Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

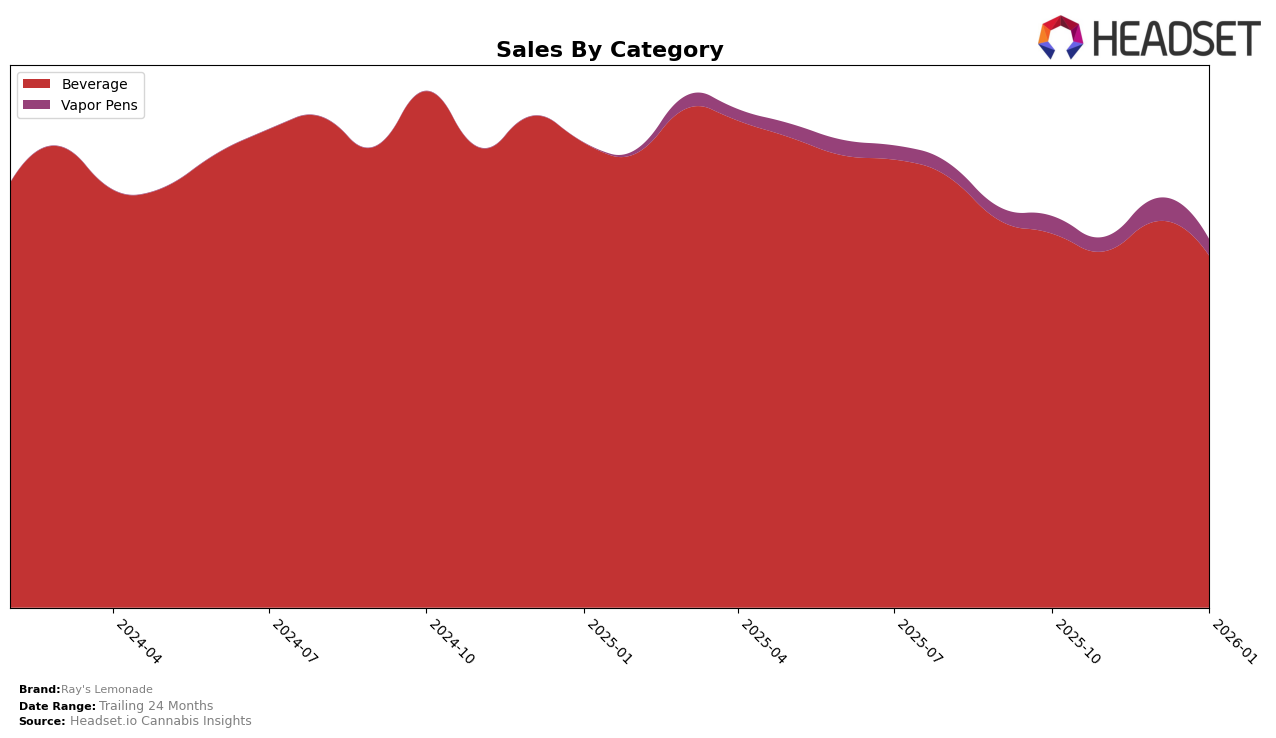

Ray's Lemonade has shown notable performance in the Beverage category across various regions, with particularly strong standings in Washington, where it consistently held the top rank from October 2025 to January 2026. This indicates a dominant presence and possibly a strong brand loyalty within the state. In British Columbia, the brand climbed from the 10th position in October 2025 to maintain a steady 5th place from November 2025 to January 2026, suggesting a growing acceptance and popularity. Meanwhile, in Ontario, Ray's Lemonade experienced some fluctuations, peaking at 5th place in November 2025 but dropping to 7th in December before slightly recovering to 6th in January 2026. These movements highlight the competitive nature of the market in Ontario.

In contrast, Ray's Lemonade's presence in the Vapor Pens category in Washington is less prominent, with rankings outside the top 30, ranging from 88th to 73rd during the same period. This indicates that while the brand is a leader in beverages, it faces challenges in gaining a foothold in the vapor pen market. Additionally, Ray's Lemonade's absence from the top 30 in Michigan after an initial 11th place ranking in October 2025 suggests a need for strategic adjustments to capture or recapture market share in this region. These insights into Ray's Lemonade's performance across categories and states provide a glimpse into the brand's strengths and areas for potential growth.

Competitive Landscape

In the Washington beverage category, Ray's Lemonade has consistently maintained its top position from October 2025 through January 2026, showcasing its dominance in the market. Despite a slight dip in sales from October to January, Ray's Lemonade has managed to stay ahead of its closest competitor, Journeyman, which has consistently ranked second during the same period. Journeyman's sales figures, although robust, remain below Ray's Lemonade, indicating a strong brand loyalty and market presence for Ray's. Meanwhile, Major holds the third spot, with sales figures significantly lower than both Ray's Lemonade and Journeyman, further solidifying Ray's Lemonade's leading position in the Washington beverage market. This consistent ranking suggests that Ray's Lemonade has effectively captured consumer preference, making it a formidable leader in its category.

Notable Products

In January 2026, Strawberry Lemonade (10mg THC, 355ml) from Ray's Lemonade maintained its top position as the best-selling product in the Beverage category, despite a slight decrease in sales to 11,315 units. Original Lemonade (10mg THC, 355ml) consistently held the second rank, with sales remaining robust at 9,297 units. CBD/THC 1:1 Tiger's Blood Lemonade (10mg CBD, 10mg THC, 355ml) stayed steady in third place, showing a minor dip in sales compared to December 2025. Lil Ray's - Strawberry Lemonade (100mg THC, 1.75oz) remained in fourth place, showing an increase in sales to 6,714 units from the previous month. Lil Ray's - Huckleberry Lemonade Drink (100mg THC, 1.75oz) continued to rank fifth, with sales figures slightly declining to 5,058 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.