Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

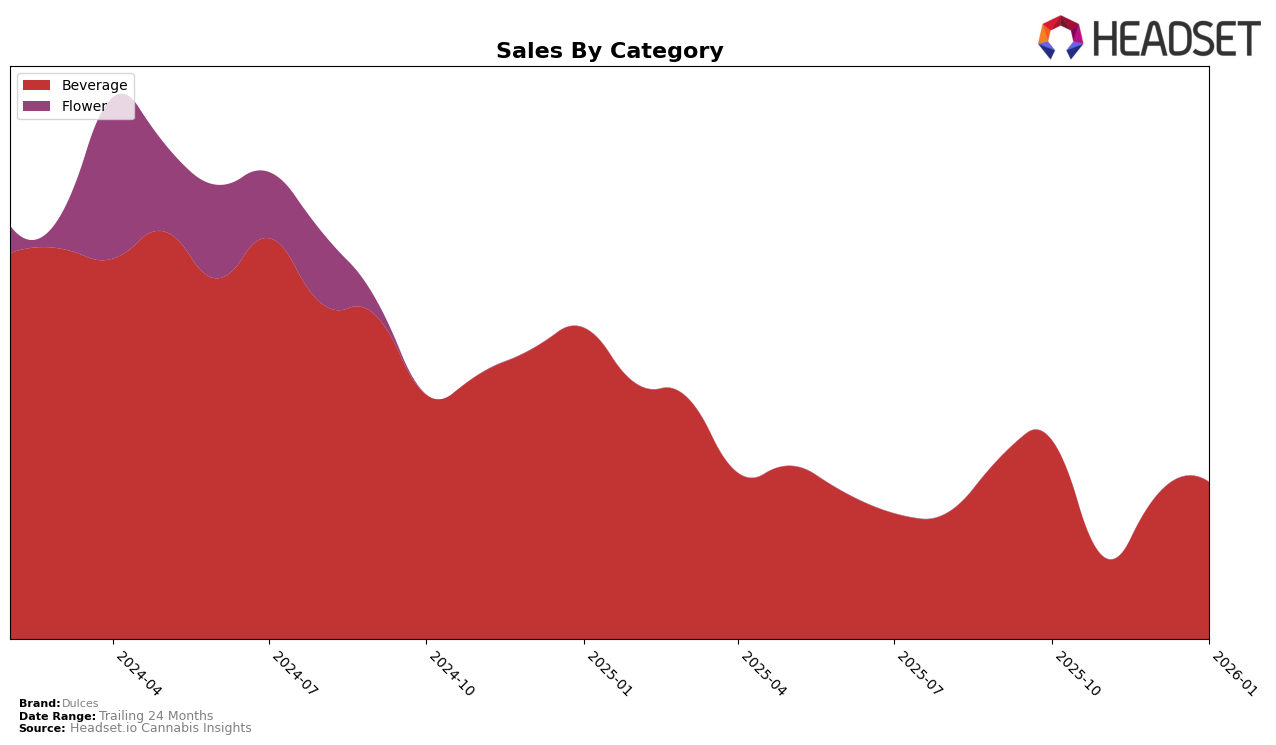

Dulces has shown a dynamic performance across different categories and states, with notable fluctuations in its rankings. In the Beverage category within Ontario, Dulces experienced a dip in November 2025, falling to the 26th position, before rebounding to 21st in December and further improving to 19th by January 2026. This upward trajectory suggests a positive reception of their products, possibly due to strategic marketing or product adjustments. The brand's ability to climb back up the rankings after a setback indicates resilience and adaptability in a competitive market.

However, it's important to note that Dulces did not consistently maintain a top 30 position across all states and categories, which could be seen as a challenge for the brand. The absence of rankings for some months might imply missed opportunities or the need for enhanced market penetration strategies in those areas. Despite this, the sales figures in Ontario highlight a promising trend, with a notable increase in sales from November 2025 to January 2026. This growth could be indicative of successful initiatives or a growing consumer base in the region. For a deeper dive into Dulces' performance, further analysis of specific strategies and market conditions would be beneficial.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Dulces has experienced notable fluctuations in its rank and sales over the past few months. Starting from October 2025, Dulces was ranked 20th, but saw a dip to 26th in November, indicating a significant drop in its market presence. However, it rebounded to 21st in December and climbed further to 19th in January 2026, showcasing a positive recovery trend. This fluctuation contrasts with the more stable performance of competitors like Señorita, which consistently maintained its rank at 15th until January 2026 when it slipped to 16th, and RIFF, which remained steady at 16th before dropping to 17th in January. Meanwhile, Palmetto and Embody have been trailing behind Dulces, with ranks mostly outside the top 20, although Palmetto briefly surpassed Dulces in November. The sales data suggests that while Dulces faced a sharp decline in November, its recovery in December and January indicates a potential for regaining market share, especially as it outperformed Palmetto and Embody in the latest month. This dynamic environment highlights the importance for Dulces to capitalize on its recent upward trend to strengthen its position against more stable competitors like Señorita and RIFF.

Notable Products

In January 2026, the top-performing product for Dulces was the CBD:THC 1:1 Cherry Shockwave Sparkling Beverage, which maintained its lead from December, with sales of 1248 units. The Sweet Peach Sparkling Beverage followed closely, maintaining its second position, although sales slightly decreased compared to the previous month. The Watermelon Sparkling Beverage showed a significant rise in popularity, climbing from the fourth to the third rank, with a notable increase in sales. Meanwhile, the Fruity Berry Beverages dropped to fourth place, reflecting a decrease in consumer preference. Overall, the January rankings suggest a strong consumer preference for the Cherry Shockwave variant, while the Watermelon variant is gaining traction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.