Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

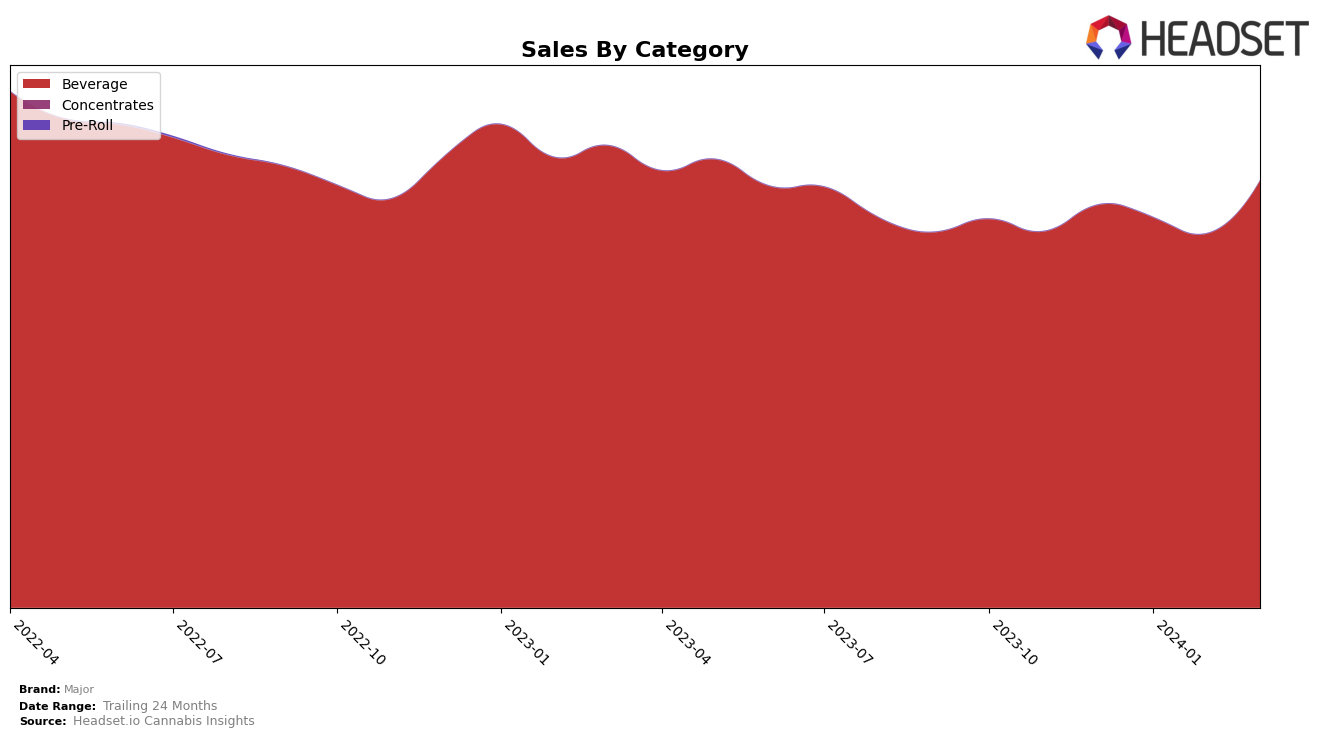

In the competitive landscape of cannabis beverages, Major has shown a varied performance across different states, reflecting both its market strengths and areas for improvement. In Colorado and Washington, Major has maintained a strong position within the top 10 brands, with a notable increase in its ranking from 6th to 7th in Colorado and consistently holding the 2nd position in Washington. This upward trajectory, especially in Washington where sales jumped significantly from 564,722 in February 2024 to 675,514 in March 2024, underscores Major's strong market presence and consumer preference in these states. Conversely, in Oregon, Major experienced a significant drop, falling from the 13th to not ranking within the top 30 by March 2024, indicating a potential challenge in maintaining its market share amidst competitive pressures.

Emerging trends in newer markets such as Nevada and Arizona provide a mixed picture for Major. In Nevada, the brand made a noteworthy entry in February 2024, quickly moving up to the 13th position by March 2024, suggesting a positive reception among consumers and a strong launch strategy. However, Arizona presents a contrasting scenario where, despite an initial strong performance, Major saw a gradual decline in its ranking from 17th in December 2023 to 20th by March 2024, coupled with a significant drop in sales from 1,452 in January 2024 to 173 in March 2024. These movements highlight the volatile nature of cannabis market preferences and the importance of strategic agility for brands like Major to sustain and grow their market share across different states.

Competitive Landscape

In the competitive landscape of the beverage category in Washington, Major has consistently held the second rank from December 2023 through March 2024, showcasing its strong position in the market. Despite this steady rank, Major has seen a fluctuation in sales, with a notable increase in March 2024, suggesting a positive trend in consumer demand. Its main competitor, Ray's Lemonade, has maintained the top position with higher sales, indicating a significant lead in the market. Other competitors such as Green Revolution and Journeyman have consistently held the third and fourth ranks, respectively. The sales gap between Major and its competitors, particularly Ray's Lemonade, highlights the competitive challenge Major faces. However, Major's sales increase in March suggests potential for narrowing this gap and increasing its market share in the Washington beverage category.

Notable Products

In Mar-2024, Major saw the "Blackberry Lemonade Blast Shot (100mg THC, 2oz)" rise to the top spot in sales with 14,288 units sold, marking a significant climb from its previous positions. Following closely was the "Fruit Punch Blast Shot (100mg THC, 2oz)", which had consistently held the lead in prior months but dropped to second place. The "Blueberry Blast Shot (100mg THC, 2oz)" also made notable progress, moving up to the third rank, demonstrating a steady increase in its market presence. The "Sunset Pink Lemonade Fruit Drink (100mg THC, 6.7oz)" and the "Pacific Coast Blue Raspberry Fruit Drink (100mg THC, 6.7oz)" rounded out the top five, indicating a strong preference among consumers for beverage products. These rankings highlight dynamic shifts in consumer preferences within Major's product line, with beverages dominating the sales chart.

Top Selling Cannabis Brands