Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

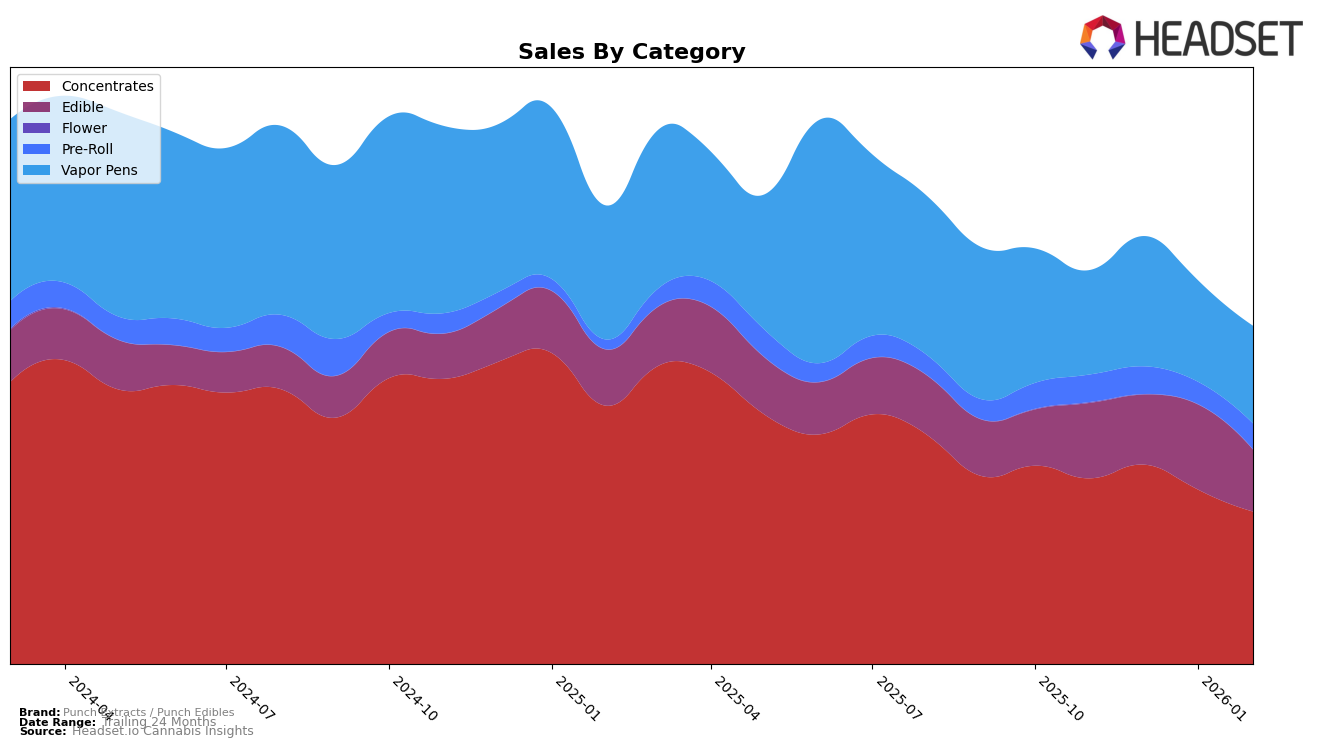

Punch Extracts / Punch Edibles has demonstrated a strong presence in the California market, particularly within the Concentrates category. Over the months from November 2025 to February 2026, the brand maintained a consistent top-five position, ultimately climbing to the third rank in February. This upward movement is indicative of a robust market strategy and consumer preference in this category. In contrast, their performance in the Edible category in California has been more volatile, with rankings fluctuating between 22nd and 27th. This suggests potential challenges in maintaining a competitive edge within this segment, despite a slight recovery in February 2026.

In New York, Punch Extracts / Punch Edibles has experienced varied success. Within the Edible category, the brand's ranking improved significantly in January 2026, reaching 20th place, before dropping back to 30th in February. This fluctuation might reflect market dynamics or consumer trends specific to New York. Additionally, the absence of Punch Extracts / Punch Edibles in the top 30 for other categories in New York could indicate a focus on edibles or potential growth opportunities in other segments. Such insights are crucial for understanding the brand's strategic positioning and potential areas for expansion.

Competitive Landscape

In the competitive landscape of the California concentrates market, Punch Extracts / Punch Edibles has shown resilience and adaptability, maintaining a consistent presence in the top ranks. From November 2025 to February 2026, the brand held steady at the 4th position before climbing to 3rd place in February 2026. This upward movement indicates a positive trend in brand performance, despite facing strong competition from industry leaders like Raw Garden, which consistently held the top spot, and STIIIZY, which maintained a solid 2nd place. Although 710 Labs experienced a decline from 3rd to 4th place, Punch Extracts / Punch Edibles capitalized on this shift, demonstrating its ability to capture market share. Meanwhile, WVY remained a distant competitor, consistently ranking 5th or 6th. The strategic positioning and competitive pricing of Punch Extracts / Punch Edibles have likely contributed to its improved rank and sales performance, making it a formidable player in the California concentrates market.

Notable Products

In February 2026, the top-performing product for Punch Extracts / Punch Edibles was the Dulce Fresca Distillate Cartridge (1g), which climbed to the number one rank from fifth position in January, with sales reaching 2482 units. The Sugar Free Milk Chocolate Bar 10-Pack (100mg) emerged as a strong contender, ranking second, although it was not ranked in the previous three months. The Original Sea Salt Dark Chocolate Bar 10-Pack (100mg) dropped from second to third place, experiencing a notable decrease in sales to 1916 units. The Raspberry Dark Chocolate Solventless Hash Rosin Bar 10-Pack (100mg) also saw a decline, moving from third to fourth rank. Meanwhile, the Blue Dream Distillate Cartridge (1g) fell to fifth place after leading the sales in December, highlighting a shift in consumer preferences towards the Dulce Fresca variant.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.