Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

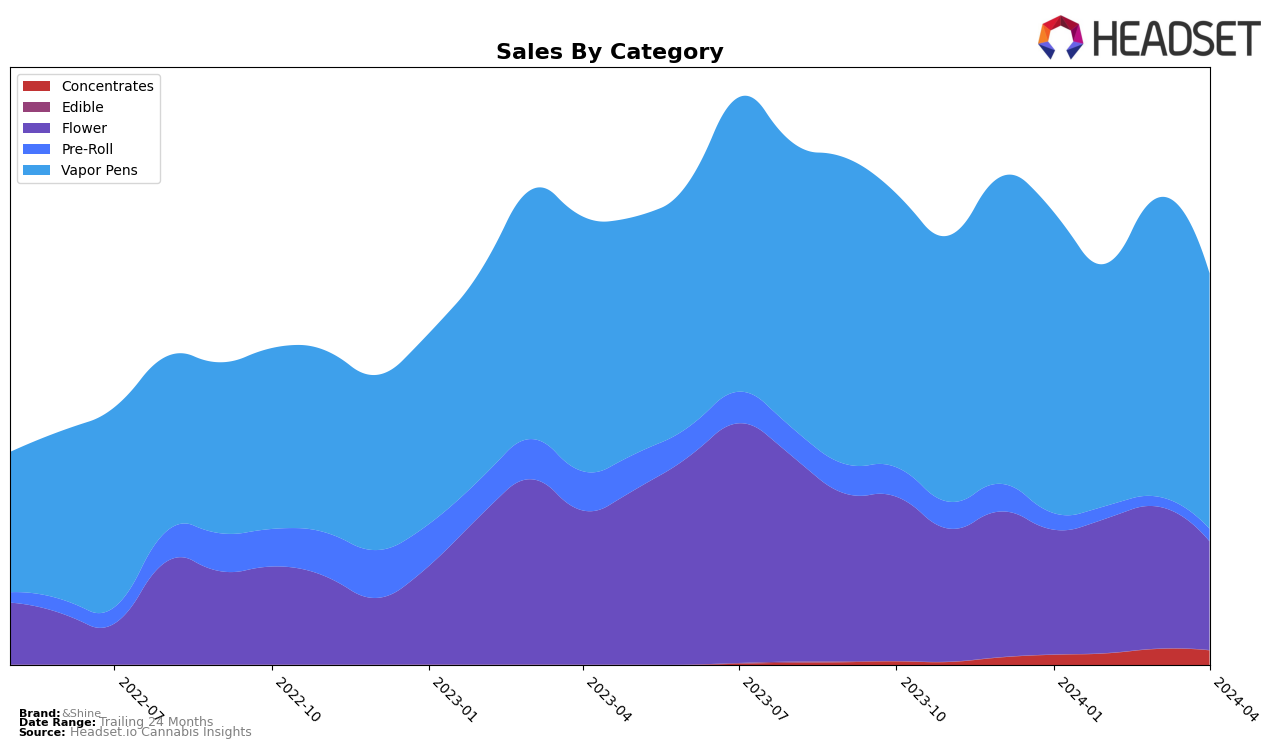

In the dynamic landscape of cannabis markets, &Shine has shown noteworthy performance across various states and categories, particularly excelling in the Vapor Pens category. In Illinois, &Shine has maintained a dominant position in Vapor Pens, consistently holding the number 1 rank from January to April 2024, despite a slight fluctuation in sales figures. This achievement underscores the brand's strong foothold in the Illinois market. However, the brand's performance in the Flower category within the same state presents a slightly varied picture, with rankings oscillating between 4th and 7th place over the same period, indicating a competitive but stable presence. Contrastingly, in Nevada, while &Shine's Vapor Pens category also secured a firm position in the top 4 ranks, its Flower category witnessed a decline, slipping from 14th to 25th place, which could signal a need for strategic adjustments to bolster its market share in this segment.

Exploring other states, &Shine's performance in the Vapor Pens category showcases a pattern of high competitiveness, with notable standings in Maryland and Ohio. Maryland saw the brand moving within the top 5 ranks, a testament to its strong market presence and consumer preference. Ohio, in particular, highlighted &Shine's upward trajectory in Vapor Pens, moving from 6th to 3rd place from January to April 2024, alongside a significant sales increase. This growth trajectory, however, contrasts with the brand's performance in the Flower category within Ohio, where its ranking experienced more volatility, peaking at 14th place in March before dropping to 22nd in April. This mixed performance across categories and states underscores the brand's strengths and areas for potential growth, with its success in Vapor Pens highlighting a key area of consumer demand and brand loyalty.

Competitive Landscape

In the competitive landscape of Vapor Pens in Illinois, &Shine has maintained its position as the leading brand over the observed months, consistently ranking 1st from January to April 2024. This dominance is notable when compared to its closest competitors, STIIIZY and Joos. STIIIZY, despite fluctuating slightly in rank (2nd in January, 3rd in February, and back to 2nd in March and April), has shown a strong sales performance, ending April with a significant increase. Joos, on the other hand, has seen more stability in its ranking (3rd across all months) but has not matched STIIIZY's upward sales trajectory. The consistent top ranking of &Shine, combined with its sales performance, underscores its competitive edge in the Illinois Vapor Pens category. However, the growth in sales for STIIIZY suggests a competitive market where &Shine must continue to innovate and engage consumers to maintain its lead.

Notable Products

In Apr-2024, &Shine's top product was the Ghost Train Haze BDT Distillate Disposable (0.3g) with sales reaching 6432 units, marking it as the highest-selling product of the month in the Vapor Pens category. Following closely, the Ghost Train Haze Distillate Cartridge (0.5g) and Green Crack BDT Distillate Disposable (0.3g) secured the second and third ranks, respectively, indicating a strong preference for disposable options among consumers. The Blue Dream Distillate Cartridge (0.5g) landed in the fourth position, showcasing the variety in consumer choices within the Vapor Pens category. Notably, the Granddaddy Purple BDT Distillate Disposable (0.3g) experienced a ranking shift from the third position in March to the fifth in April, demonstrating slight changes in consumer preferences over the months. This shift underscores the dynamic nature of product popularity in the cannabis market, with &Shine maintaining a diverse portfolio to cater to varying tastes.

Top Selling Cannabis Brands