Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

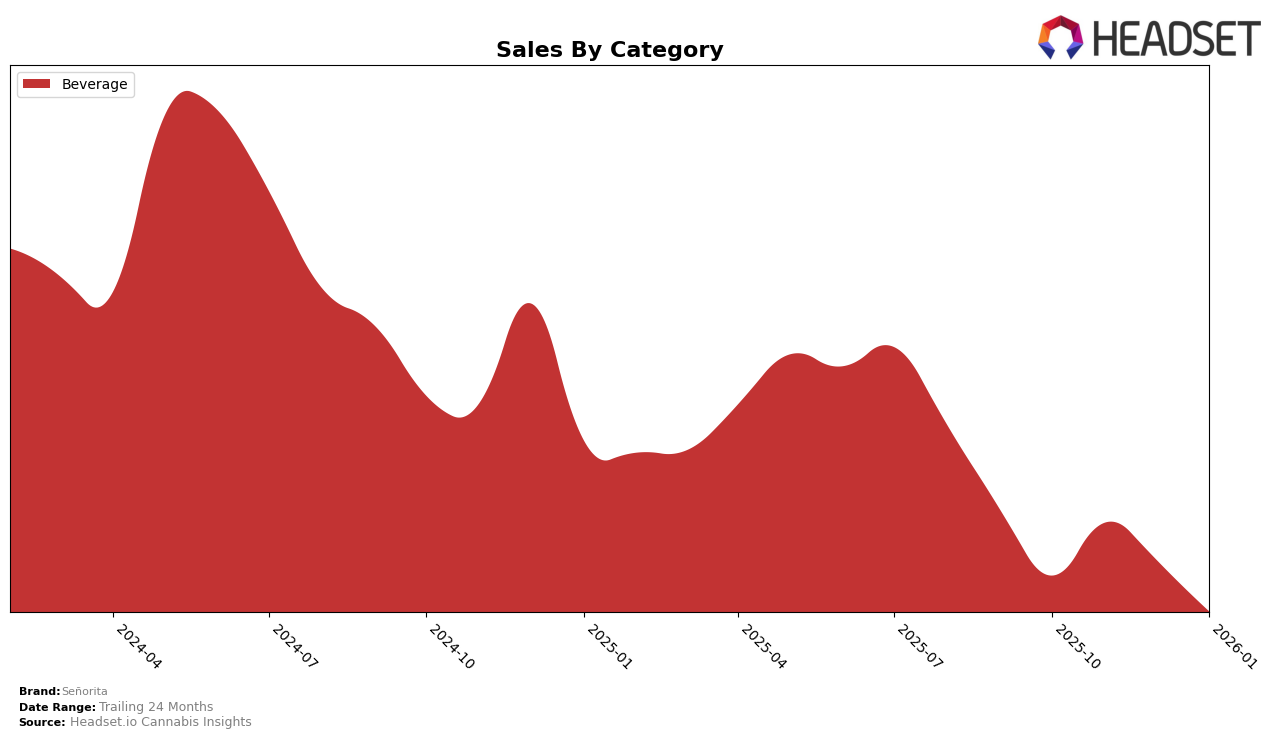

Señorita's performance in the beverage category across Canadian provinces has shown notable fluctuations. In British Columbia, the brand did not make it into the top 30 in October 2025, which could indicate a challenging market presence or increased competition. However, it entered the rankings in November, maintaining a steady position at 17th and 18th in the subsequent months. This consistency, despite a decline in sales from approximately 23,958 CAD in October to 16,806 CAD in January, suggests a stable, albeit modest, market penetration. The entry into the rankings could be seen as a positive development, indicating a potential for growth or a successful adaptation to market demands.

In contrast, Señorita's performance in Ontario has been more stable, maintaining a consistent rank at 15th from October to December 2025, with a slight drop to 16th in January 2026. This steadiness in ranking, despite a noticeable decrease in sales from 48,440 CAD to 36,673 CAD over the same period, highlights a resilient brand presence in the province. The consistent ranking suggests that Señorita has a loyal customer base or effective marketing strategies that keep it competitive in Ontario's beverage category. The slight drop in January may warrant attention to ensure it does not signal a downward trend, but overall, the brand's position remains relatively strong in this market.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Señorita has maintained a consistent presence, with its rank holding steady at 15th place from October to December 2025 before slipping slightly to 16th in January 2026. This stability is noteworthy when compared to competitors like Solei, which maintained a steady 14th rank throughout the same period, and RIFF, which dropped from 16th to 17th in January 2026. Meanwhile, Sense & Purpose Beverages showed a positive trajectory, improving from 19th in October to 15th in January, potentially posing a threat to Señorita's position. Despite a decline in sales from October to January, Señorita's ability to largely maintain its rank suggests a loyal customer base, but the brand must strategize to counter the upward momentum of competitors like Sense & Purpose Beverages to safeguard its market share.

Notable Products

In January 2026, the top-performing product for Señorita was the Mexican Agave, Lime & Jalapeno Margarita Drink (10mg THC, 12oz), maintaining its consistent first-place rank from previous months with sales of 6039 units. The Mexican Agave, Lime & Ruby Red Grapefruit Margarita Drink (10mg THC, 12oz) climbed to the second position, improving from its third-place rank in December 2025. Meanwhile, the Mexican Agave, Mango Margarita and Lime Drink (10mg THC, 355ml) held steady in the third position, showing a slight decrease in sales compared to December. Notably, the Mango Liquid Live Resin Margarita (25mg THC, 355ml) and the Mexican Agave, Lime & Jalapeno Margarita Drink 4-Pack (20mg THC, 12oz, 355ml) were not ranked in January 2026, indicating a possible shift in consumer preference. Overall, the rankings reflect a strong preference for the classic lime and jalapeno flavor, while newer flavors continue to compete for market share.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.