Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

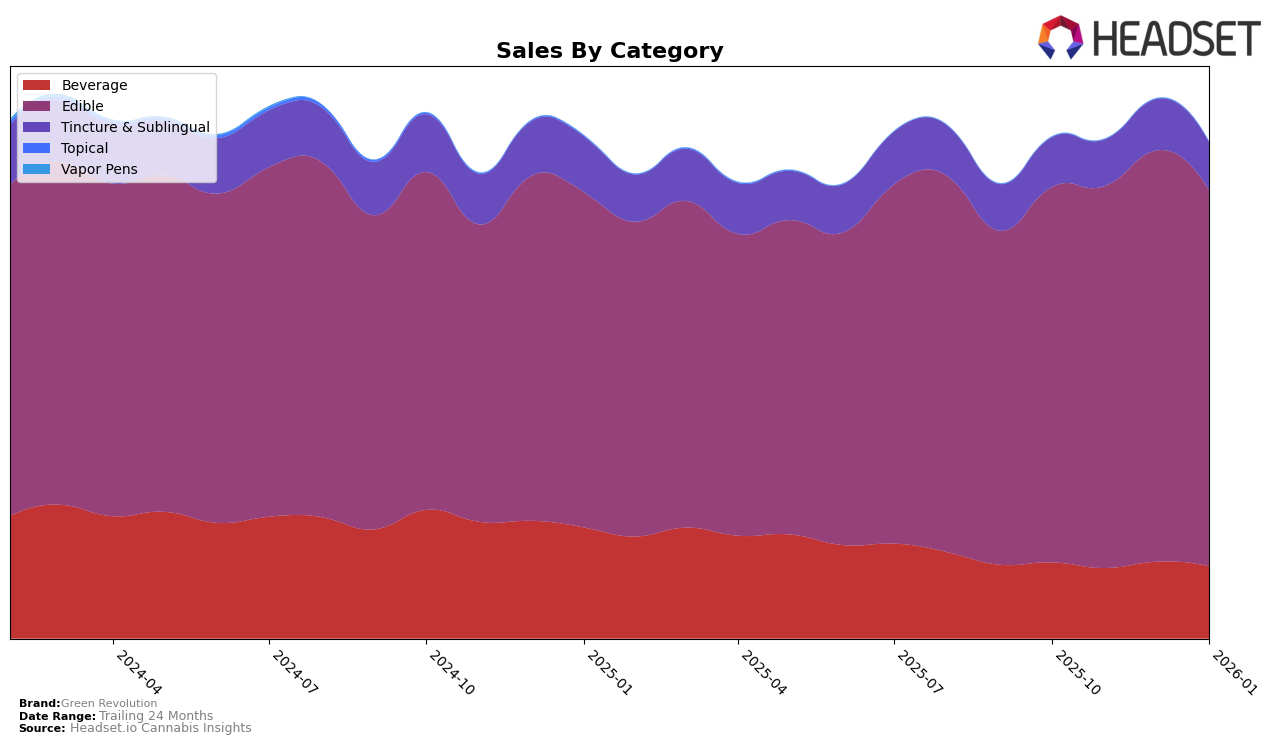

Green Revolution has shown a varied performance across different states and product categories. In Washington, the brand has maintained a strong presence, consistently ranking within the top four for beverages and securing the top spot in the tincture and sublingual category over several months. This stability in rankings suggests a strong foothold and consumer loyalty in the Washington market. However, the brand's performance in the edible category in California and New York tells a different story, as it did not place within the top 30 brands during the months analyzed. This absence from the top rankings could indicate challenges in gaining market traction or strong competition in these states.

Despite the challenges in California and New York, Green Revolution's sales figures in Washington provide a positive outlook. The brand's sales in the edible category in Washington have consistently exceeded the million-dollar mark each month, highlighting robust consumer demand. However, the brand's absence from the top 30 in the edible category in California and New York suggests areas for potential growth and strategic focus. The consistent top ranking in the tincture and sublingual category in Washington further emphasizes the brand's strength and potential leverage point to expand its market presence in other states. These insights indicate that while Green Revolution has a solid foundation in Washington, there is room for strategic improvements and market penetration in other regions.

Competitive Landscape

In the Washington edible market, Green Revolution consistently holds the second position from October 2025 to January 2026, demonstrating a stable performance in the competitive landscape. Despite facing tough competition from Wyld, which maintains the top rank with significantly higher sales, Green Revolution's steady rank indicates a strong brand presence and customer loyalty. Meanwhile, competitors like Hot Sugar and Journeyman consistently rank third and fourth, respectively, with lower sales figures compared to Green Revolution. This consistent ranking suggests that while Green Revolution is not the market leader, it has carved out a significant niche, outperforming other brands in the category and maintaining a competitive edge in terms of sales and market position.

Notable Products

In January 2026, the top-performing product from Green Revolution was the Nano Doozies CBD/CBN/THC 1:1:1 Blue Raspberry Nighttime Gummies 10-Pack, maintaining its number one rank for four consecutive months with sales of 11,880. The Doozies CBD/THC 60:1 Juicy Peach Gummies 10-Pack rose to the second position from third in December 2025. The Nano Doozies CBD/THC 60:1 Raspberry Gummies 10-Pack slipped from second to third place, showing a slight decline in sales. The Doozies Chill 3:1 CBN/THC Blackberry Punch Gummies 10-Pack, which had dropped to fifth in December 2025, climbed back to fourth place. Finally, the Doozies Fly CBG/THC 3:1 Watermelon Kiwi Gummies 10-Pack re-entered the rankings in fifth place after a previous absence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.