Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

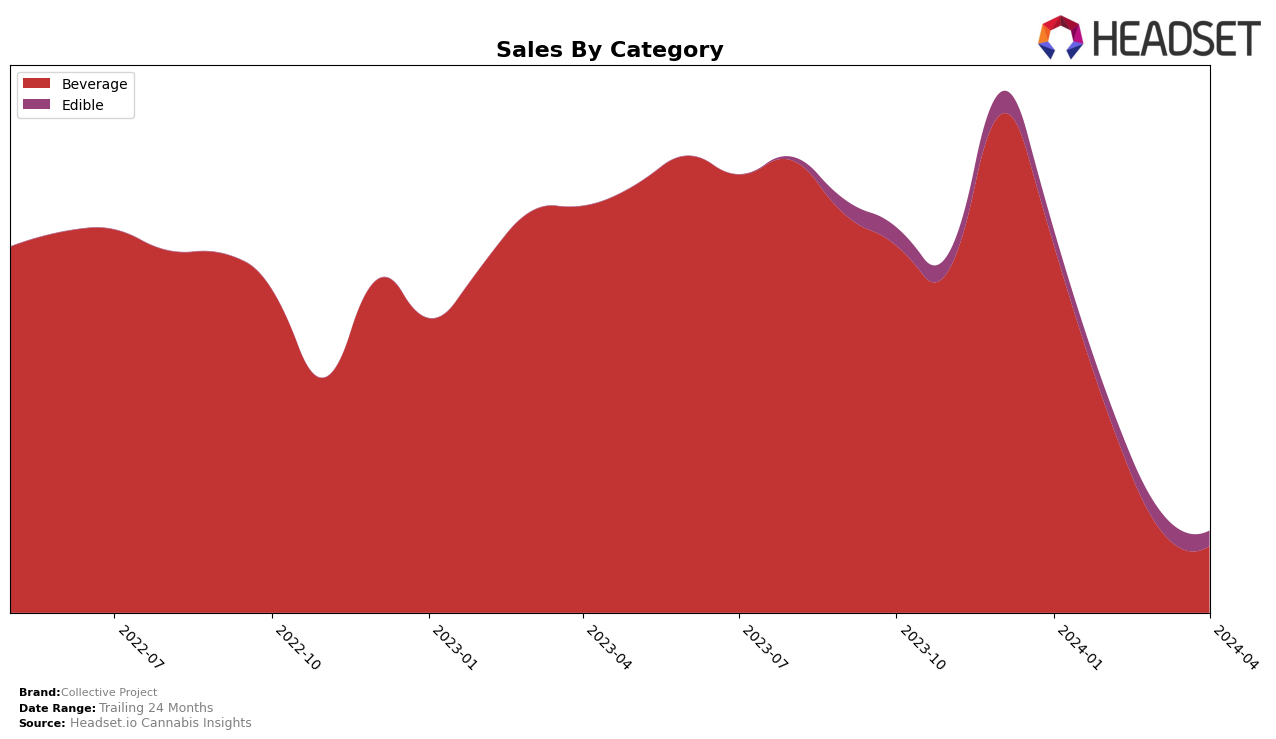

In the Beverage category, Collective Project has shown a varied performance across the Canadian provinces, indicating a fluctuating market presence. In Alberta, the brand maintained a steady presence in the top 20, albeit with a slight decline, moving from 16th to 20th position from January to April 2024, while sales dropped from 23,214 to 11,284 over the same period, highlighting a significant decrease in consumer interest or market competition. Conversely, in British Columbia, Collective Project started strong at 4th position in January but saw a more pronounced decline, ending at 12th by April 2024, with sales more than halving, which could suggest market saturation or shifts in consumer preferences within the province. Ontario presented the most dramatic shift, where the brand fell from 2nd to 17th position from January to April, despite starting with a robust sales figure of 519,825, indicating a potential strategic or operational misstep in maintaining its market stronghold.

Exploring the Edible category in Ontario, Collective Project's performance reveals a consistent yet challenging market position. The brand hovered around the low 20s, specifically maintaining the 24th position in January and February, and slightly slipping to 26th by March and April 2024. This consistency in ranking, despite a slight uptick in sales in March, suggests a stable but niche consumer base, with sales figures indicating a modest demand relative to competitors. The lack of significant movement in rankings, combined with the relatively stable sales figures, could imply that while Collective Project has secured a foothold within the Edibles market in Ontario, breaking into a higher echelon of market dominance may require innovative strategies or expanded product offerings to capture a larger share of consumer interest.

Competitive Landscape

In the competitive landscape of the cannabis beverage market in Ontario, Collective Project has experienced notable fluctuations in its ranking and sales over the recent months. Starting strong at 2nd place in January 2024, it saw a decline to 4th in February, a significant drop to 16th in March, and further down to 17th in April. This trend indicates a challenging period for Collective Project, especially when compared to its competitors. For instance, Vacay, despite minor fluctuations, maintained a relatively stable presence in the top 15, ending in 14th place in April. Similarly, Green Monke showed resilience by improving its rank to 15th in March and maintaining the 16th position in April, closely trailing behind Collective Project. On the other end, Señorita and Dulces lingered at the lower end of the ranking spectrum but displayed a steady position without drastic drops, ending in 18th and 19th places respectively in April. This analysis underscores the volatile nature of the cannabis beverage market in Ontario and highlights the need for Collective Project to reassess its market strategies amidst stiff competition and shifting consumer preferences.

Notable Products

In April 2024, Collective Project saw CBD/THC 1:1 Blood Orange, Yuzu & Vanilla Sparkling Juice (10mg CBD, 10mg THC, 355ml) reclaiming its top position in sales with 4,484 units sold, after briefly falling to second place in March. Following closely was Day Tripper - CBD:THC 1:1 Raspberry and Vanilla Sparkling Juice (10mg CBD, 10mg THC), which moved down to second after being the best-seller in March. Squeezys -CBD:THC 1:1 Blood Orange Original Sour Soft Chews 5-Pack (10mg CBD, 10mg THC) made a notable entrance into the top three, ranking third in April, showing a significant rise from its previous position at fifth in March. The CBD:THC 1:1 Mango Pineapple & Coconut Sparkling Juice (5mg CBD, 5mg THC) dropped to the fourth spot, despite its consistent performance in the top three in earlier months. Lastly, Day Tripper- CBD:THC 1:1 Raspberry & Vanilla Sour Squeezys Chews 5-Pack (10mg CBD, 10mg THC) rounded out the top five, indicating a diversifying preference among Collective Project's consumers for both beverages and edibles.

Top Selling Cannabis Brands