Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

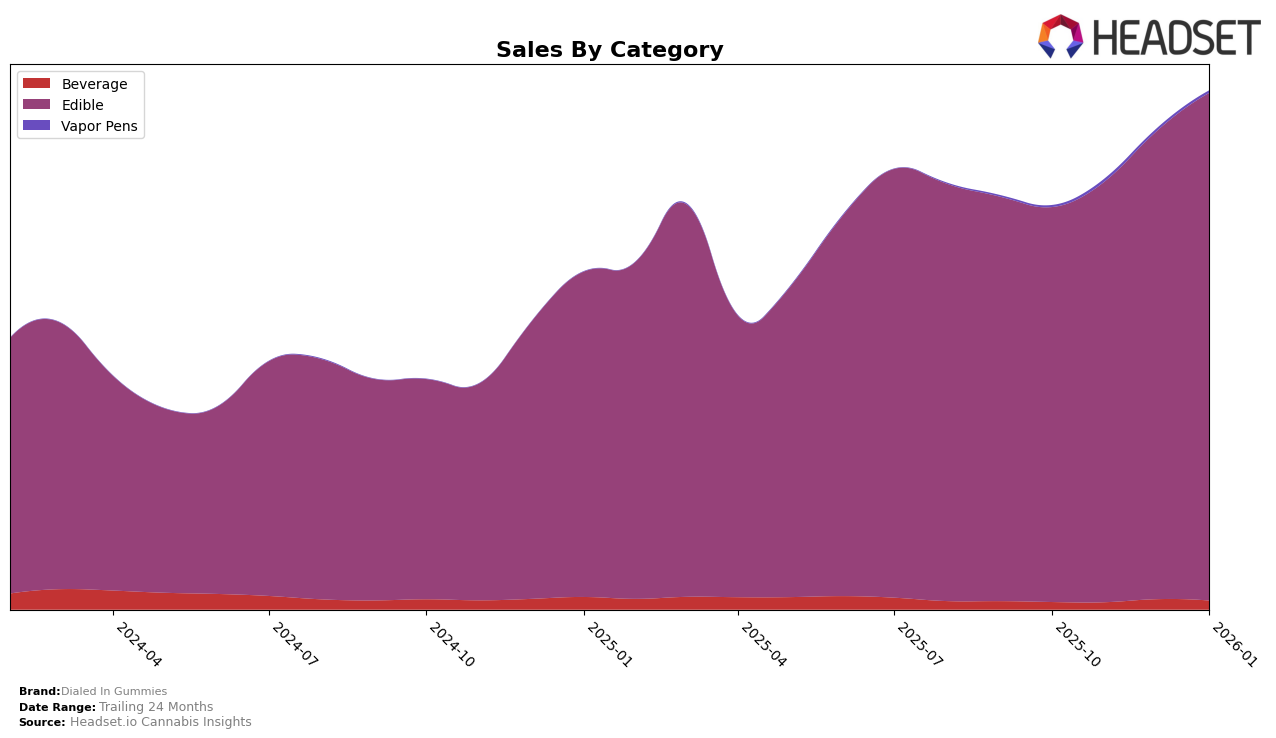

Dialed In Gummies has shown varied performance across different states and product categories. In Arizona, the brand made a notable entry into the Edible category, reaching the 24th rank by December 2025 and climbing to 15th by January 2026. This upward trajectory indicates a growing consumer interest and a successful market penetration strategy. In Colorado, the brand's presence in the Beverage category was marked by a strong debut at the 4th position in January 2026, highlighting a promising start. However, the Edible category in Colorado has been consistently strong, maintaining a solid 3rd place ranking for four consecutive months, which suggests a well-established market position.

In Massachusetts, Dialed In Gummies showed an impressive climb in the Edible category, moving from a 24th rank in November 2025 to 18th by January 2026. This consistent improvement suggests effective marketing and product acceptance in the region. Meanwhile, in Missouri, the brand maintained a steady presence with minor fluctuations, ranking between 15th and 17th over the observed months, indicating a stable consumer base. In Ohio, Dialed In Gummies consistently improved its position, reaching the 9th spot by January 2026, reflecting a positive reception and growing popularity among consumers in the state. These movements across states and categories demonstrate the brand's strategic adaptability and market growth potential.

Competitive Landscape

In the competitive landscape of the Colorado edible cannabis market, Dialed In Gummies consistently held the third rank from October 2025 to January 2026. Despite maintaining a stable position, the brand faces stiff competition from industry leaders like Wyld and Wana, which have consistently occupied the first and second ranks, respectively. Wyld's dominance is evident with significantly higher sales figures, while Wana also outpaces Dialed In Gummies in terms of revenue. Meanwhile, Ript and Good Tide trail behind, maintaining the fourth and fifth positions. The consistent ranking of Dialed In Gummies suggests a strong brand presence, yet the sales gap highlights potential growth opportunities to capture a larger market share and challenge the leading competitors.

Notable Products

In January 2026, the top-performing product from Dialed In Gummies was the CBD/THC/CBN 1:1:1 Acai Berry Sleep Rosin Gummies 10-Pack, maintaining its number one rank for four consecutive months with sales reaching 20,003 units. The Hybrid Live Rosin Gummies 10-Pack consistently held the second spot since November 2025. The CBD/THC 5:1 Rocket Berry Live Rosin Relax Gummies moved up to third place in January, showing a steady increase from its fourth-place position in previous months. The CBG/THC 2:1 Pomegranate Rosin Gummies slipped to fourth place, despite a consistent sales increase. The Focus- THCV/CBC/THC 1:1:1 Blood Orange Rosin Gummies remained in fifth place, showing stable performance across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.