Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

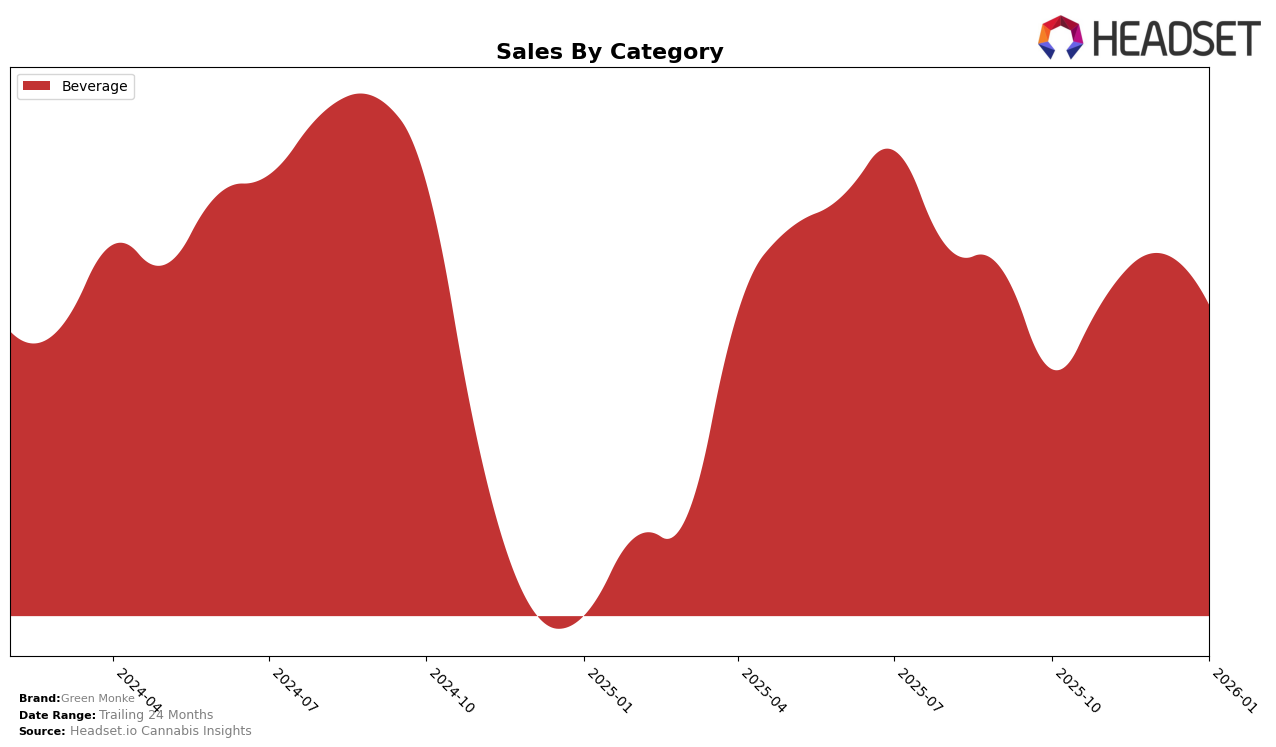

Green Monke's performance in the cannabis beverage category has shown some interesting movements across different regions. In British Columbia, the brand maintained a relatively strong position, starting at rank 5 in October 2025 and settling at rank 6 by January 2026. This consistency suggests a stable market presence, even though there was a slight dip in November 2025. The sales figures reflect a notable peak in November, indicating a possible seasonal or promotional influence. On the other hand, the brand's absence from the top 30 in several other states might indicate either a lack of market penetration or competition challenges in those regions.

In Ontario, Green Monke consistently held its ground at rank 11 from October 2025 through January 2026, suggesting a steady demand for their beverages. Despite a dip in sales from October to November, the brand saw an increase in December, which could be attributed to holiday season buying patterns. The consistency in ranking, despite the fluctuating sales, indicates a loyal customer base or effective market strategies that maintain their position against competitors. The absence of Green Monke in the top 30 rankings in other provinces or states, however, points to significant opportunities for growth and expansion in those markets.

Competitive Landscape

In the Ontario cannabis beverage market, Green Monke has maintained a consistent rank of 11th from October 2025 to January 2026, indicating a stable position amidst fluctuating sales figures. Despite a dip in sales in November 2025, Green Monke rebounded in December, though it experienced another decline in January 2026. Notably, TeaPot consistently outperformed Green Monke, holding the 10th position throughout the same period with significantly higher sales, suggesting a strong consumer preference. Meanwhile, Mary Jones maintained a higher rank, only dropping to 9th in January 2026, yet still demonstrating robust sales figures. In contrast, Sheeesh! and Astro Lab trailed behind Green Monke, with Sheeesh! fluctuating between 11th and 13th and Astro Lab consistently ranking 13th, indicating that while Green Monke faces stiff competition from higher-ranked brands, it remains ahead of some competitors in the Ontario market.

Notable Products

In January 2026, Green Monke's top-performing product was the CBD/THC 2:1 Mango Guava Sparking Soda, maintaining its lead from December 2025 with sales of 6223 units. The CBD/THC 2:1 Blue Raspberry Sparkling Beverage, which was the leader in October 2025, slipped to the second position, showing a decrease in sales compared to the previous month. The Orange Passionfruit Sparkling Soda held steady at the third rank throughout the observed months, indicating consistent performance. Meanwhile, the Tropical Citrus Sparking Soda and Purple Grape Ginger Lime Sparkling Soda remained in the fourth and fifth positions, respectively, with the latter showing a notable increase in sales from October 2025. These rankings highlight the dominance of the Mango Guava flavor, which has consistently performed well across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.