Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

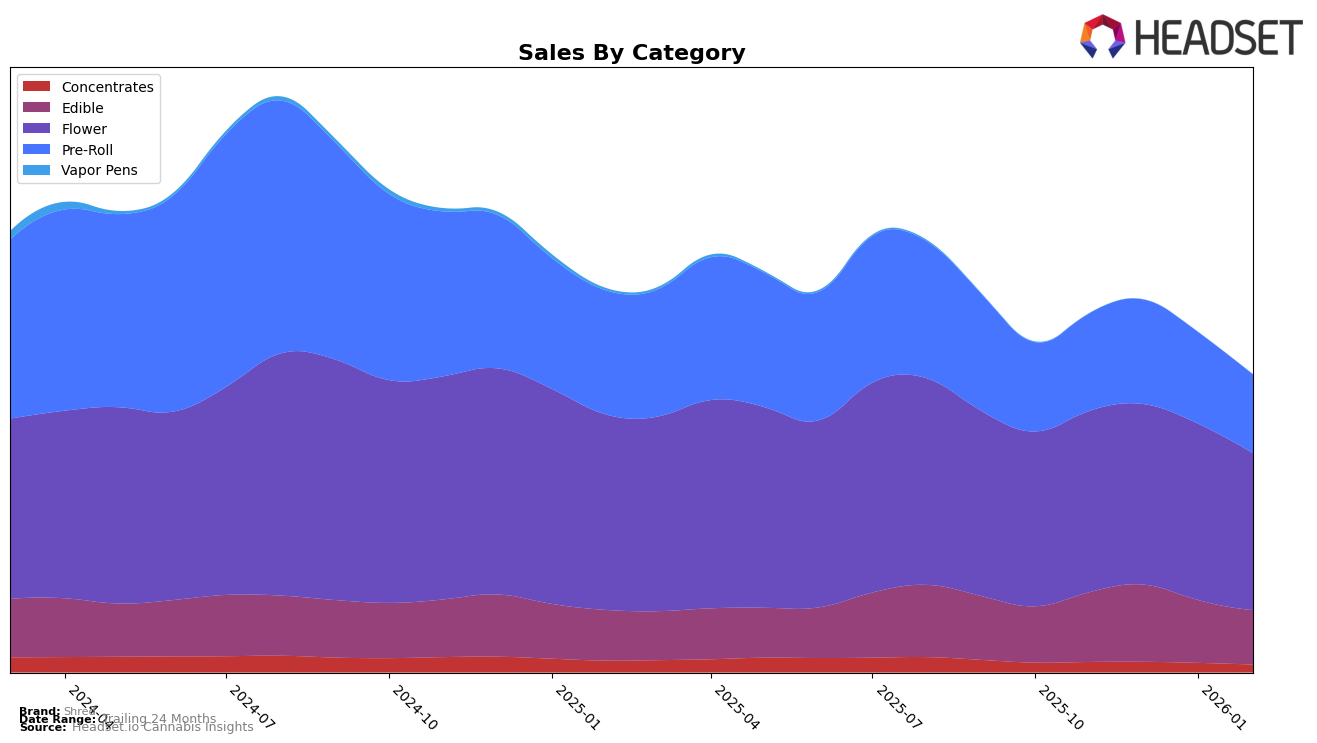

Shred has demonstrated a consistent presence in the cannabis market across various provinces in Canada, particularly in the edible category. In Alberta, Shred has maintained a steady third-place ranking in edibles from November 2025 through February 2026, despite a decline in sales from December to February. This consistency is mirrored in Ontario, where Shred also held the third spot in edibles for the same period, albeit with a slight drop to fourth in January and February. However, in Saskatchewan, Shred's performance in edibles improved, reaching the second spot in January 2026, although it fell out of the top 30 by February, indicating a potential area for concern or opportunity for recovery.

In the flower category, Shred's performance varied significantly across provinces. In Ontario, the brand consistently ranked third from November 2025 to February 2026, showcasing a strong foothold in this category. Conversely, in British Columbia, Shred's ranking fluctuated outside the top 30, peaking at 26th in November 2025 and dropping to 31st in January 2026 before slightly recovering to 28th in February. This indicates potential challenges in maintaining a strong market position in British Columbia's flower category, contrasting with its stable performance in Ontario. Additionally, Shred's presence in the pre-roll category has been noteworthy, maintaining a top 10 position in both Alberta and British Columbia, despite slight fluctuations in rankings over the observed months.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Shred consistently holds the third position from November 2025 through February 2026, trailing behind Back Forty / Back 40 Cannabis and Spinach, both of which maintain their ranks at first and second, respectively. Despite Shred's stable ranking, its sales figures show a slight decline from December 2025 to February 2026, indicating potential challenges in market share retention. Meanwhile, Big Bag O' Buds, consistently ranked fourth, shows a positive sales trend, closing the gap with Shred in February 2026. This competitive pressure suggests that while Shred remains a strong player, it may need to innovate or adjust strategies to maintain its position and counteract the upward momentum of its closest competitors.

Notable Products

In February 2026, the top-performing product from Shred was Shred'ems - CBD/THC 4:1 Wild Berry Blaze Gummy 4-Pack, maintaining its first-place rank for four consecutive months, despite a sales figure of 21,785. Shred'ems - CBD/THC 2:1 Sour Blue Razzberry Gummies 4-Pack climbed back to the second spot after slipping to third in January. Shred'ems Pop! - CBD/THC 1:1 Root Beer Blast Gummies 4-Pack made a notable return to the rankings in February, securing the third position. Gnarberry (7g) saw a slight dip, moving from second in January to fourth in February. Shred'em Pop! - Crazy Cream Soda Gummies 4-Pack consistently held the fifth spot, showing resilience in its category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.