Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

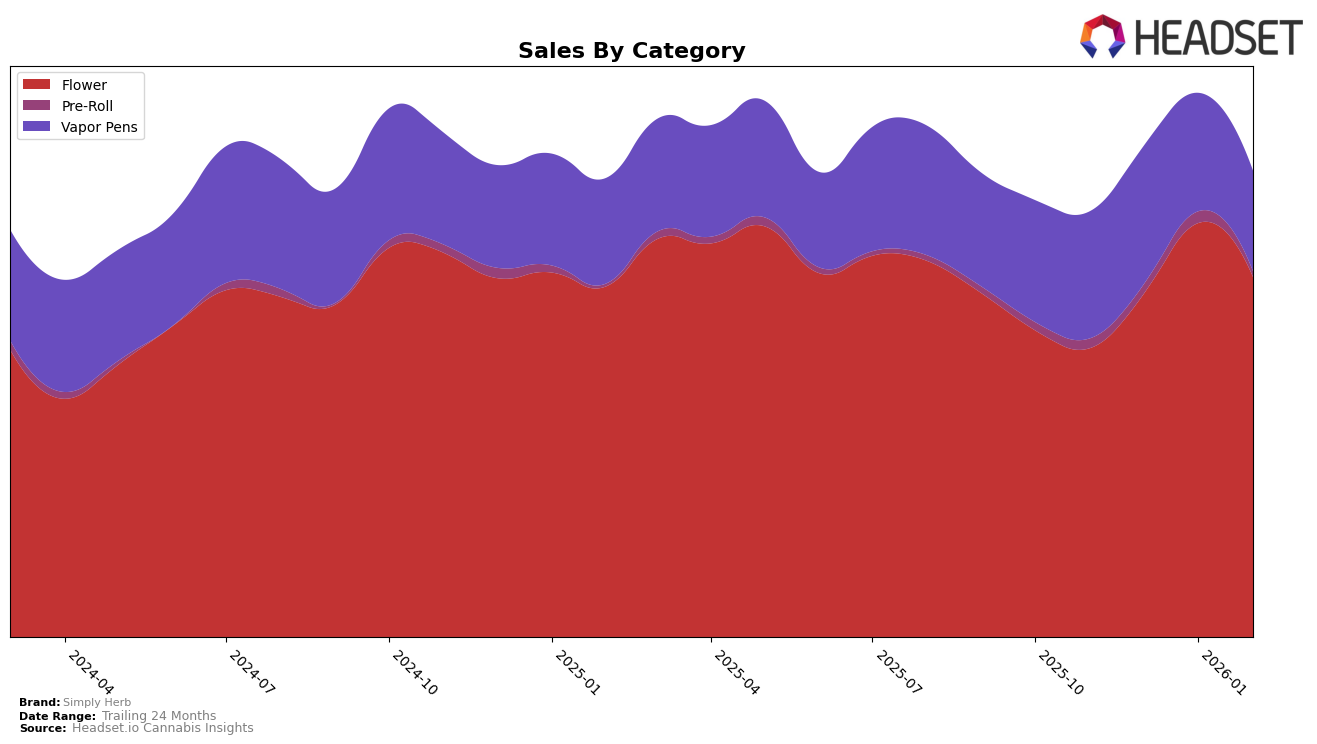

Simply Herb has shown notable performance across various categories and states, particularly in the Flower category. In Illinois, Simply Herb's Flower category has seen a steady rise, moving from the 7th position in November 2025 to the 3rd position by February 2026. This upward trend indicates a strong market presence and growing consumer preference. In contrast, their Vapor Pens category in Illinois did not maintain a top 30 ranking by January 2026, suggesting challenges in this segment. Meanwhile, in Massachusetts, Simply Herb has consistently held the top spot in the Flower category over the same period, demonstrating dominance in this category within the state.

In New Jersey, Simply Herb's Flower category has also seen a commendable rise, climbing from the 12th position in November 2025 to the 4th position by February 2026, reflecting a significant gain in market share. However, the Pre-Roll category in both Illinois and Massachusetts has shown less consistent performance, with rankings fluctuating and not breaking into the top 10. This indicates potential areas for improvement or strategic focus. Moreover, Simply Herb's Vapor Pens in New Jersey have maintained a stable 3rd position throughout the months, showcasing a steady demand for their products in this category.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Simply Herb has demonstrated a notable upward trajectory in its market position over the past few months. Starting from a rank of 7th in November 2025, Simply Herb has climbed to an impressive 3rd place by February 2026. This ascent is particularly significant given the consistent dominance of High Supply / Supply and RYTHM, which have maintained their 1st and 2nd ranks respectively throughout the same period. Simply Herb's rise is further accentuated by its surpassing of Good Green, which has remained steady at 4th and 5th positions. Meanwhile, Grassroots has also shown a positive trend, moving from 9th to 4th place, indicating a dynamic shift in consumer preferences. Simply Herb's sales growth trajectory suggests a strengthening brand presence and increasing consumer appeal in a highly competitive market.

Notable Products

In February 2026, Simply Herb's Fruity Loops Distillate Cartridge (1g) reclaimed its top position in the Vapor Pens category with sales of 9306. The Dungeons & Dragonfruit Distillate Cartridge (1g) dropped to the second spot after leading in January 2026. Tropical Thunder Distillate Cartridge (1g) maintained a strong presence, securing the third rank. Grape Escape Distillate Cartridge (1g) climbed from fifth to fourth place, indicating a positive trend. Notably, Omakase Pre-Roll (1g) entered the rankings for the first time, debuting at the fifth position in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.