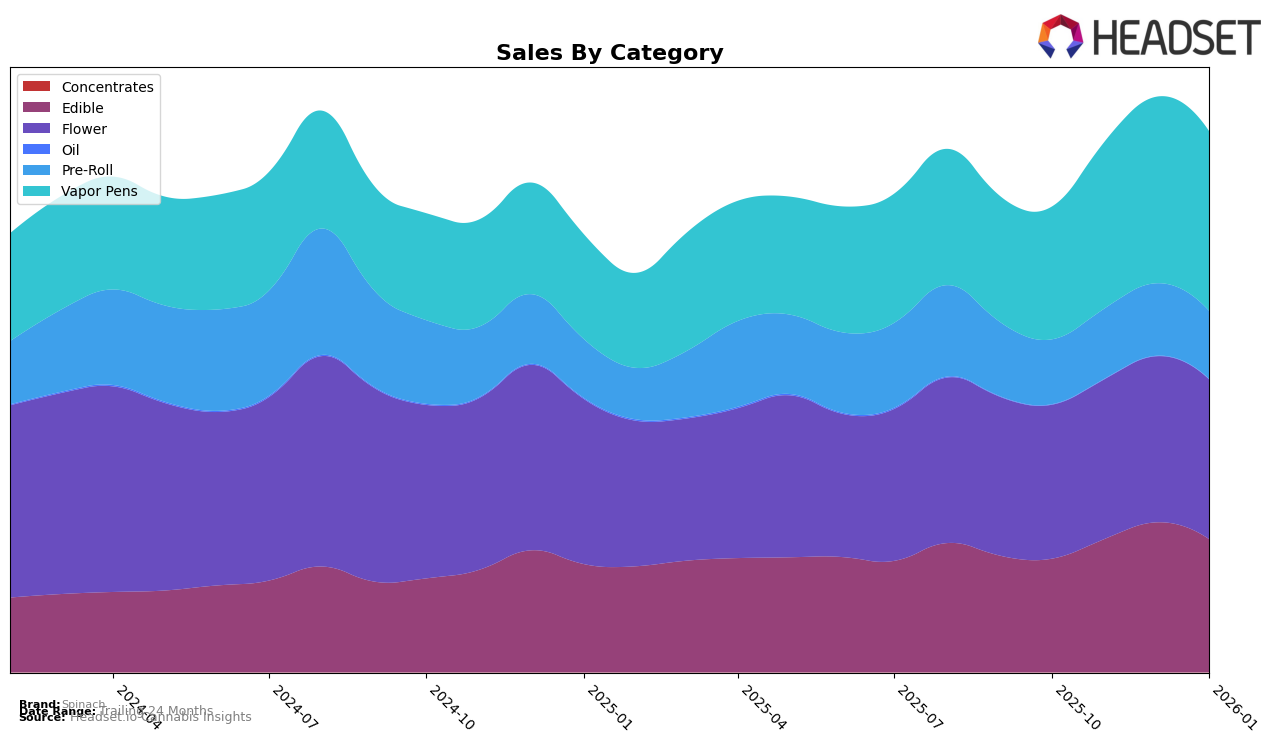

Spinach has demonstrated a strong performance across various categories in provinces such as Alberta and Ontario. In Alberta, Spinach has consistently maintained the top position in the Edible and Vapor Pens categories from October 2025 to January 2026, indicating a dominant presence in these segments. The Flower and Pre-Roll categories have also seen positive movement, with the Flower category improving its rank from 7th to 5th. Meanwhile, in Ontario, Spinach has secured the top rank in the Edible category consistently, while maintaining a solid second place in the Flower category. The Pre-Roll category saw a slight improvement, moving from 17th to 14th position, suggesting a growing acceptance among consumers.

In British Columbia, Spinach's performance has been more varied. While the brand wasn't ranked in the top 30 for October 2025, it made significant strides in subsequent months, achieving a consistent second place in the Edible category and improving its Vapor Pens ranking from 3rd to 2nd. The Flower category showed some fluctuations, initially entering at 4th before settling at 7th by January 2026. Notably, the Pre-Roll category saw a substantial improvement from being outside the top 30 to reaching 14th place, reflecting an increasing market penetration. In Saskatchewan, Spinach maintained a steady second position in the Vapor Pens category, although the sales figures showed some decline, hinting at potential challenges in maintaining market share.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Spinach has experienced a slight decline in its ranking over the past few months. In October 2025, Spinach held the top position but was overtaken by Back Forty / Back 40 Cannabis in November 2025, which maintained its lead through January 2026. Despite this shift, Spinach consistently held the second position, indicating strong brand loyalty and market presence. The sales figures for Spinach showed a slight dip in November 2025 but rebounded in December 2025 and January 2026, suggesting resilience and effective market strategies. Meanwhile, Shred and Big Bag O' Buds remained steady in third and fourth positions, respectively, without posing a significant threat to Spinach's standing. The competitive dynamics highlight the importance for Spinach to innovate and differentiate to reclaim the top spot in this vibrant market.

Notable Products

In January 2026, the top-performing product from Spinach was the Sourz - Fully Blasted Blue Raspberry Watermelon Gummy (10mg), maintaining its leading position from the previous month despite a slight decrease in sales to 62,457 units. The Sourz - Blue Raspberry Watermelon Gummies 5-Pack (10mg) ranked second, swapping places with the top product compared to December 2025. The Sourz - Fully Blasted Pink Lemonade Gummy (10mg) consistently held the third position across the months from October 2025 to January 2026. A new entrant, the Sourz - Fully Blasted Blue Raspberry Watermelon Gummies 10-Pack (100mg), secured the fourth rank in its first recorded month of sales. Finally, the CBD/THC 1:1 Fully Blasted Peach Orange Gummies 10-Pack (100mg CBD, 100mg THC) reappeared in the rankings, coming in fifth after missing from the December list.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.