Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

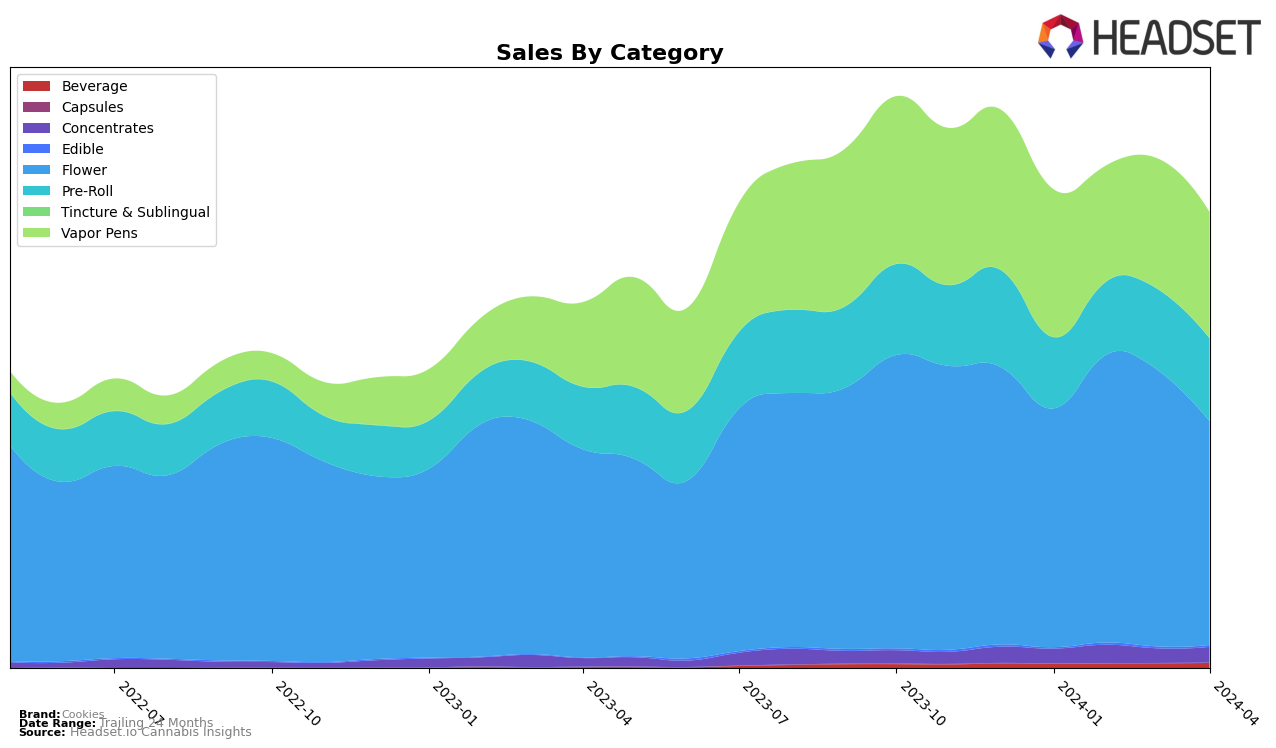

In the competitive cannabis market, Cookies has demonstrated varied performance across different states and categories, reflecting both its strengths and areas for improvement. For instance, in California, Cookies showed significant improvement in the Flower category, moving from a rank of 74 in January 2024 to 45 by April 2024, indicating a positive trend in consumer preference and market penetration. However, this trend was not uniform across all states; in Michigan, the brand saw a decline in the Flower category, falling from a rank of 61 in January to 77 in April, which could signal challenges in market dynamics or consumer preferences within the state. The Vapor Pens category in California remained relatively stable, maintaining a position in the mid-20s, which suggests a consistent demand for this product line.

Looking at newer markets, Cookies has made notable entries and shown potential for growth. In Ontario, the brand improved its standing in the Flower category from 36th in January to 24th by April, alongside a consistent performance in the Pre-Roll category. This upward trajectory in Ontario contrasts with its performance in categories like Concentrates in Illinois, where the brand did not rank in January but then appeared in the rankings by February, suggesting a growing presence in this market segment. The absence from the top 30 in certain states and categories at times highlights areas where Cookies may need to bolster its market strategies or product offerings to capture a larger share of consumer interest. Despite these challenges, the brand's ability to rank in a diverse array of product categories across multiple states underscores its potential for further growth and market adaptation.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in California, Cookies has seen a fluctuation in its rank over the first four months of 2024, starting outside the top 20 in January and experiencing a slight decline in rank through April. This indicates a challenging period for Cookies in terms of visibility and market share within this category. Notably, its competitors have shown varied performance; Punch Extracts / Punch Edibles and Buddies have demonstrated resilience and adaptability, with Punch Extracts / Punch Edibles improving its rank and Buddies maintaining a relatively stable position despite a slight drop in April. "Eighth Brother, Inc." and Flavorade have also shown significant movements, with Flavorade experiencing a notable decline from a higher rank in February to below Cookies by April. These dynamics suggest a highly competitive environment where brand positions can shift rapidly, underscoring the importance for Cookies to innovate and adapt to regain and enhance its market standing.

Notable Products

In April 2024, Cookies saw the 4 Cultivar Pre-Roll 4-Pack (2g) from the Pre-Roll category as its top-selling product, maintaining its leading position from the previous month with sales peaking at 7736.0 units. Following closely was the BernieHana Butter Pre-Roll (1g), also in the Pre-Roll category, which climbed to the second rank in April, showing a significant rebound from earlier rankings. The third spot was taken by the Green Monke x Cookies - CBD/THC Georgia Pie Peach Iced Tea (2mg CBD, 10mg THC, 12oz) from the Beverage category, consistently performing well and securing the third rank again in April. Bernie Hana Butter (3.5g) from the Flower category made a notable entry into the top rankings at the fourth position, despite not being ranked in the previous months. Lastly, the Mexican Flan (3.5g) from the Flower category, which had previously led the sales in February and March, experienced a drop to the fifth rank in April, indicating a shift in consumer preferences within Cookies' product lineup.

Top Selling Cannabis Brands