Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

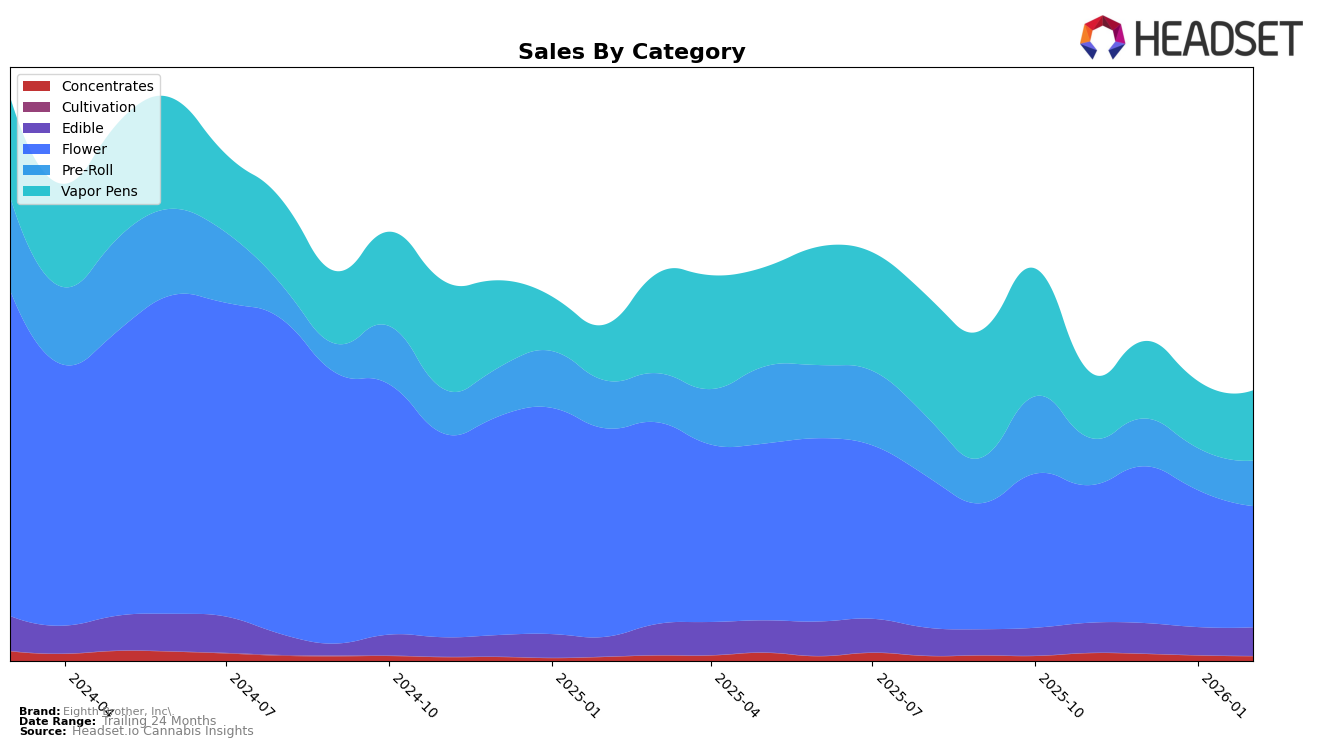

In the dynamic cannabis market of California, Eighth Brother, Inc. has shown varied performance across different product categories. Notably, in the Edibles category, the brand has demonstrated consistent improvement, climbing from a rank of 29 in November 2025 to 27 by February 2026. This upward trajectory is a positive indicator of their growing market presence in this segment. Conversely, their performance in the Concentrates category is less favorable, as they did not make it into the top 30 brands, indicating potential areas for growth or reevaluation of market strategies. In the Flower category, Eighth Brother, Inc. experienced a slight decline from rank 24 in December 2025 to 26 in February 2026, suggesting a need for strategic adjustments to regain momentum.

The Pre-Roll category presents a more optimistic outlook for Eighth Brother, Inc., where they improved their ranking from 43 in December 2025 to 36 by February 2026, showcasing a significant upward trend. This improvement could be attributed to product innovation or marketing efforts that resonated well with consumers. Meanwhile, their Vapor Pens category has maintained a steady position, holding at rank 38 from January to February 2026, which could indicate a stable consumer base. However, the lack of significant movement might also signal a plateau in growth potential within this segment. Overall, Eighth Brother, Inc.'s performance across these categories highlights both challenges and opportunities, with certain areas showing promise and others requiring strategic focus to enhance their market standing in California.

Competitive Landscape

In the competitive landscape of the California flower category, Eighth Brother, Inc. has experienced a fluctuating rank, moving from 25th in November 2025 to 26th by February 2026. This slight decline in rank is mirrored by a decrease in sales over the same period. Notably, Mr. Zips has shown a significant upward trajectory, improving from 47th to 28th, indicating a robust growth in market presence that could pose a competitive threat to Eighth Brother, Inc. Meanwhile, Delighted and Originals have maintained stronger positions, although Delighted saw a drop to 27th, aligning with a decrease in sales. Smoken Promises has also shown resilience, improving its rank to 25th in February 2026. These dynamics suggest that while Eighth Brother, Inc. maintains a stable presence, increased competition and shifting consumer preferences are influencing its market position.

Notable Products

In February 2026, the top-performing product for Eighth Brother, Inc. was the Blue Dream Distillate Disposable (1g) in the Vapor Pens category, maintaining its consistent first-place ranking with sales of 14,636 units. The Blackberry Kush Distillate Disposable (1g) also showed strong performance, climbing to second place from third in January 2026. Gorilla Glue 4 Pre-Roll (1g) made a notable entry, securing third place after not being ranked in January. The Blue Dream Pre-Roll (1g) slipped from second to fourth place compared to the previous month, indicating a slight decrease in its popularity. A new entrant, Blue Dream Pre-Roll 6-Pack (6g), debuted at fifth place, suggesting a growing interest in multi-pack options.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.