Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

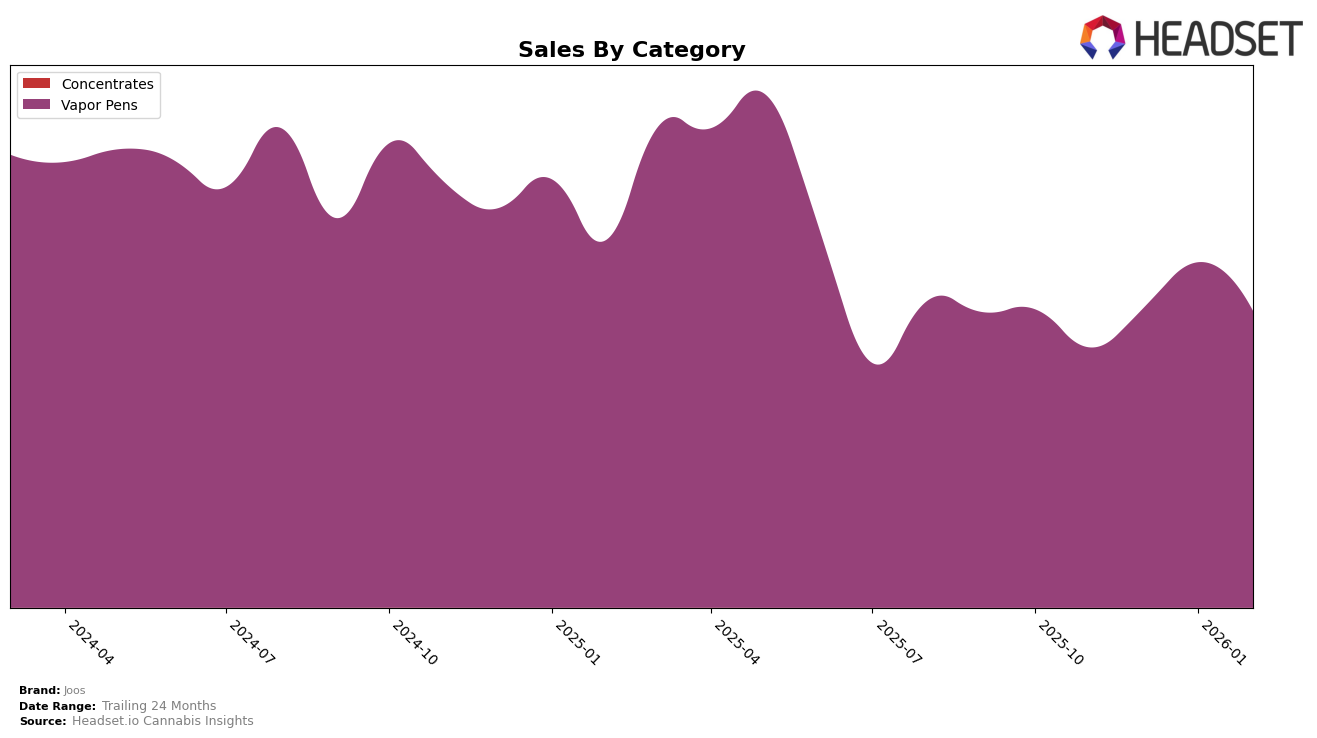

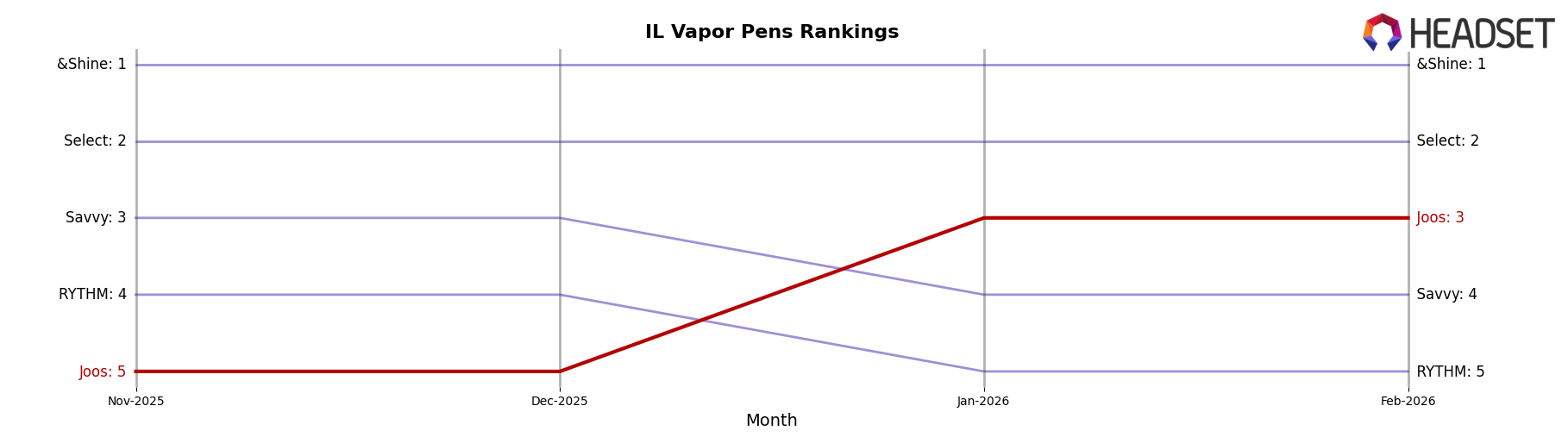

Joos has shown a strong performance in the Vapor Pens category in Illinois, maintaining a steady presence in the top five rankings over several months. In November and December 2025, Joos held the fifth position, but saw a noteworthy improvement as it climbed to the third spot in January and February 2026. This upward trend suggests a growing consumer preference for Joos products in Illinois. The brand's ability to improve its ranking while seeing a slight dip in sales from January to February indicates a robust market strategy that keeps it competitively positioned despite fluctuations in sales figures.

Interestingly, Joos's presence in other states or categories is not immediately visible, as they do not appear in the top 30 brands for those segments. This absence could be interpreted in various ways. It might suggest that Joos has a concentrated focus on the Illinois market, particularly in the Vapor Pens category, where it has established a strong foothold. Alternatively, it may highlight potential opportunities for growth and expansion into other states or product categories. The brand's concentrated success in Illinois could serve as a model for replicating its strategies in other markets.

```Competitive Landscape

