Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

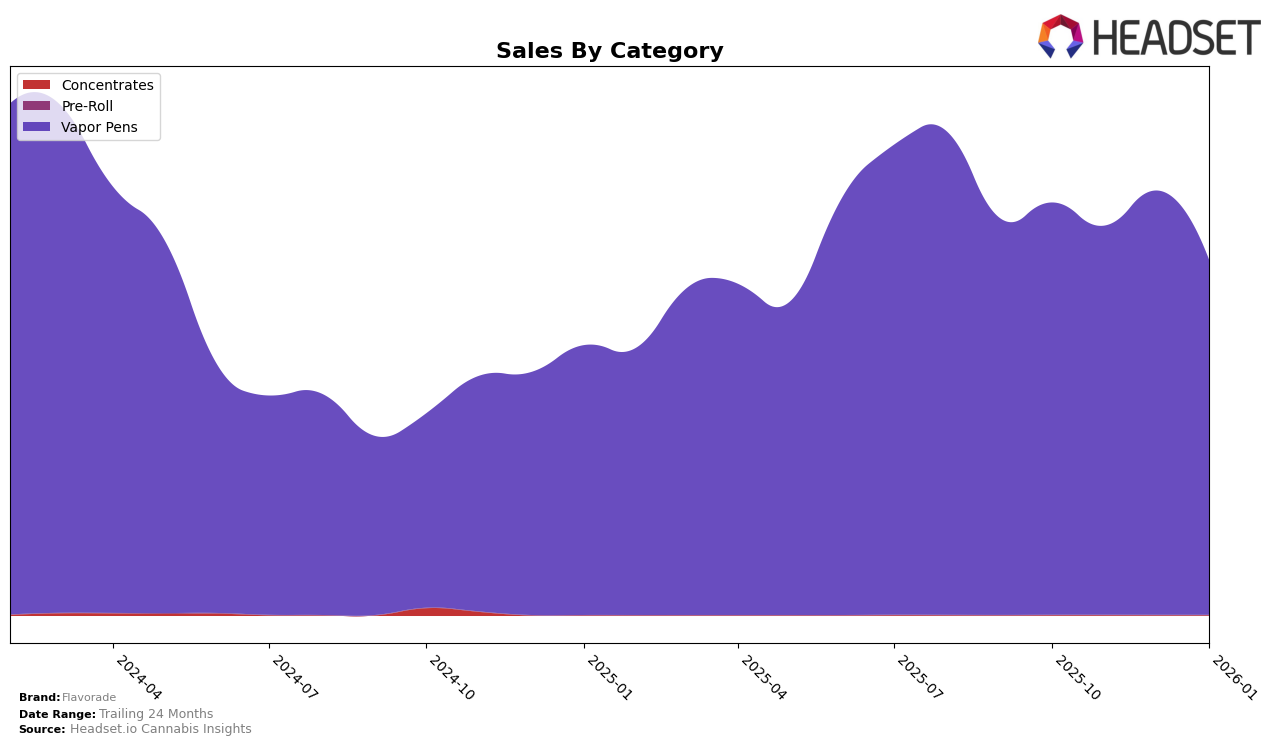

Flavorade has shown a notable presence in the California market, particularly within the Vapor Pens category. Over the past few months, the brand has consistently ranked within the top 30, although there has been some fluctuation in its position. Starting at 18th place in October 2025, Flavorade experienced a slight dip to 19th in November, bounced back to 18th in December, but dropped to 21st by January 2026. This movement suggests a competitive landscape within the Vapor Pens category, where maintaining a stable ranking can be challenging. The sales figures reflect this volatility, with a noticeable decline in January 2026 compared to the previous months, indicating potential market pressures or seasonal variations impacting consumer demand.

Interestingly, the absence of rankings in other states or categories underlines a crucial aspect of Flavorade's current market strategy or performance. Being outside the top 30 in states or categories other than California's Vapor Pens might suggest areas for potential growth or highlight regions where the brand has yet to establish a strong foothold. This could either be a strategic decision to focus on specific markets or a challenge the brand faces in expanding its reach. Observing how Flavorade navigates these dynamics in the coming months could provide deeper insights into its long-term strategy and adaptability in a competitive industry.

Competitive Landscape

In the competitive landscape of the California vapor pens category, Flavorade has experienced notable fluctuations in rank and sales over the past few months. In October 2025, Flavorade held a strong position at 18th place, but by January 2026, it had slipped to 21st, indicating a decline in market standing. This downward trend in rank coincides with a decrease in sales from December 2025 to January 2026. Meanwhile, competitors such as Micro Bar maintained a stable presence, consistently ranking around the 18th to 20th positions, while ABX / AbsoluteXtracts improved their rank from 24th to 19th over the same period. These shifts suggest that Flavorade faces increasing competition from brands like Muha Meds, which achieved a peak rank of 20th in December 2025, and Buddies, which climbed to 23rd in January 2026. To regain its competitive edge, Flavorade may need to innovate or enhance its marketing strategies to better capture consumer interest and regain lost market share.

Notable Products

In January 2026, Flavorade's top-performing product was the Sour Cheese Cured Resin Cartridge, ranking first among the offerings with sales reaching 926 units. Following closely was the Double Cup Cured Resin Cartridge, securing the second position. The Grand Prix Cured Resin Cartridge and Zprite Cured Resin Cartridge occupied the third and fourth ranks, respectively. The Opalz Cured Resin Cartridge rounded out the top five. Compared to previous months, there were no rankings available, suggesting these products were either newly introduced or data was not recorded for prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.