Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

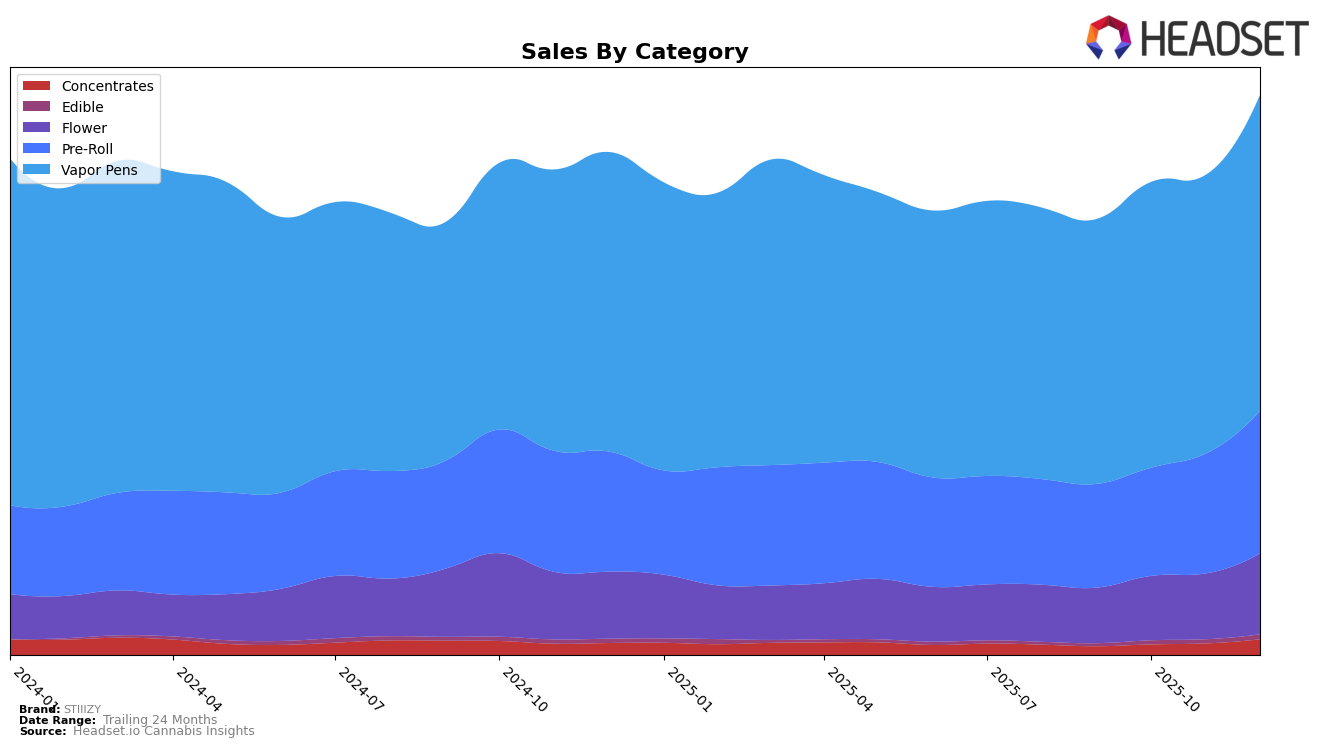

STIIIZY has demonstrated a strong performance across various categories in different states, with notable consistency in maintaining high rankings. In California, STIIIZY consistently held the top position in the Vapor Pens category throughout the last quarter of 2025, showcasing their dominance in this segment. Their performance in the Pre-Roll and Flower categories was also impressive, consistently ranking second over the same period, with a noticeable upward trend in sales figures. Contrastingly, in Nevada, while they maintained the top position in Pre-Rolls, they experienced a slight drop in the Flower category, moving from second to third place by December 2025. This indicates a competitive landscape in Nevada's Flower market.

In Arizona, STIIIZY showed stability with consistent second-place rankings in the Pre-Roll category and fifth place in Vapor Pens, indicating a steady market presence. Interestingly, New York presented a new opportunity for growth as STIIIZY entered the top 10 in the Vapor Pens category by December 2025, marking their first appearance in this market segment. The absence of rankings in other categories for New York suggests potential areas for expansion or increased competition. Overall, STIIIZY's performance highlights their stronghold in established markets like California and emerging presence in newer markets such as New York.

Competitive Landscape

In the competitive landscape of vapor pens in California, STIIIZY consistently holds the top rank from September to December 2025, showcasing its dominance in the market. Despite the strong presence of competitors like Raw Garden, which maintained a steady second place, and Jetty Extracts, which improved from fourth to third place, STIIIZY's sales figures demonstrate a significant lead. The brand's sales not only surpass those of its closest competitors but also show a notable upward trend, particularly in December 2025, indicating effective market strategies and strong consumer loyalty. This consistent performance underscores STIIIZY's robust market position and suggests a continued trajectory of growth and influence in the California vapor pen category.

Notable Products

In December 2025, the top-performing product for STIIIZY was the Blue Dream Distillate STIIIZY Pod (1g) in the Vapor Pens category, maintaining its first-place ranking from previous months with a sales figure of 41,089. The 40's - Blue Dream Infused Pre-Roll 5-Pack (2.5g) held steady in the second position, showing consistent performance after a brief dip to third place in October. The Blue Burst BDT Distillate STIIIZY Pod (1g) remained third, indicating stable demand across the last four months. Skywalker OG CDT Distillate STIIIZY Pod (1g) consistently ranked fourth, showing no change in its position throughout the observed months. Notably, the Original - Pink Acai CDT Distillate Stiiizy Pod (1g) debuted in December, entering directly at the fifth spot in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.