Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

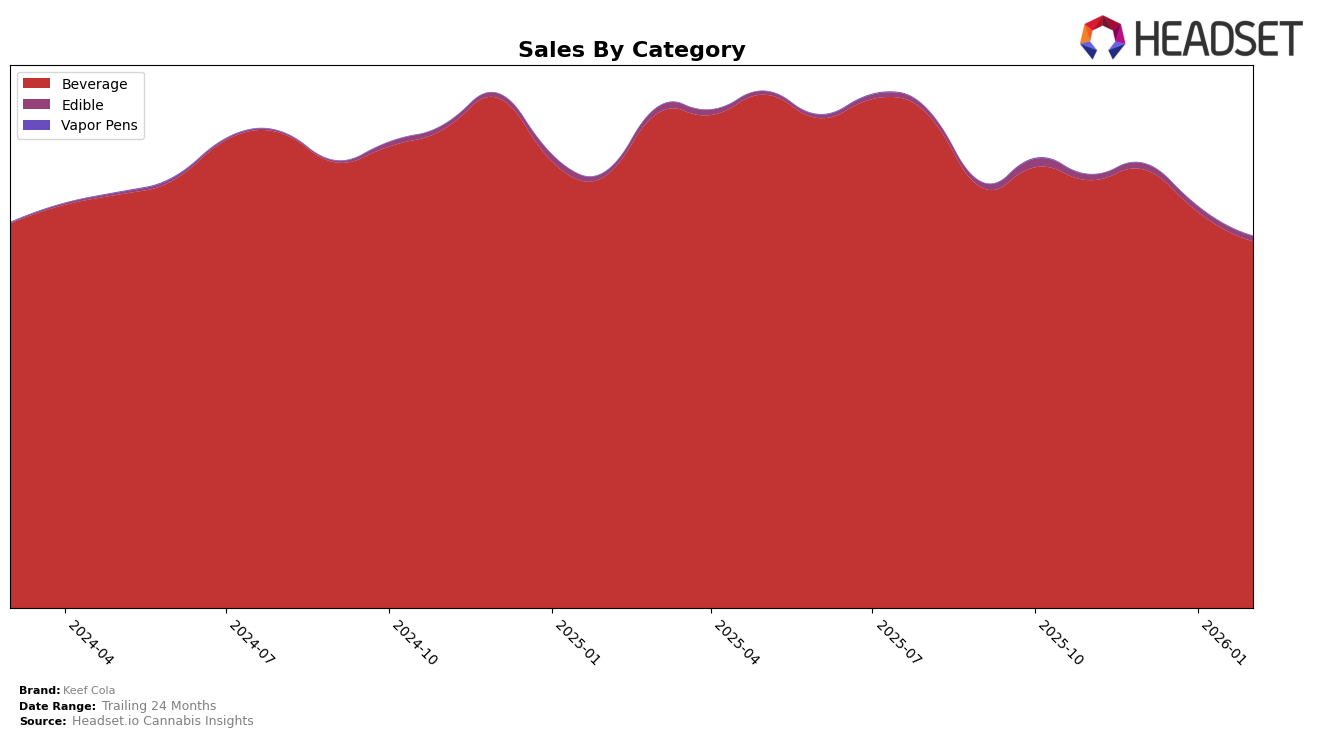

Keef Cola has demonstrated a strong presence in the cannabis beverage category across several states, maintaining impressive rankings throughout late 2025 and early 2026. In Arizona, the brand consistently held the top position, with only a brief dip to second place in January 2026, indicating its robust market leadership. Similarly, in Colorado, Keef Cola remained the top-ranked brand, although there was a noticeable decline in sales from November 2025 to February 2026. This trend of leading the category is mirrored in Maryland and Missouri, where the brand held the number one spot consistently, albeit with varying sales figures.

In contrast, Keef Cola's performance in California and Illinois has been more stable but less dominant, maintaining a steady ninth and sixth place respectively without breaking into the top five. The brand's presence in Michigan saw a positive shift, climbing to the top spot in February 2026 from second place in the preceding months, suggesting a strengthening foothold in the market. Meanwhile, in Nevada and Oregon, Keef Cola consistently held the second rank, indicating solid performance but with room for growth to capture the leading position. Notably, Keef Cola did not appear in the top 30 brands in any other state or category, highlighting areas where the brand could expand its reach.

Competitive Landscape

In the Colorado beverage category, Keef Cola has consistently maintained its top position from November 2025 through February 2026, showcasing its dominance in the market. Despite a noticeable decline in sales from January to February 2026, Keef Cola's leadership remains unchallenged. However, Journeyman has shown significant growth, climbing from not being in the top 20 in November 2025 to securing the second position by February 2026, with a steady increase in sales. Meanwhile, Ripple (formerly Stillwater Brands) has slipped from second to third place in February 2026, indicating a potential shift in consumer preferences. The competitive landscape suggests that while Keef Cola remains a strong leader, emerging brands like Journeyman are gaining traction, which could influence Keef Cola's strategies to maintain its market share.

Notable Products

In February 2026, the top-performing product from Keef Cola was the Xtreme - Bubba Kush Root Beer Classic Soda (100mg THC, 355ml), maintaining its first position for the fourth consecutive month with sales of 20,477 units. The Orange Kush Classic Soda (10mg THC, 12oz, 355ml) consistently held the second rank, despite a slight decrease in sales compared to previous months. The Classic Bubba Kush Root Beer (10mg THC, 355ml) remained in third place, continuing its steady performance. Notably, the Xtreme - Classic Orange Kush Soda (100mg THC, 12oz) and Xtreme - Classic Blue Razzberry Soda (100mg THC, 12oz) entered the rankings at fourth and fifth positions, respectively, indicating a successful expansion of the Xtreme product line. These new entries suggest a growing consumer interest in higher THC beverages from Keef Cola.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.