Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

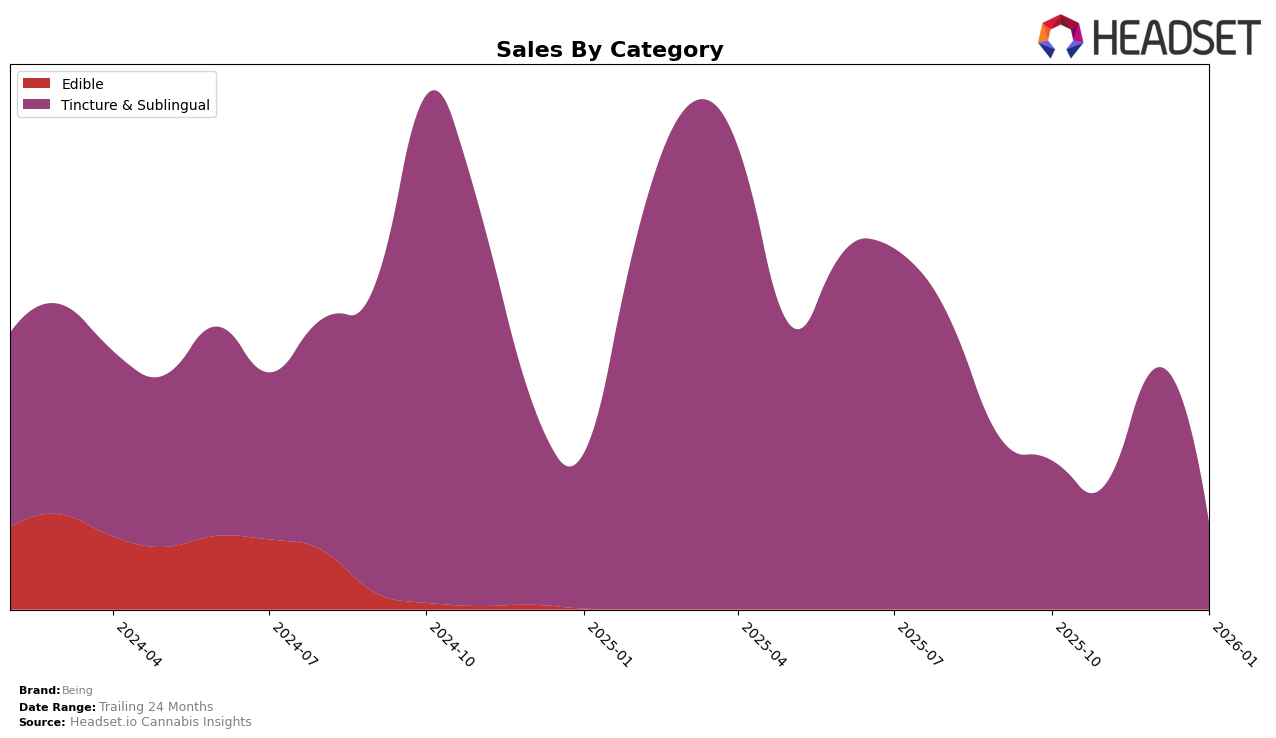

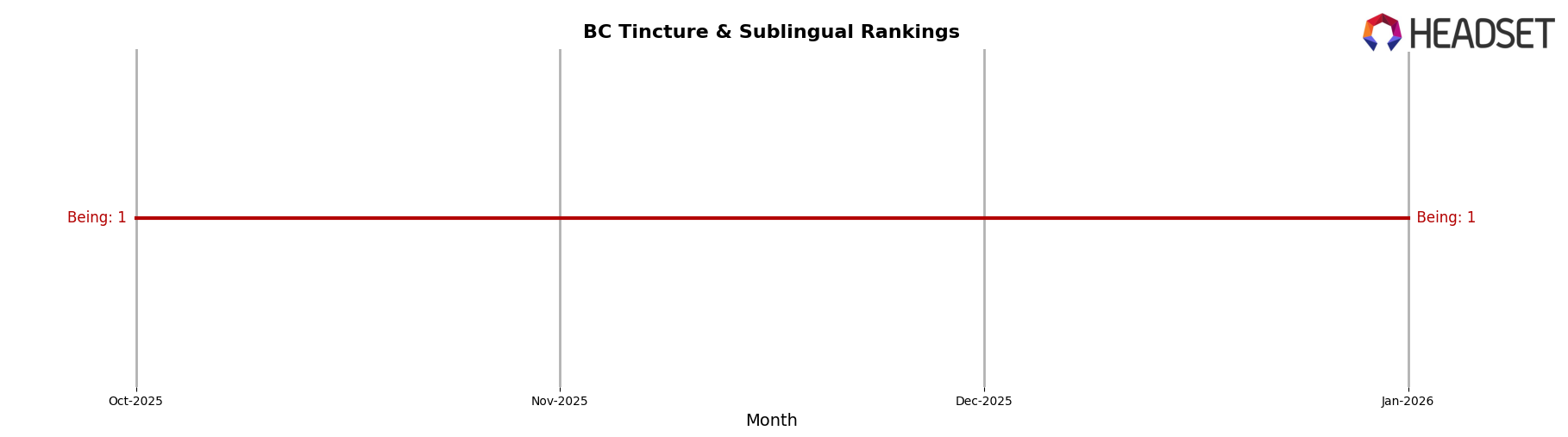

In the British Columbia market, Being has consistently maintained its top position in the Tincture & Sublingual category from October 2025 through January 2026. This impressive performance is highlighted by a peak in sales during December 2025, followed by a noticeable dip in January 2026. Despite this decline, the brand's ability to retain the number one ranking indicates a strong market presence and consumer loyalty within the province. The consistent top ranking suggests that Being has effectively captured the market in British Columbia, maintaining a competitive edge over other brands in the same category.

Meanwhile, in Saskatchewan, Being also achieved the first position in the Tincture & Sublingual category for October and December 2025. However, the absence of a ranking in November and January indicates potential challenges or market fluctuations that may have impacted its standing. This inconsistency might point to either a temporary supply issue or increased competition during those months. The ability to regain the top spot in December, after a missing rank in November, suggests resilience and adaptability, but the lack of data for January leaves room for speculation regarding its ongoing performance in Saskatchewan.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in British Columbia, Being has maintained a consistent top rank from October 2025 through January 2026. This steady performance underscores its strong market presence and consumer preference in the region. Despite fluctuations in sales, with a notable peak in December 2025, Being's ability to hold the number one spot suggests a robust brand loyalty and effective marketing strategies. Competitors in this category have not been able to displace Being from its leading position, indicating a potential gap in market penetration or consumer engagement strategies. For instance, brands like Competitor1 and Competitor2, which have not appeared in the top 20 during this period, may need to reassess their approach to gain traction. This dominance by Being highlights the importance of innovative product offerings and strategic market positioning in maintaining leadership in the competitive cannabis market of British Columbia.

```

Notable Products

In January 2026, the THC Fast Acting Oral Quickstrip 10-Pack (100mg) maintained its position as the top-performing product for Being, continuing its streak as the number one ranked product from previous months. Despite a decrease in sales to 416 units, it retained its leading rank, highlighting its consistent popularity. The CBD Fast Acting Oral Quickstrip 10-Pack (100mg CBD) emerged as a new contender, ranking second in January, marking its first appearance in the sales rankings. This suggests a growing consumer interest in CBD products within the Tincture & Sublingual category. The consistent performance of THC products alongside the rising interest in CBD indicates a diversifying consumer preference within Being's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.