Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

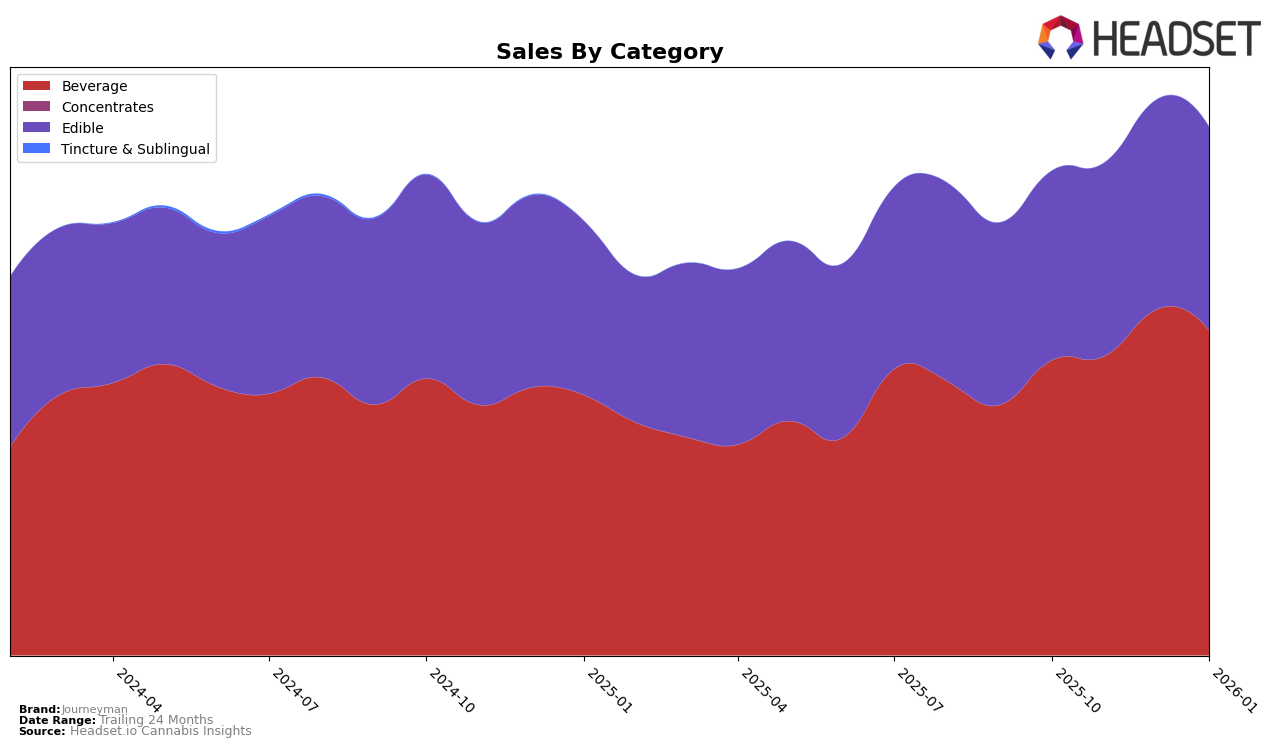

Journeyman has demonstrated a strong performance in the Beverage category across several states, maintaining a consistent presence in the top ranks. In New Jersey, the brand has impressively held the number one position from October 2025 through January 2026, indicating a dominant market presence. Meanwhile, in Illinois and Washington, Journeyman consistently ranked second over the same period, showcasing stable consumer demand. Notably, in Colorado, the brand made a significant leap into the top three by December 2025 and maintained this rank into January 2026, suggesting a growing market share in this region. However, the absence of rankings in October and November 2025 in Colorado implies that the brand was not initially in the top 30, highlighting a noteworthy upward trajectory.

In the Edible category within Washington, Journeyman has consistently held the fourth position from October 2025 through January 2026. This steady ranking indicates a strong foothold in the market, although it suggests there may be room for growth to climb higher in the rankings. The brand's stable performance in Washington's Edible category contrasts with its more dynamic movement in the Beverage category across states. The data suggests that while Journeyman is a formidable player in the Beverage market, its Edible products, though popular, face stiffer competition. This analysis highlights the brand's strategic positioning and potential areas for expansion or increased market penetration.

Competitive Landscape

In the Washington Edible market, Journeyman consistently maintained its 4th place rank from October 2025 through January 2026, indicating a stable position amidst strong competition. Notably, Green Revolution held a firm grip on the 2nd rank throughout this period, with sales figures significantly higher than Journeyman's, suggesting a robust brand presence and consumer preference. Meanwhile, Hot Sugar consistently ranked 3rd, slightly ahead of Journeyman, with sales figures that were marginally higher, indicating a close competition between these two brands. Craft Elixirs maintained the 5th position, trailing behind Journeyman, which underscores Journeyman's solid standing in the market. The consistent rankings and sales trends suggest that while Journeyman is stable, there is an opportunity for growth by capturing market share from close competitors like Hot Sugar and Craft Elixirs.

Notable Products

In January 2026, the top-performing product from Journeyman was Peach Hash Rosin Lemonade (100mg THC, 2oz), maintaining its number one rank consistently from previous months with sales of 19,867 units. Pineapple Hash Rosin Lemonade (100mg THC, 60ml, 2oz) secured the second position, improving from third place in December 2025. Strawberry Lemonade Hash Rosin Jellies (100mg THC, 60ml, 2oz) dropped to third place after being second in December. Berry Lemonade (100mg THC, 2oz) climbed to fourth place, showing a steady increase in rank from fifth in November. Tart Lemonade (100mg THC, 2oz) remained in fifth place, despite a drop in sales compared to December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.