In the Illinois Vapor Pens market, Joos has demonstrated a notable upward trajectory in its competitive positioning. Starting from a rank of 5th in November and December 2025, Joos climbed to 3rd place by January 2026 and maintained this position through February 2026. This rise in rank reflects a strategic improvement in sales performance, as Joos surpassed RYTHM, which remained at 4th and 5th positions during the same period. Despite Select and &Shine consistently holding the top two spots, Joos's advancement suggests a narrowing gap with these leading brands. The sustained sales growth for Joos, particularly in January 2026, indicates a strengthening brand presence and consumer preference, positioning it as a formidable contender in the Illinois Vapor Pens category.

Notable Products

In February 2026, the top-performing product for Joos was the Green Crack Distillate Cartridge (1g) in the Vapor Pens category, which ascended from a previous rank of 5 in January to secure the top position. The Northern Lights Distillate Cartridge (1g) followed closely in second place, although it experienced a slight dip from its rank of 4 in January. The Apple Fritter CDT Distillate Cartridge (1g) made a notable reappearance at rank 3, showing a recovery from its absence in January. Jack Herer CDT Distillate Cartridge (1g) saw a decrease in performance, dropping from the top spot in January to fourth place in February with sales of 2914. Lastly, Pineapple Express CDT Distillate Cartridge (1g) rounded out the top five, experiencing a decline from its previous second-place rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.