Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

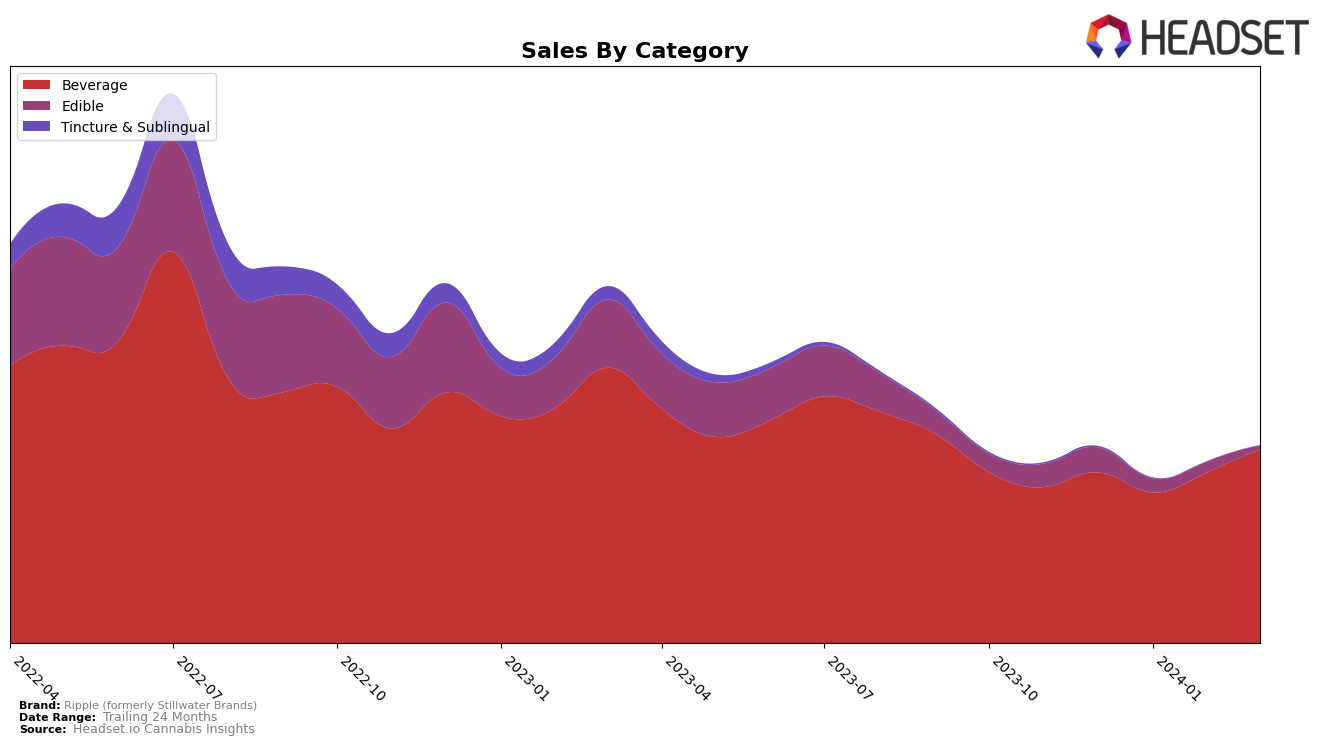

In the competitive landscape of cannabis products, Ripple (formerly Stillwater Brands) has shown a notable performance across different states and categories, with a particular strength in the Beverage category. In Colorado, Ripple has consistently maintained the 2nd rank in the Beverage category from December 2023 through March 2024, showcasing a strong market presence with sales peaking at $451,508 in March 2024. However, the brand's performance in the Edible and Tincture & Sublingual categories within the same state tells a different story. The rankings in the Edible category have seen a significant drop, moving from 26th in December 2023 to 48th by March 2024, coupled with a sharp decline in sales. Similarly, in the Tincture & Sublingual category, the absence of a ranking in March 2024 after a gradual decline from 10th to 15th suggests a challenging period for Ripple in maintaining its market share in these segments.

Expanding the analysis to other states, Ripple's foray into the Michigan and Nevada markets with its Beverage products reveals a struggle to climb the ranks, with a downward trend observed in Michigan from 17th to 26th place from December 2023 to March 2024 and sales dwindling to a mere $158 in March. Conversely, the brand's entry into the Missouri market in March 2024 at the 13th rank, with sales amounting to $6,159, indicates a potentially promising start in a new market. The fluctuating performance across different states and categories underscores the dynamic nature of the cannabis market, where brand presence and product acceptance can vary significantly. While Ripple shows strong potential and consumer loyalty in the Beverage category, especially in Colorado, it faces challenges in other categories and states that require strategic adjustments to maintain and grow its market position.

Competitive Landscape

In the competitive landscape of the beverage category in Colorado, Ripple (formerly Stillwater Brands) has maintained a consistent second-place ranking from December 2023 through March 2024, showcasing its strong presence in the market. Its main competitor, Keef Cola, has held the top position during the same period, with sales figures significantly higher than Ripple, indicating a dominant market share. Meanwhile, Dixie Elixirs and Dialed In Gummies have been trailing behind, occupying the third and fourth ranks, respectively. Notably, Dixie Elixirs has shown a remarkable sales increase in March 2024, potentially challenging Ripple's position in the future. However, Ripple's steady sales growth suggests a solid consumer base and indicates potential for further market penetration and competition with Keef Cola. This competitive analysis underscores the importance of monitoring sales trends and market rankings to understand Ripple's position and strategize for growth in Colorado's beverage category.

Notable Products

In Mar-2024, Ripple (formerly Stillwater Brands) saw its top product, Quick - Pure - Fast-Acting Dissolvable Powder 10-Pack (100mg), maintain its number one position from previous months with a notable sales figure of 12,826 units. Following closely, Quick - Sleep - CBN/THC 1:2 Dissolvable Powder 10-Pack (50mg CBN, 100mg THC) also held its second rank consistently, highlighting its steady demand. The third spot was secured by RipStick - Blue Raspberry Dissolvable Powder 10-Pack (100mg), which showed an upward trend moving from the fifth position in Dec-2023 to third by Mar-2024. Revive - CBG/THC 1:1 Dissolvable Powder 10-Pack (100mg CBG, 100mg THC) experienced a slight dip, settling at fourth after being ranked third in Dec-2023. Lastly, RipStick - Watermelon Dissolvable Powder 10-Pack (100mg) entered the rankings in Jan-2024 and has since maintained its fifth position, indicating a stable consumer interest in this flavor.

Top Selling Cannabis Brands