Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

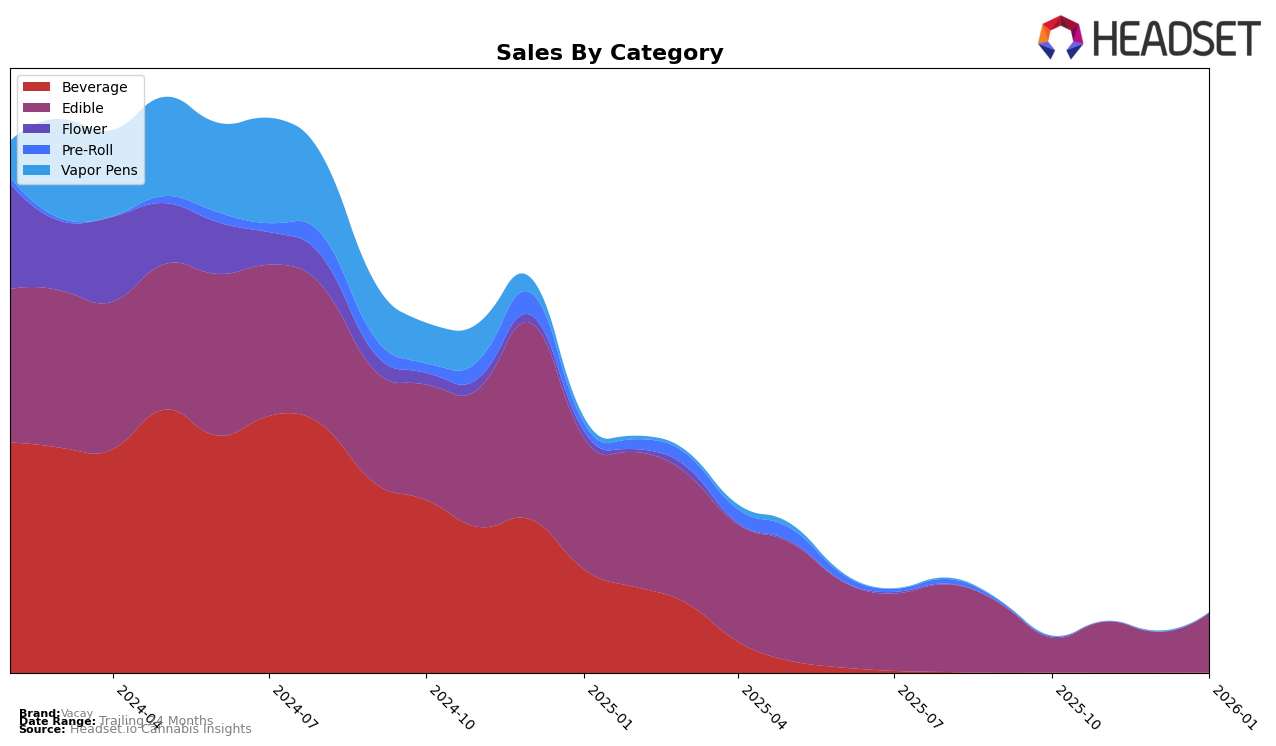

In the British Columbia market, Vacay's performance in the Edible category has shown some notable fluctuations. In October 2025, Vacay was not in the top 30 brands, but by November, they had climbed to the 22nd position. This upward movement was briefly interrupted in December, where they fell out of the top 30 again, only to make a comeback in January 2026, reaching the 17th position. This indicates a promising upward trend in their market presence within British Columbia, suggesting potential growth or successful strategic adjustments during this period.

Conversely, in Ontario, Vacay's ranking in the Edible category has been more stable, albeit less dynamic. Starting at the 30th position in October 2025, they slightly dipped to the 31st position in November and then to the 32nd in December, maintaining this rank into January 2026. This steady presence in the lower ranks of the top 30 suggests that while Vacay holds a consistent place in Ontario's market, there may be challenges in gaining higher traction or breaking into the top tiers. The sales trend over these months reflects minor fluctuations, hinting at a need for strategic initiatives to boost their standing in this competitive market.

```Competitive Landscape

In the competitive landscape of the edible category in British Columbia, Vacay has shown a notable fluctuation in its market position over the recent months. While Vacay was not ranked in the top 20 in October 2025, it emerged at the 22nd position in November 2025, indicating a positive shift. By January 2026, Vacay improved its rank to 17th, suggesting a growing acceptance and presence in the market. In comparison, Olli consistently maintained a stronger position, ranking 15th in November and 14th in December 2025, before slightly dropping back to 15th in January 2026. Aurora Drift also showed stability, holding the 16th position from December 2025 to January 2026. Meanwhile, Edison Cannabis Co experienced a decline from 14th in October 2025 to 18th in January 2026, which could indicate an opportunity for Vacay to capture more market share. These dynamics highlight Vacay's potential for growth amidst fluctuating performances of its competitors.

Notable Products

In January 2026, Vacay's top-performing product was Peanut Butter Chocolate Cup (10mg) in the Edible category, maintaining its first-place rank for four consecutive months with a notable sales figure of 5001 units. Baked Apple Soft Chews 5-Pack (10mg) climbed to second place, showing a strong performance after not being ranked in November and December. Pecan Cluster Chocolate Caramel (10mg) held steady in the second position for most months, except for a slight dip to third in December. The CBD/THC 1:1 Island Punch Soda (10mg CBD, 10mg THC, 355ml) ranked third in January, having previously been second in December. The CBD/CBG Island Vibes Co2 Cartridge (1.2g) entered the rankings in January at fourth place, highlighting its growing popularity among vapor pen products.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.